157:

126:

872:. Under this method, the first lien offered for sale will be offered to the investor holding bidder number one, who has the right of first refusal. If bidder number one refuses the lien, bidder number two may then bid. However, bidder number one will not be offered another lien until his number comes up again in the rotation. The next lien will go to the next number in line. Under this method, the investor has virtually no control over which liens s/he will obtain in the bidding, except to take or refuse what is offered.

22:

919:"non-self-executing": after the expiration of the redemption period the entity will conduct a tax deed sale of the property; the payments made by the lienholder constitute the opening bid and, if no other bids are received, the lienholder will acquire title to the property (the lienholder may choose to participate in the sale beyond the opening bid and make additional bids on the property if so desired).

985:, tax liens are illiquid. They cannot be "cashed in" (resold to the taxing authority), but must be held until either they are repaid or the holder takes action to foreclose. (It is possible to sell or assign one's interest in a tax lien to another party; such transfers usually require a fee to do so. However, the acquiring party may or may not wish to purchase the lien for the original amount.)

860:(excess above the lien amount) will be the winner. The premium may earn interest at a different rate than the base lien value (or may not earn interest at all), and in some cases may not be paid back to the investor upon redemption of the lien. (States that include this method include Colorado; Colorado does not pay interest on the premium nor does it return it upon redemption)

782:

necessary to start the tax deed sale process, such as required fees and payment of any still-unpaid taxes or buyout of other certificate holders' interests) constitutes the minimum bid; if no other bids are received at the sale then the lienholder will take title to the property subject to redemption periods (if applicable) or any lawsuit to overturn the sale.

905:

jurisdictions allow the lienholder first right to pay subsequent taxes, but if the lienholder chooses not to do so, a separate lien is offered for sale. Still other jurisdictions do not offer subsequent tax payment priority; each lien is sold separately (and can result in multiple liens on a property held by different lienholders).

724:

are various auction bidding methods used to determine final sale, the method and the terms of sale vary by county for each county in every state. Each county will advertise that no tax sale is risk-free since all title and certificates on property are sold 'as is' with no warranties, and no expectation of clear title.

900:

permitted during this period to contact the property owner (or anyone else having an interest in the property, such as the mortgage holder) to demand payment or threaten foreclosure, or else the lienholder can face sanctions (such as: termination of the lien and loss of money spent, being banned from

884:

on the property will be awarded the lien. For example, a bidder may agree to take a lien on only 95% of the property. If the lien is not redeemed, the investor would only receive 95% ownership of the property with the remaining 5% owned by the original owner. In practice, few investors will bid on

707:

Once the process begins, the property owner can still avoid foreclosure by paying the amount owed plus interest, penalties, and/or other costs or fees. The amounts can end up being quite high if the process is well under way. Even after foreclosure, in some jurisdictions the owner can still recover

977:

In "bid down the interest" jurisdictions, valuable properties are usually bid to the lowest rate possible greater than zero percent. Similarly, in "premium" states, valuable properties are bid up above the means of an average investor, and further, depending on the jurisdiction, the premium may not

814:

Some states allow a post-closing redemption period, during which time the original owner can redeem the property by paying the amount bid plus interest/penalty and costs. As such, if the purchaser makes improvements on the property and the original owner redeems it within the redemption period, the

806:

As stated above, in most jurisdictions properties sold in this manner are conveyed to the highest bidder via "tax deed" (or similarly-named deed), a form of quitclaim deed. Thus, the holder of the tax deed would then have to file a quiet title action, in order to clear any title defects or obtain a

1092:

Technically per the statutes, Nevada is supposed to award the lien to the first buyer making an offer; however, in practice it is sometimes hard to determine who was the first person bidding – especially at live auctions where multiple bidders are shouting interest – and thus the random

988:

Though touted as a means of obtaining property at very low cost, in practice liens are nearly always paid off prior to the auction date, and in those cases where the property is placed for auction, it is usually sold at a higher price than the original minimum bid of the lien, accrued interest, and

