397:

pricing by an enterprise will affect its competitors and thus affect the supply and pricing of the whole market. Oligopolies generally rely on non-price weapons, such as advertising or changes in product characteristics. Several large companies hold large market shares in industrial production, each facing a downward sloping demand, and the industry is often characterized by extensive non-price competition. The oligopoly considers price cuts to be a dangerous strategy. Businesses depend on each other. Under this market structure, the differentiation of products may or may not exist. The product they sell may or may not be differentiated and there are barriers to entry: natural, cost, market size or dissuasive strategies.

63:

203:

457:

affect the profits of monopolists. The monopolist has market power, that is, it can influence the price of the good. Moreover, a monopoly is the sole provider of a good or service and thus, faces no competition in the output market. Hence, there are significant barriers to market entry, such as, patents, market size, control of some raw material. Examples of monopolies include public utilities (water, electricity) and

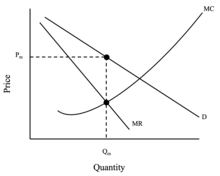

461:. A monopolist faces a downward sloping demand curve. Thus, as the monopolist raises its price, it sells fewer units. This suggests that when prices rise, even monopolists can drive away customers and sell fewer products. The difference between monopoly and other models is that monopolists can price their products without considering the reactions of other firms' strategic decisions.

370:: a product that only some consumers prefer to competing products (e.g. Mercedes Benz and BMW). Customers make subjective choices about what they want to buy, because they have no objective criteria to distinguish the quality of products. Location and taste are important criteria to determine whether they are consumers' special preferences.

456:

In a monopoly market, there is only one supplier and many buyers; it is a firm with no competitors in its industry. If there is competition, it is mainly some marginal companies in the market, generally accounting for 30-40% of the market share. The decisions of marginal companies will not materially

508:

Governments often restrict monopolies through high taxes or anti-monopoly laws as high profits obtained by monopolies may harm the interests of consumers. However, restricting the profits of monopolists may also harm the interests of consumers, because companies may create unsatisfied products that

374:

Enterprises entering the monopolistic competition market may realize profit increase or loss in the short term, but will realize normal profit in the long run. If the price of the enterprise is high enough to offset the fixed cost above the marginal cost, it will attract the enterprise to enter the

210:

Imperfect competition is inherent in capitalist economies. Firms are incentivised by profit, and hence undertake competitive strategies which reap the greatest revenue, by setting P > MC, at the cost of macroeconomic market efficiency. In the most extreme case of a monopoly, producers overcharge

227:

Conversely, imperfect competition assumptions promote intervention in the international trade market. Assuming imperfect competition allows for economic modelling of policies to contain imperfectly competitive firms' market power, or for enhancing monopoly power in situations of national interest.

437:

A special type of

Oligopoly, where two firms have exclusive power and control in a market. Both companies produce the same type of product and no other company produces the same or alternative product. The goods produced are circulated in only one market, and no other company intends to enter the

618:

are said to have market power. This terms means that the markets have a certain power to decide their own price. This does not mean that the firm can decide the quantity they wish to sell. The firm can decide the price and the quantity is determined by the demand curve. The firm should expect a

396:

In an oligopoly market structure, the market is supplied by a small number of firms (more than 2). Moreover, there are so few firms that the actions of one firm can influence the actions of the other firms. Due to the small number of sellers in the market, any adjustment of product quantity and

34:

The competitive structure of a market can significantly impact the financial performance and conduct of the firms competing within it. There is a causal relationship between competitive structure, behaviour and performance paradigm. Market structure can be determined by measuring the degree of

214:

Economists are in dispute over whether economic policy should be based on assumptions of perfect competition or imperfect competition. The imperfect theorists' perspective argues that policy based on assumptions of perfect competition is not effective as no market exists in purely perfectly

349:

1. There are many sellers in the market. Each vendor assumes that a slight change in the price of his product will not affect the overall market price. The belief that competitors will not change their prices just because a vendor in the market changes the price of a product.

