89:

54:

150:

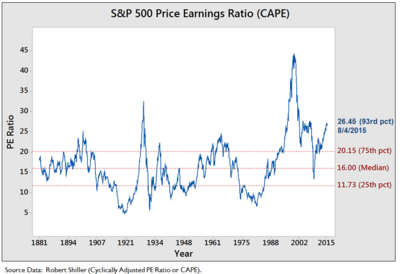

15.21; this corresponds to an average annual return over the next 20 years of around 6.6 per cent. CAPE values above this produce corresponding lower returns, and vice versa. In 2014, Shiller expressed concern that the prevailing CAPE of over 25 was "a level that has been surpassed since 1881 in only three previous periods: the years clustered around 1929, 1999 and 2007. Major market drops followed those peaks" (ref 4). A high CAPE ratio has been linked to the phrase "

179:

earnings in the business is done in the expectation of growing future earnings, and this earnings growth should ideally be accounted for when smoothing earnings over the previous ten years for the purpose of predicting long-term future earnings. This modified measure has been referred to as P-CAPE, or payout and cyclically-adjusted earnings.

118:

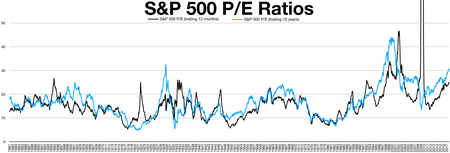

concluded that "a long moving average of real earnings helps to forecast future real dividends" which in turn are correlated with returns on stocks. The idea is to take a long-term average of earnings (typically 5 or 10 year) and adjust for inflation to forecast future returns. The long term average

174:

The measure exhibits a significant amount of variation over time, and has been criticized as "not always accurate in signaling market tops or bottoms". One proposed reason for this time variation is that CAPE does not take into account prevailing risk-free interest rates. A common debate is whether

149:

Using market data from both estimated (1881–1956) and actual (1957 onward) earnings reports from the S&P index, Shiller and

Campbell found that the lower the CAPE, the higher the investors' likely return from equities over the following 20 years. The average CAPE value for the 20th century was

187:

Originally derived for the US equity market, the CAPE has since been calculated for 15 other markets. Research by

Norbert Keimling has demonstrated that the same relation between CAPE and future equity returns exists in every equity market so far examined. Research by others has also found CAPE

178:

Recently, investors have sought an improvement to CAPE that reflects the fact that, in general, companies don’t pay out all their earnings as dividends each year. The fraction of earnings not paid out in dividends is either reinvested in the business or paid out via stock buybacks. Reinvesting

166:

However, Shiller's views on what CAPE value is a predictor of poor returns have been criticized as overly pessimistic and based on the original definition of CAPE, which fails to take into account changes in accounting standards in 1990s, which, according to

50:), adjusted for inflation. As such, it is principally used to assess likely future returns from equities over timescales of 10 to 20 years, with higher than average CAPE values implying lower than average long-term annual average returns.

175:

the inverse CAPE ratio should be further divided by the yield on 10 year

Treasuries. This debate regained currency in 2014 as the CAPE ratio reached an all-time high in combination with historically very low rates on 10 year Treasuries.

305:

158:

coined the term in 1996, the CAPE ratio reached an all-time high during the 2000 dot-com bubble. It also reached a historically high level again during the housing bubble up to 2007 before the crash of the

92:

CAPE based on data from economist Robert

Shiller's website, as of 8/4/2015. The 26.45 measure was 93rd percentile, meaning 93% of the time investors paid less for stocks overall relative to earnings.

221:

74:

It is a variant of the more popular price to earning ratio and is calculated by dividing the current price of a stock by its average inflation-adjusted earnings over the last 10 years.

71:

The ratio is used to gauge whether a stock, or group of stocks, is undervalued or overvalued by comparing its current market price to its inflation-adjusted historical earnings record.