893:

The investor must wait a specified period of time (commonly referred to as the "redemption period") before taking action to foreclose on the property. During the redemption period, the lien (plus interest and any other fees) may be repaid by the owner or a legal designee of the owner. Usually the

777:

Some jurisdictions allow for a post-sale "redemption period", whereby the former owner has a specified amount of time to reclaim the property by repaying the amount bid at auction plus interest, penalties, and/or other costs. As such, purchasers of properties at tax deed sales are cautioned not to

680:

on the property which, if not paid, will result in future cost during a specified grace period wherein, to recover the property, the owner can be charged interest and/or penalties as well as other costs; and if completely non-paid, ultimately the seizure and selling of the property. In most places

1179:

For example, in

Florida a tax lien certificate must be redeemed within 7 years from the date of issuance (which is statutorily defined as the first day of the sale on which the certificate was purchased, even if the certificate was purchased after the first day), unless the lien holder has applied

1057:

For example, Texas allows a two year redemption period for homestead or agricultural properties, and a 180-day period for all other properties. The amount to be paid is the amount paid at the sale (which could be more than the original bid), plus 25% of that amount paid at the sale (for homestead

973:

In many states, further actions must be taken to protect the lien holder's rights after purchase of a lien, which require additional costs beyond the original investment (and the costs may or may not be repaid upon redemption). In addition, the actions must be performed within a certain period of

969:

Payment is usually required at purchase or within a very short time afterward (often no more than 24–72 hours). Failure to pay the full amount results in all lien certificates purchased by the investor being cancelled, and may result in the investor losing his/her deposit and/or being barred from

926:

If the lienholder does not act within a specified period of time, as defined by state law, the lien is forfeited and the holder loses his investment. This period of time cannot be extended unless the tax lien holder is officially in the process of foreclosing on the property or other legal action

723:

method. The title not the property is up for auction at a tax lien or deed sale, the property may or may not be salable. Traditionally, the auctions have been live events held at the county courthouse or another designated official location. However, online auctions have increased in usage. There

659:

on the property is sold) Under the tax lien sale process, depending on the jurisdiction, after a specified period of time if the lien is not redeemed, the lienholder may seek legal action which will result in the lienholder either automatically obtaining the property, or forcing a future tax deed

1138:

In many jurisdictions, technically per statute only the actual property owner or a legal designee are legally permitted to redeem the lien. In practice, though, jurisdictions usually do not strictly enforce the statute, desiring to have money in their accounts (and liens paid off to lienholders,

908:

Once the redemption period is over, the lien holder may initiate foreclosure proceedings. Normally, the cost of the proceedings will include, in addition to statutorily-mandated costs (such as application fees and costs for public notices), buy-outs of other liens and payment of any other unpaid

847:

rate of return is the winner. In the event that more than one investor will accept the same lower rate, the tie may be broken by 1) first bid received, 2) random selection, or 3) rotational method (see below for further discussion of the latter two methods). (States that use this method include

781:

A tax deed sale may also be used in conjunction with a tax lien sale process, whereby the lienholder (instead of a governmental agency) starts the process toward forcing a public sale of the property. In those instances the lienholder's investment (the price of the lien plus any additional costs

1286:

For example, Florida permits the interest rate to be bid down in 0.25% increments to as low as a minuscule 0.25% annual rate of return – though it guarantees a minimum 5% return on investment– while

Arizona allows the bid to be bid down in 1% increments to as low as 1% annual rate of

938:

The popularity of tax lien sales is driven, in large part, by the maximum rate of returns offered, which can be far higher than other investments, as well as the guarantee that the governmental entity, if the lien is redeemed, will repay the investor. Examples of such high returns include:

745:

Depending on the jurisdiction, any amount in excess of the minimum bid may or may not be returned to the original property title owner, or the owner may forfeit rights to such excess amount if not claimed within a specified period. Also, anyone having an interest in the property (such as a

904:

In some jurisdictions, the lienholder must agree to pay subsequent unpaid property taxes during the redemption period in order to protect his/her interest. If the lienholder does not pay such taxes, a subsequent lienholder would "buy out" (redeem) the prior lienholder's interest. Other

741:

bid for the property takes title. However, the purchaser must follow each county's rules, which vary widely, and usually have a very short period (generally 48–72 hours, or much less) to pay the entire amount owed, or else the sale is invalidated and usually the auction deposit is lost.