541:

is the number of firms in the market). Thus, the more concentrated the market is, the larger the value of the

Herfindahl Index will be. The table below provides an overview of price competition and intensity in the four main classes of market structure.

223:

Utilising the assumptions of perfect competition, foreign trade policies advocate for minimal intervention. In a perfectly competitive market, subsidies are harmful, and improvements to terms-of-trade are the first point of call for import protections.

364:: a product is unambiguously better or worse than a competing product (e.g. products that differ in efficiency or effectiveness); Customers select a product by using objective measures (e.g., price and quality) to rank their choices from best to worst.

438:

market. The two companies have a lot of control over market prices. It is a particular case of oligopoly, so it can be said that it is an intermediate situation between monopoly and perfect competition economy. Hence, it is the most basic form of

338:

A situation in which many firms with slightly different products compete. Moreover, firms compete by selling differentiated products that are highly substitutable, but are not perfect substitutes. Therefore, the level of market power under

82:

also plays a very vital role in this market. As price increases, quantity demanded decreases for the given product. The demand curve in perfectly competitive and imperfectly competitive market has been illustrated in the image on the left.

215:

competitive conditions. The argument for assuming perfect competition in economic decision making prevails on the widespread use of its logic, and the present lack of substantial and consistent imperfectly competitive economic models.

353:

2. The sellers in the market all offer non-homogenous products. Companies have some control over the price of their products. Different types of consumers will buy the goods they like according to their subjective judgment.

31:. Imperfect competition usually describes behaviour of suppliers in a market, such that the level of competition between sellers is below the level of competition in perfectly competitive market conditions.

509:

are not available in new markets. These products will bring positive benefits to consumers and create huge economic value for enterprises. Tax and antitrust laws can discourage companies from innovating.

211:

for their good or service, and underproduce. Thus, imperfectly competitive pricing strategies impact consumer preferences and purchases, business operation and revenue, and economic policy.

382:) is downward sloping, rather than flat. The main difference between monopoly competition and perfect competition lies in the paradox of excess capacity and price exceeding marginal cost.

378:

Furthermore, each firm shares a small percentage of the total monopolistic market and hence, has limited control over the prevailing market price. Thus, each firms' demand curve (unlike

231:

Thus, assumptions of perfect competition or imperfect competition have implications for policy choices and the efficacy of their effect, domestically and internationally.

537:= market share of firm i) . Large companies are given more weight in the index (unlike the N-concentration ratio). The value of the index ranges from 1/N to 1 (where

375:

market to obtain more profits. Once the enterprise enters the market, it will occupy more market share by lowering the product price until economic profit reaches 0.

1010:

343:

is contingent on the degree of product differentiation. Monopolistic competition indicates that enterprises will participate in non-price competition.

1038:

Kifle, T. (2020). Lecture 6: Competitors and

Competition (Part II) . Unpublished Manuscript, ECON2410, University of Queensland, St Lucia, Australia.

199:

Imperfect conditions theorists believe that in the aggregate economy no market has ever, or will ever, exhibit the conditions of perfect competition.

971:

626:: If an organisation has authority over an important input it will have market power. For example, the company that look over the operation of

46:

The greater extent to which price is raised above marginal cost, the greater the market inefficiency. Competition in markets ranges from

78:

and substitution occurs in the market. It is very easy for a consumer to change their seller which makes the consumer sensitive to price. The

66:(a) Demand Curve under Perfectly Competitive market (b) Demand Curve under Imperfectly Competitive market

1114:

1048:

885:

787:

39:

refers to firms' ability to affect the price of a good and thus, raise the market price of the good or service above

23:

refers to a situation where the characteristics of an economic market do not fulfil all the necessary conditions of a

1139:

1089:

994:

955:

831:

821:

748:

54:, where monopolies are imperfectly competitive markets with the greatest ability to raise price above marginal cost.