77:

Using average earnings over the last decade helps to smooth out the impact of business cycles and other events and gives a better picture of a company's sustainable earning power.

356:

527:, Denis B. Chaves and Tzee-man Chow. King of the Mountain: The Shiller P/E and Macroeconomic Conditions. The Journal of Portfolio Management Fall 2017, 44 (1) 55-68; DOI:

539:

Kenourgios, D., Papathanasiou, S. & Bampili, A.C. On the predictive power of CAPE or

Shiller’s PE ratio: the case of the Greek stock market. Oper Res Int J (2021).

513:

276:

551:

Sébastien Lleo and

William T. Ziemba. Predicting Stock Market Crashes in China. The Journal of Portfolio Management Spring 2018, 44 (5) 125-135; DOI:

123:

of earnings and medium-term business cycles in the general economy and they thought it was a better reflection of a firm's long term earning power.

345:

Johnathan Davis and

Alasdair Nairn (2012). Templeton's Way With Money: Strategies and Philosophy of a Legendary Investor. Wiley, ISBN 1118149610

110:. Graham and Dodd noted one-year earnings were too volatile to offer a good idea of a firm's true earning power. In a 1988 paper economists

191:

It also suggests that comparison of CAPE values can assist in identifying the best markets for future equity returns beyond the US market.

597:

141:. Shiller would share the Nobel Memorial Prize in Economic Sciences in 2013 for his work in the empirical analysis of asset prices.

364:

80:

It is not intended as an indicator of impending market crashes, although high CAPE values have been associated with such events.

702:

137:

Shiller later popularized the 10-year version of Graham and Dodd's P/E as a way to value the stock market as measured by the

188:

ratios are reliable in estimating market returns over five to ten year periods in many international stock markets.

773:

590:

322:

502:

284:

828:

130:

used a method adapted from Graham and Dodd, and somewhat similar to the later

Shiller P/E, but with the

755:

412:

131:

833:

767:

583:

714:

200:

106:

22:

431:

801:

726:

708:

651:

151:

104:

argued for smoothing a firm's earnings over the past five to ten years in their classic text

790:

743:

640:

120:

8:

680:

628:

453:

127:

46:

equity market. It is defined as price divided by the average of ten years of earnings (

779:

749:

617:

566:

88:

65:

251:

761:

737:

691:

524:

111:

606:

514:

Predicting Stock Market

Returns Using the Shiller CAPE, Keimling, N. January 2016

160:

97:

39:

656:

646:

155:

115:

47:

53:

822:

807:

796:

732:

570:

540:

168:

528:

785:

686:

552:

138:

101:

43:

503:

Global Stock Market

Valuation Ratios, Star Capital, Germany, June 2014

720:

696:

662:

386:

674:

575:

479:

668:

454:"P-CAPE: A Better Way for Investors to Estimate Future Returns"

154:" and to Shiller's book of the same name. After Fed President

634:

357:"Global Value: Building Trading Models with the 10 Year CAPE"

306:

Shiller, R The Mystery of Lofty Stock Market Elevations

222:"Super Isas are here - is it the worst time to buy?"

144:

320:

820:

182:

323:"Stock Prices, Earnings and Expected Dividends"

277:"Price to 10 Year Inflation Adjusted Earnings"

246:

244:

242:

219:

591:

64:The ratio was invented by American economist

239:

598:

584:

541:https://doi.org/10.1007/s12351-021-00658-x

480:"Improving Our Favorite Returns Estimator"

354:

529:https://doi.org/10.3905/jpm.2017.44.1.055

87:

60:compared to trailing 12 months P/E ratio

52:

821:

553:https://doi.org/10.3905/jpm.2018.1.078

410:

213:

703:Present value of growth opportunities

623:Cyclically adjusted price-to-earnings

579:

477:

269:

669:Enterprise value/gross cash invested

605:

348:

413:"Don't put faith in CAPE crusaders"

13:

432:"The data point that screams sell"

42:measure usually applied to the US

14:

845:

561:

429:

145:Use in forecasting future returns

171:, produce understated earnings.