995:

As with tax deed sales, a property obtained via tax lien may still be subject to other liens and assessments on the property which are not extinguished at sale, which (along with any accrued interest) can, in some instances, exceed the value of the property itself, making it virtually

810:

Should a property be obtained, it may still be subject to other liens and assessments on the property which are not extinguished at sale. These liens and assessments (and their related interest) can, in some instances, exceed the value of the property itself, making it virtually

684:

The requirements to begin the foreclosure process (and to avoid it) must be strictly followed; otherwise, the property owner will lose all rights to the property (or the governmental entity will lose its right to collect the outstanding debt). Common requirements include:

1221:

Florida

Statutes, Section 197.472(2). The 5% minimum applies to the redeemer of the certificate; however, except for the additional $ 6.25 certificate fee assessed at redemption per Section 197.472(3) which is paid to the county, the balance due is remitted to the lien

749:

In the event the property is not purchased at auction, title generally reverts to the governmental entity that initiated the sale, which can then offer it for at or even below the original minimum bid (depending on property value and/or interest in the parcel).

708:

the property by paying the amounts owed (plus additional interest/penalties/costs) within a specified time. Alternatively, the owner can file suit to have the sale set aside on grounds that the requirements were not followed (such as proper notice not given).

689:

sending a letter by certified or registered mail to any and all owners of record as shown on the entity's records (some jurisdictions require an attempt at personal service), as well as to any person shown as having a mortgage, lien, or "other interest" in the

885:

liens for less than full right to the property or sale proceeds. Therefore, with multiple owners bidding on 100% encumbrance, the process then generally reverts to a tiebreaker method such as random selection. (States that use this method include Iowa)

802:

Though touted as a means of obtaining property at very low cost, in practice when a property is placed for auction at a tax deed sale, it is usually sold at a higher price than the original minimum bid of the back taxes, accrued interest, and costs of

866:. Under this method, a bidder will be randomly selected from those offering a bid. Usually, a computer is used to make the selection, but in smaller jurisdictions more rudimentary methods may be used. (States that use this method include Nevada)

794:

Payment is usually required at purchase or within a very short time afterward (often no more than 24–72 hours), and certified funds are required (i.e. financing is not allowed). Failure to pay the full amount generally results in the sales of

889:

Liens not sold at auction are considered "struck" (sold) to the jurisdiction conducting the auction. Some jurisdictions allow "over the counter" purchases of liens not sold at auction, subject to some liens being exempt from sale.

824:

In a tax lien sale, instead of selling the actual property, the governmental entity sells a lien on the property. The lien is generally for the amount of delinquent taxes, accrued interest, and costs associated with the sale.

909:

taxes plus accrued interest. During the period between the initiation of proceedings and actual foreclosure, the property owner still has the opportunity to repay the lien with interest plus the costs incurred to foreclose.

773:

action in order to resell the property later. However, title to the property can be sold from one purchaser to another using a limited warranty or another quitclaim deed, though usually at far less than its market value.

946:

Florida, which offers a maximum annual return rate of 18% (with a guaranteed minimum 5% return on the original lien investment, regardless of time held and regardless of the original rate bid, except if the rate bid was

1025:

NPR reported on a woman losing her home in

Baltimore in May 2010 because she had missed a water payment of $ 360; over time her obligation multiplied to over $ 3,000 after penalties, interest, and other fees were

1257:

668:

The governmental entity can be any level of government that can assess and collect property taxes or other governmental debt, such as counties (parishes, in the case of

Louisiana), cities, townships (in

1129:

April 1 (by law, the start date for tax lien certificate sales must be no later than June 1), in

Florida the redemption period is roughly 22 months after the date the certificate is sold.