619:

decrease in quantity demanded if they choose to increase the price. This market power emerges from factors such as:

728:

144:

of the above conditions of perfect competition are dissatisfied, the market is imperfectly competitive. Moreover;

1170:

1071:

Robert

Pindyck and Daniel Rubinfeld. (2013). Microeconomics. United States: PEARSON INDIA; Edición: 8th (2017)

91:

Economists primarily use these assumptions of perfect competition for developing economic policy, including

764:

476:

151:

of the following conditions are satisfied within an economic market, the market is considered "imperfect":

24:

1134:(6th ed.). the United States of America: Hoboken, NJ : John Wiley & Sons. pp. 171–172.

1109:(6th ed.). the United States of America: Hoboken, NJ : John Wiley & Sons. pp. 176–177.

989:(6th ed.). the United States of America: Hoboken, NJ : John Wiley & Sons. pp. 177–180.

782:(6th ed.). the United States of America: Hoboken, NJ : John Wiley & Sons. pp. 171–172.

664:. This was done so that the government has the power to preserve the national park but it still created a

35:

suppliers' market concentration, which in turn reveals the nature of market competition. The degree of

74:

in contrast to a perfectly elastic demand curve in the perfectly competitive market. This is because

683:

340:

333:

247:. The table below provides an overview of the characteristics of each of these market structures.

521:

is another good measure of how much control a firm within a market structure has over price. The

187:

75:

740:

661:

636:

The health industry does research and development of major drugs. The government often issues

627:

732:

113:

Large number of suppliers in the market such that no one firm has significant market power;

8:

678:

465:

379:

47:

965:

925:

758:

413:

346:

Monopolistic competition is defined to describe two main characteristics of a market:

1153:

Massimiliano

Vatiero (2009), "An Institutionalist Explanation of Market Dominances".

1135:

1110:

1085:

990:

951:

950:(4th ed.). Cambridge, Massachusetts; London, England: MIT Press. pp. 1–12.

881:

827:

783:

744:

733:

518:

400:

In an oligopoly, barriers to market entry and exit are high. The major barriers are:

103:

917:

646:: A product's value increases as more and more people use it. This often creates a

505:

occurs when it is cheaper for a single firm to provide all of the market's output.

502:

92:

660:: Yosemite Hospitality in the US has a Government license to run a lodge in the

921:

861:

Unpublished

Manuscript, ECON2410, University of Queensland, St Lucia, Australia

458:

107:

28:

1164:

486:

183:

79:

40:

615:

173:

159:

71:

36:

640:

in this industry so that a company can be the only legal seller of a drug.

62:

494:

820:

Frank, Robert H.; Bernanke, Ben; Antonovics, Kate; Heffetz, Ori (2018).

739:. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp.

1084:(Third ed.). New York, USA: Joseph E. Stiglitz. 2000. p. 78.

929:

703:

579:

Depending on product differentiation, intensity may be light or fierce

905:

202:

698:

688:

651:

439:

391:

234:

525:

provides a measure of firm concentration within a market and is the

162:

and hence have control over the pricing of their goods and services;

693:

665:

647:

451:

419:

Government regulation (e.g. limiting the issuance of licences); and

51:

27:. Imperfect competition causes market inefficiencies, resulting in

708:

590:

Depending on interfere rivalry, intensity may be light or fierce

432:

404:

546:

Price

Competition Intensity in Four Classes of Market Structure

637:

527:

sum of the squared market shares of all the firms in the market

468:

is where marginal cost equals marginal revenue. At this point:

131:

Absence of externalities including increasing returns to scale.

102:

Prices are influenced by supply and demand such that P=MC, via

819:

654:

popularity increased as its usage increased amongst consumers.

179:

There is information asymmetry between buyers and sellers;

206:

Monopoly firm maximises where MR = MC, but sets P > MC

727:

194:

135:

1041:

86:

235:Range of Imperfectly Competitive Market Structures

512:

251:Characteristics of "Imperfect" Market Structures

1162:

880:. London: Palgrave Macmillan. pp. 534–535.