774:Risk-adjusted return on capital

545:

533:

518:

507:

496:

471:

446:

423:

404:

379:

339:

314:

299:

220:Evans, Richard (28 Jun 2014).

16:Stock market valuation measure

1:

411:Siegel, Jeremy (2013-08-19).

355:Faber, Meb (23 August 2012).

206:

183:CAPE for other equity markets

83:

58:S&P 500 shiller P/E ratio

635:Cash return on cash invested

7:

194:

10:

850:

756:Return on capital employed

571:ONLINE DATA ROBERT SHILLER

132:Dow Jones Industrial Index

768:Return on tangible equity

613:

478:Admin, Elm (2024-06-19).

721:Price-earnings to growth

321:Campbell & Shiller.

663:Enterprise value/EBITDA

119:smooths out short term

23:price-to-earnings ratio

675:Enterprise value/sales

93:

61:

152:irrational exuberance

91:

56:

744:Return on net assets

201:Price–earnings ratio

26:, commonly known as

21:cyclically adjusted

829:Valuation (finance)

629:Capitalization rate

417:The Financial Times

802:Sustainable growth

387:"Shiller PE Ratio"

128:Sir John Templeton

94:

62:

816:

815:

750:Return on capital

618:Buffett indicator

567:Robert J. Shiller

107:Security Analysis

66:Robert J. Shiller

841:

834:Financial ratios

762:Return on equity

738:Return on assets

692:Operating margin

607:Financial ratios

600:

593:

586:

577:

576:

555:

549:

543:

537:

531:

525:Robert D. Arnott

522:

516:

511:

505:

500:

494:

493:

491:

490:

475:

469:

468:

466:

465:

458:Morningstar, Inc

450:

444:

443:

441:

439:

427:

421:

420:

408:

402:

401:

399:

397:

383:

377:

376:

374:

372:

363:. Archived from

352:

346:

343:

337:

336:

334:

332:

327:

318:

312:

303:

297:

296:

294:

292:

283:. Archived from

281:VectorGrader.com

273:

267:

266:

264:

262:

248:

237:

236:

234:

232:

217:

126:From the 1940s,

112:John Y. Campbell

96:Value investors

849:

848:

844:

843:

842:

840:

839:

838:

819:

818:

817:

812:

709:Price/cash flow

652:Dividend payout

609:

604:

564:

559:

558:

550:

546:

538:

534:

523:

519:

512:

508:

501:

497:

488:

486:

476:

472:

463:

461:

452:

451:

447:

437:

435:

428:

424:

409:

405:

395:

393:

385:

384:

380:

370:

368:

367:on 29 July 2013

353:

349:

344:

340:

330:

328:

325:

319:

315:

304:

300:

290:

288:

287:on 13 July 2014

275:

274:

270:

260:

258:

250:

249:

240:

230:

228:

218:

214:

209:

197:

185:

161:great recession

147:

98:Benjamin Graham

86:

40:stock valuation

17:

12:

11:

5:

847:

837:

836:

831:

814:

813:

811:

810:

805:

799:

794:

791:Short interest

788:

783:

777:

771:

765:

759:

753:

747:

741:

735:

730:

724:

718:

715:Price-earnings

712:

706:

700:

694:

689:

684:

678:

672:

666:

660:

657:Earnings yield

654:

649:

647:Dividend cover

644:

641:Debt-to-equity

638:

632:

626:

620:

614:

611:

610:

603:

602:

595:

588:

580:

569:'s data page "

563:

562:External links

560:

557:

556:

544:

532:

517:

506:

495:

470:

445:

430:Tully, Shawn.

