116:

have unexpected and unpredictable expenses unrelated to production, such as warehouse costs and the like that are fixed only over the time period of the lease. By definition, there are no fixed costs in the long run, because the long run is a sufficient period of time for all short-run fixed inputs to become variable. Investments in facilities, equipment, and the basic organization that cannot be significantly reduced in a short period of time are referred to as committed fixed costs. Discretionary fixed costs usually arise from annual decisions by management to spend on certain fixed cost items. Examples of discretionary costs are advertising, insurance premia, machine maintenance, and research & development expenditures. Discretionary fixed costs can be expensive.

136:, and variable costs are those captured in costs of goods sold under the variable costing method. Under full (absorption) costing fixed costs will be included in both the cost of goods sold and in the operating expenses. The implicit assumption required to make the equivalence between the accounting and economics terminology is that the accounting period is equal to the period in which fixed costs do not vary in relation to production. In practice, this equivalence does not always hold, and depending on the period under consideration by management, some overhead expenses (e.g., sales, general and administrative expenses) can be adjusted by management, and the specific allocation of each expense to each category will be decided under

120:

the salaries of a certain quantity of unskilled labor. Many things are included in fixed costs depending on the product and market - some firms may decide to hold some resources at fixed rates that other companies may not - but these unexpected or predictable short term fixed costs can be the reason a firm doesn't enter the market (if the costs are too high). These costs and variable costs have to be taken into account when a firm wants to determine if they can enter a market.

140:. In recent years, fixed costs gradually exceed variable costs for many companies. There are two reasons. Firstly, automatic production increases the cost of investment equipment, including the depreciation and maintenance of old equipment. Secondly, labor costs are often considered as long-term costs. It is difficult to adjust human resources according to the actual work needs in short term. As a result, direct labor costs are now regarded as fixed costs.

31:

119:

In economics, the most commonly spoken about fixed costs are those that have to do with capital. Capital can be the fixed price for buying a warehouse for production, machines (which can be paid once at the beginning and not depend on quantity or time of production), and it can be a certain total for

103:

generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns. In a survey of nearly 200 senior marketing managers, 60 percent responded that they found the "variable and fixed costs" metric very useful. These costs affect each other and are both extremely

115:

Fixed costs are not permanently fixed; they will change over time, but are fixed, by contractual obligation, in relation to the quantity of production for the relevant period. In other words, there is a recurring cost, but the value of this cost is not permanently fixed. For example, a company may

83:

the monthly rent and phone line are fixed costs, irrespective of how much bread is produced and sold; on the other hand, the wages are variable costs, as more workers would need to be hired for the production to increase. For any factory, the fix cost should be all the money paid on capitals and

131:

will allocate fixed costs to business activities for profitability measures. This can simplify decision-making, but can be confusing and controversial. In accounting terminology, fixed costs will broadly include almost all costs (expenses) which are not included in

38:

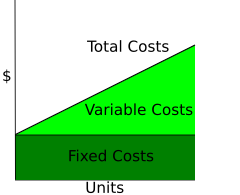

as fixed costs plus variable costs. Quantity of output is measured on the horizontal axis. Along with variable costs, fixed costs make up one of the two components of total cost: total cost is equal to fixed costs plus variable

67:

that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month. These costs also tend to be capital costs. This is in contrast to

84:

land. Such fixed costs as buying machines and land cannot be not changed no matter how much they produce or even not produce. Raw materials are one of the variable costs, depending on the quantity produced.

107:

In economics, there is a fixed cost for a factory in the short run, and the fixed cost is immutable. But in the long run, there are only variable costs, because they control all factors of production.

123:

In business planning and management accounting, usage of the terms fixed costs, variable costs and others will often differ from usage in economics, and may depend on the context. Some

72:, which are volume-related (and are paid per quantity produced) and unknown at the beginning of the accounting year. Fixed costs have an effect on the nature of certain variable costs.

186:

264:

231:

99:, it is necessary to know how costs divide between variable and fixed costs. This distinction is crucial in forecasting the

281:

197:

182:

352:

357:

185:. The content used from this source has been licensed under CC-By-SA and GFDL and may be used verbatim. The

17:

223:

303:

Dr Alex, Suleman. "A controversial-issues approach to enhance management accounting education".