857:Lecture 5: Competitors and Competition (Part I)

357:There are two types of product differentiation:

497:if it faces small levels, or no competition in

70:The imperfect market faces a down-ward sloping

948:Imperfect Competition and International Trade

99:Suppliers are price takers, not price makers;

1011:"3 Different Forms of Imperfect Competition"

970:: CS1 maint: multiple names: authors list (

906:"Imperfect Competition and Its Implications"

826:(8 ed.). McGraw-Hill US Higher Ed ISE.

218:

1155:World Competition. Law and Economics Review

327:

1034:

1032:

119:Buyers and sellers have full information;

945:

851:

849:

847:

845:

843:

201:

116:Little to no barriers to entry and exit;

61:

1129:

1104:

984:

875:

777:

243:broad market structures that result in

1163:

1029:

903:

840:

614:Markets that face a downward sloping

125:Product homogeneity and divisibility;

1065:

941:

939:

899:

897:

871:

869:

815:

813:

811:

809:

807:

805:

803:

801:

799:

182:The market's goods and services are

195:Importance of Imperfect Competition

136:Conditions of Imperfect Competition

13:

14:

1182:

936:

894:

866:

796:

262:Degree of product differentiation

87:Conditions of Perfect Competition

1017:. Saqib Shaikh. 16 November 2015

128:Lack of collusion between firms;

57:

1123:

1098:

1074:

735:Economics: Principles in Action

609:

557:Intensity of Price Competition

1082:Economics of the Public Sector

1003:

978:

771:

731:; Sheffrin, Steven M. (2003).

721:

513:Intensity of price competition

1:

714:

650:in that market. For example,

265:Degree of control over price

823:Principles of Microeconomics

477:perfectly competitive market

385:

259:Number of buyers and sellers

25:perfectly competitive market

7:

1053:Corporate Finance Institute

946:Grossman, Gene, M. (1997).

672:

630:in Sydney has market power.

445:

301:Two sellers and many buyers

287:Few sellers and many buyers

10:

1187:

922:10.1177/002224293500200308

910:American Marketing Journal

466:profit maximising quantity

449:

430:

426:

389:

368:Horizontal differentiation

331:

315:One seller and many buyers

501:of its output markets. A

219:Case Study: Foreign Trade

95:and efficiency analysis.

763:: CS1 maint: location (

684:Monopolistic competition

573:Monopolistic Competition

475:is below the level of a

362:Vertical differentiation

341:monopolistic competition

334:Monopolistic competition

328:Monopolistic competition

270:Monopolistic Competition

122:Negligible search costs;

16:Type of market structure

1130:Besanko, David (2012).

1105:Besanko, David (2012).

1049:"Imperfect Competition"

985:Besanko, David (2012).

778:Besanko, David (2012).

273:Many buyers and sellers

76:product differentiation

878:The World of Economics

876:Roberts, John (1991).

662:Yosemite National Park

634:Copyrights and Patent:

529:(Herfindahl Index = (S

464:Hence, a monopolist's

422:Firm name recognition.

207:

172:There are barriers to

67:

1171:Imperfect competition

1132:Economics of Strategy

1107:Economics of Strategy

987:Economics of Strategy

904:Bader, Louis (1935).

780:Economics of Strategy

245:Imperfect Competition

205:

65:

21:imperfect competition

1015:Economics discussion

554:Range of Herfindahls

165:The market contains

679:Perfect competition

624:Control over inputs

562:Perfect Competition

547:

380:perfect competition

252:

48:perfect competition

932:– via JSTOR.

855:Kifle, T. (2020).