422:

403:

391:www.multpl.com

378:

347:

338:

313:

308:New York Times

298:

268:

252:"P/E 10 Ratio"

238:

211:

210:

208:

205:

204:

203:

196:

193:

184:

181:

156:Alan Greenspan

146:

143:

116:Robert Shiller

85:

82:

48:moving average

15:

9:

6:

4:

3:

2:

846:

835:

832:

830:

827:

826:

824:

809:

806:

803:

800:

798:

795:

792:

789:

787:

784:

781:

778:

775:

772:

769:

766:

763:

760:

757:

754:

751:

748:

745:

742:

739:

736:

734:

733:Profit margin

731:

728:

725:

722:

719:

716:

713:

710:

707:

704:

701:

698:

697:Price-to-book

695:

693:

690:

688:

685:

682:

681:Loan-to-value

679:

676:

673:

670:

667:

664:

661:

658:

655:

653:

650:

648:

645:

642:

639:

636:

633:

630:

627:

624:

621:

619:

616:

615:

612:

608:

601:

596:

594:

589:

587:

582:

581:

578:

574:

572:

568:

554:

548:

542:

536:

530:

526:

521:

515:

510:

504:

499:

485:

481:

474:

459:

455:

449:

433:

426:

418:

414:

407:

392:

388:

382:

366:

362:

358:

351:

342:

324:

317:

311:

309:

302:

286:

282:

278:

272:

257:

253:

247:

245:

243:

227:

226:The Telegraph

223:

216:

212:

202:

199:

198:

192:

189:

180:

176:

172:

170:

169:Jeremy Siegel

164:

162:

157:

153:

142:

140:

135:

133:

129:

124:

122:

117:

113:

109:

108:

103:

99:

90:

81:

78:

75:

72:

69:

67:

59:

55:

51:

49:

45:

41:

37:

33:

29:

25:

24:

622:

565:

547:

535:

520:

509:

498:

487:. Retrieved

484:Elm Partners

483:

473:

462:. Retrieved

460:. 2024-07-24

457:

448:

436:. Retrieved

425:

416:

406:

394:. Retrieved

390:

381:

369:. Retrieved

365:the original

361:MebFaber.com

360:

350:

341:

329:. Retrieved

316:

307:

301:

289:. Retrieved

285:the original

280:

271:

259:. Retrieved

256:Investopedia

255:

229:. Retrieved

225:

215:

190:

186:

177:

173:

165:

148:

136:

125:

105:

95:

79:

76:

73:

70:

63:

57:

36:P/E 10 ratio

35:

31:

27:

20:

18:

780:Risk return

727:Price-sales

665:(EV/EBITDA)

310:14 Aug 2014

139:S&P 500

44:S&P 500

32:Shiller P/E

823:Categories

677:(EV/Sales)

631:(Cap Rate)

489:2024-07-30

464:2024-07-30

207:References

121:volatility

102:David Dodd

84:Background

438:23 August

434:. Fortune

396:23 August

331:23 August

671:(EV/GCI)

195:See also

808:Treynor

797:Sortino

776:(RAROC)

637:(CROCI)

38:, is a

786:Sharpe

770:(ROTE)

758:(ROCE)

746:(RONA)

711:(P/CF)

705:(PVGO)

625:(CAPE)

371:4 July

291:4 July

261:4 July

231:4 July

804:(SGR)

793:(SIR)

782:(RRR)

764:(ROE)

752:(ROC)

740:(ROA)

729:(P/S)

723:(PEG)

717:(P/E)

699:(P/B)

687:Omega

683:(LTV)

659:(E/P)

643:(D/E)

326:(PDF)

34:, or

440:2014

398:2014

373:2014

333:2014

293:2014

263:2014

233:2014

114:and

100:and

28:CAPE

19:The

134:.

825::

573:"

482:.

456:.

415:.

389:.

359:.

279:.

254:.

241:^

224:.

163:.

68:.

30:,

599:e

592:t

585:v

492:.

467:.

442:.

419:.

400:.

375:.

335:.

295:.

265:.

235:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.