256:

128:

248:

215:

8:

216:

189:

endorses the definitions, purposes, and constructs of classes of measures that appear in

133:

260:

249:

227:

178:

88:

201:

137:

124:

79:

must pay rent and utility bills irrespective of sales. As another example, for a

173:

Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010).

347:

69:

341:

92:

194:

175:

Marketing

Metrics: The Definitive Guide to Measuring Marketing Performance

154:

44:

35:

149:

96:

48:

251:

Micro

Markets: A Market Structure Approach to Microeconomic Analysis

100:

64:

322:

Ali, H.F. "A multicontribution activity-based income statement".

80:

76:

30:

255:. Hoboken, New Jersey: John Wiley & Sons, 2010. p.

177:, Upper Saddle River, New Jersey: Pearson Education, Inc.

222:. Mason, Ohio: South-Western Cengage Learning. p.

339:

167:

187:Marketing Accountability Standards Board (MASB)

213:

27:Business expenses not dependant on output

246:

29:

14:

340:

218:Economics: A Contemporary Introduction

296:

279:

195:Common Language in Marketing Project

302:

24:

315:

25:

369:

280:Bragg, Steven (3 November 2011).

321:

305:Journal of Accounting Education

282:"What is a discretionary cost?"

273:

240:

207:

110:

87:Fixed costs are considered an

13:

1:

160:

104:important to entrepreneurs.

7:

214:McEachern, William (2012).

143:

10:

374:

324:Journal of Cost Management

247:Schwartz, Robert (2010).

193:as part of its ongoing

129:activity-based costing

40:

353:Management accounting

33:

358:Production economics

284:. Accounting Tools

200:2019-04-05 at the

134:cost of goods sold

127:practices such as

41:

266:978-0-470-44765-9

233:978-0-538-45374-5

191:Marketing Metrics

16:(Redirected from

365:

332:

331:

319:

313:

312:

300:

294:

293:

291:

289:

277:

271:

270:

254:

244:

238:

237:

221:

211:

205:

171:

55:, also known as

21:

373:

372:

368:

367:

366:

364:

363:

362:

338:

337:

336:

335:

320:

316:

301:

297:

287:

285:

278:

274:

267:

245:

241:

234:

212:

208:

202:Wayback Machine

172:

168:

163:

146:

138:cost accounting

125:cost accounting

113:

75:For example, a

63:, are business

28:

23:

22:

15:

12:

11:

5:

371:

361:

360:

355:

350:

334:

333:

330:(Fall): 45–54.

314:

295:

272:

265:

239:

232:

206:

165:

164:

162:

159:

158:

157:

152:

145:

142:

112:

109:

70:variable costs

61:overhead costs

57:indirect costs

26:

9:

6:

4:

3:

2:

370:

359:

356:

354:

351:

349:

346:

345:

343:

329:

325:

318:

310:

306:

299:

283:

276:

268:

262:

258:

253:

252:

243:

235:

229:

225:

220:

219:

210:

203:

199:

196:

192:

188:

184:

183:0-13-705829-2

180:

176:

170:

166:

156:

153:

151:

148:

147:

141:

139:

135:

130:

126:

121:

117:

108:

105:

102:

98:

94:

93:entrepreneurs

90:

89:entry barrier

85:

82:

78:

73:

71:

66:

62:

58:

54:

50:

46:

37:

32:

19:

327:

323:

317:

308:

304:

298:

286:. Retrieved

275:

250:

242:

217:

209:

190:

174:

169:

122:

118:

114:

106:

86:

74:

60:

56:

52:

42:

34:Decomposing

111:Description

53:fixed costs

36:total costs

18:Fixed Costs

342:Categories

161:References

155:Cost curve

45:accounting

150:Flat rate

97:marketing

49:economics

311:: 59–75.

288:10 March

198:Archived

144:See also

101:earnings

91:for new

77:retailer

65:expenses

263:

230:

181:

81:bakery

39:costs.

348:Costs

95:. In

328:1994

309:1994

290:2012

261:ISBN

228:ISBN

179:ISBN

47:and

257:202

224:158

59:or

43:In

344::

326:.

307:.

259:.

226:.

51:,

292:.

269:.

236:.

204:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.