729:O'Sullivan, Arthur

658:Government License

545:

414:Economies of scale

250:

208:

68:

1116:978-1-118-27363-0

887:978-1-349-21315-3

789:978-1-118-27363-0

644:Network Economies

605:

604:

519:price competition

517:The intensity of

325:

324:

155:Market firms are

104:Pareto Efficiency

1178:

1146:

1145:

1127:

1121:

1120:

1102:

1096:

1095:

1078:

1072:

1069:

1063:

1062:

1060:

1059:

1045:

1039:

1036:

1027:

1026:

1024:

1022:

1007:

1001:

1000:

982:

976:

975:

969:

961:

943:

934:

933:

901:

892:

891:

873:

864:

853:

838:

837:

817:

794:

793:

775:

769:

768:

762:

754:

738:

725:

551:Market Structure

548:

544:

523:Herfindahl Index

503:natural monopoly

256:Market Structure

253:

249:

93:economic welfare

1186:

1185:

1181:

1180:

1179:

1177:

1176:

1175:

1161:

1160:

1150:

1149:

1142:

1128:

1124:

1117:

1103:

1099:

1092:

1080:

1079:

1075:

1070:

1066:

1057:

1055:

1047:

1046:

1042:

1037:

1030:

1020:

1018:

1009:

1008:

1004:

997:

983:

979:

963:

962:

958:

944:

937:

902:

895:

888:

874:

867:

854:

841:

834:

818:

797:

790:

776:

772:

756:

755:

751:

726:

722:

717:

675:

668:in this market.

612:

536:

532:

515:

454:

448:

435:

429:

394:

388:

336:

330:

237:

221:

197:

169:seller or none;

138:

89:

60:

17:

12:

11:

5:

1184:

1174:

1173:

1159:

1158:

1157:, 32(2):221-6.

1148:

1147:

1140:

1122:

1115:

1097:

1090:

1073:

1064:

1040:

1028:

1002:

995:

977:

956:

935:

916:(3): 179–183.

893:

886:

865:

839:

832:

795:

788:

770:

749:

719:

718:

716:

713:

712:

711:

706:

701:

696:

691:

686:

681:

674:

671:

670:

669:

655:

641:

631:

628:Sydney Harbour

611:

608:

603:

602:

599:

596:

592:

591:

588:

585:

581:

580:

577:

574:

570:

569:

566:

563:

559:

558:

555:

552:

534:

530:

514:

511:

491:

490:

480:

459:Australia Post

450:Main article:

447:

444:

431:Main article:

428:

425:

424:

423:

420:

417:

411:

408:

390:Main article:

387:

384:

372:

371:

365:

332:Main article:

329:

326:

323:

322:

319:

316:

313:

309:

308:

305:

302:

299:

295:

294:

291:

288:

285:

281:

280:

277:

274:

271:

267:

266:

263:

260:

257:

236:

233:

220:

217:

196:

193:

192:

191:

188:differentiated

180:

177:

170:

163:

137:

134:

133:

132:

129:

126:

123:

120:

117:

114:

111:

108:Invisible Hand

100:

88:

85:

59:

56:

29:market failure

19:In economics,

15:

9:

6:

4:

3:

2:

1183:

1172:

1169:

1168:

1166:

1156:

1152:

1151:

1143:

1141:9781118273630

1137:

1133:

1126:

1118:

1112:

1108:

1101:

1093:

1091:0-393-96651-8

1087:

1083:

1077:

1068:

1054:

1050:

1044:

1035:

1033:

1016:

1012:

1006:

998:

996:9781118273630

992:

988:

981:

973:

967:

959:

957:0-262-57093-9

953:

949:

942:

940:

931:

927:

923:

919:

915:

911:

907:

900:

898:

889:

883:

879:

872:

870:

862:

858:

852:

850:

848:

846:

844:

835:

833:9781264363506

829:

825:

824:

816:

814:

812:

810:

808:

806:

804:

802:

800:

791:

785:

781:

774:

766:

760:

752:

750:0-13-063085-3

746:

742:

737:

736:

730:

724:

720:

710:

707:

705:

702:

700:

697:

695:

692:

690:

687:

685:

682:

680:

677:

676:

667:

663:

659:

656:

653:

649:

645:

642:

639:

635:

632:

629:

625:

622:

621:

620:

617:

607:

601:Light or nil

600:

597:

594:

593:

589:

586:

583:

582:

578:

575:

572:

571:

567:

564:

561:

560:

556:

553:

550:

549:

543:

540:

528:

524:

520:

510:

506:

504:

500:

496:

488:

487:marginal cost

484:

481:

478:

474:

471:

470:

469:

467:

462:

460:

453:

443:

441:

434:

421:

418:

415:

412:

409:

406:

403:

402:

401:

398:

393:

383:

381:

376:

369:

366:

363:

360:

359:

358:

355:

351:

347:

344:

342:

335:

320:

317:

314:

311:

310:

306:

303:

300:

297:

296:

292:

289:

286:

283:

282:

278:

275:

272:

269:

268:

264:

261:

258:

255:

254:

248:

246:

242:

232:

229:

225:

216:

212:

204:

200:

189:

185:

184:heterogeneous

181:

178:

175:

171:

168:

164:

161:

158:

154:

153:

152:

150:

145:

143:

130:

127:

124:

121:

118:

115:

112:

109:

105:

101:

98:

97:

96:

94:

84:

81:

80:Law of demand

77:

73:

64:

58:Demand Curves

55:

53:

49:

44:

42:

41:marginal cost

38:

32:

30:

26:

22:

1154:

1131:

1125:

1106:

1100:

1081:

1076:

1067:

1056:. Retrieved

1052:

1043:

1019:. Retrieved

1014:

1005:

986:

980:

947:

913:

909:

877:

860:

856:

822:

779:

773:

734:

723:

657:

643:

633:

623:

616:demand curve

613:

610:Market Power

606:

587:0.20 to 0.60

538:

526:

522:

516:

507:

498:

493:A firm is a

492:

482:

472:

463:

455:

436:

399:

395:

377:

373:

367:

361:

356:

352:

348:

345:

337:

244:

240:

238:

230:

226:

222:

213:

209:

198:

174:market entry

166:

160:price takers

156:

148:

146:

141:

139:

90:

72:demand curve

69:

45:

37:market power

33:

20:

18:

652:Instagram's

495:Monopsonist

410:Technology;

1058:2022-04-25

715:References

704:Oligopsony

598:Above 0.60

576:Below 0.20

565:Below 0.20

533:), where S

239:There are

966:cite book

759:cite book

699:Monopsony

689:Oligopoly

584:Oligopoly

485:is above

440:oligopoly

392:Oligopoly

386:Oligopoly

321:Complete

307:Complete

284:Oligopoly

176:and exit;

1165:Category

694:Monopoly

673:See also

666:monopoly

648:Monopoly

595:Monopoly

452:Monopoly

446:Monopoly

318:Complete

312:Monopoly

304:Complete

106:and the

52:monopoly

50:to pure

1021:1 April

930:4291464

709:Duopoly

638:patents

568:Fierce

433:Duopoly

427:Duopoly

405:Patents

298:Duopoly

1138:

1113:

1088:

993:

954:

928:

884:

830:

786:

747:

473:Output

43:(MC).

926:JSTOR

483:Price

479:; but

293:Some

279:Some

1136:ISBN

1111:ISBN

1086:ISBN

1023:2020

991:ISBN

972:link

952:ISBN

882:ISBN

828:ISBN

784:ISBN

765:link

745:ISBN

290:Some

276:Some

241:FOUR

918:doi

741:153

499:ONE

186:or

167:ONE

157:NOT

149:ONE

147:If

142:ANY

140:If

1167::

1051:.

1031:^

1013:.

968:}}

964:{{

938:^

924:.

912:.

908:.

896:^

868:^

859:.

842:^

798:^

761:}}

757:{{

743:.

442:.

1144:.

1119:.

1094:.

1061:.

1025:.

999:.

974:)

960:.

920::

914:2

890:.

863:.

836:.

792:.

767:)

753:.

539:N

535:i

531:i

489:.

416:;

407:;

190:.

110:;

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.