703:

posting notice on the property itself in such a place and manner that it is visible to the public (such as the outside of an exterior door, or a sign on the property if it is unimproved).

1048:

A notable exception is

Illinois, where a "Tax Deed" delivers a clean title, as the issuing court removes all clouds on the title in its order directing the issuance of the deed.

735:

At the sale, the minimum bid is generally the amount of back taxes owed plus interest, as well as costs associated with selling the property. Often the purchaser making the

790:

Although the possibility of obtaining property at rates far below market values is promising, there are several pitfalls which must be taken into account before investing:

1232:

1218:

1206:

1194:

1181:

1149:

1120:

1107:

1080:

1261:

676:

State law offers the governmental entity a method of collecting its tax on the property without financially binding the nonpaying person or business, by placing a

778:

make major improvements on the property until after the redemption period has expired, as such improvements would then become the property of the original owner.

1071:

Florida uses tax lien sales at the initial tax delinquency, and the tax deed sale (upon a lienholder's request) to sell the property in order to redeem the lien.

616:

1035:

Online auctions allow for more sales in less time, as well as allowing bidders from outside the area (such as out-of-state or foreign bidders) to participate.

923:

In both cases, as with tax deed sales, title to the property will normally be in the form of a quitclaim deed, thus requiring further action to quiet title.

974:

time and in strict accordance with legal requirements; failure to comply exactly with such requirements may make the lien worthless and the investment lost.

1102:

For example, Florida allows purchases of liens struck to the various counties; however, per statute certificates for liens of less than $ 250 on

841:

rate of return allowed. However, investors can accept lower rates of return, including zero percent in some cases. The investor accepting the

966:

Some jurisdictions require a large deposit at the outset of the sale, regardless of how many certificates are to be purchased or their value.

673:

and other jurisdictions), and school districts (in places where they are independent of other governmental jurisdictions, such as in Texas).

1313:

1308:

828:

In the event that more than one investor seeks the same lien, depending on state law the winner will be determined by one of five methods:

1193:

For example, in

Florida the interest rate on an errant lien is only 8% (unless a lower rate was bid), vs. the 18% maximum rate allowed.

1139:

thus creating future interest in lien sales) as well as not wanting to upset members of the public who desire to pay debts legally owed.

1219:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.472.html

1207:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

1195:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

1182:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.482.html

1150:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

1121:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

1108:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

1081:

http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.432.html

954:

The market in tax liens has been so popular that a number of major banks and hedge funds have invested large amounts of capital in it.

1058:

and agricultural properties redeemed after the first year, the penalty is 50% of the amount paid), plus deed recording costs. See

1274:

For example, Miami-Dade County requires a $ 5,000 deposit, even if a buyer wants to purchase only one certificate for far less.

992:

As with tax deed sales, title to property is obtained via a form of quitclaim deed, thus requiring further action to quiet title.

1236:

799:

properties purchased by the investor being cancelled; the investor may also be barred from future sales in that jurisdiction.

371:

1275:

962:

Although the rates of return are promising, there are several pitfalls which must be taken into account before investing:

86:

930:

A lien issued in error of state law is repaid, but usually at a far lower interest rate than had the lien been valid.

156:

916:"self-executing": after the expiration of the redemption period the lienholder will acquire title to the property, or

623:

361:

105:

58:

1323:

286:

1119:

For example, in

Florida the period is "two years after April 1 of the year of issuance of the tax certificate".

281:

65:

1328:

336:

331:

43:

231:

1062:

Texas Tax Code, Section 34.21(a) (for homestead/agricultural properties) and (e) (for all other properties).

815:

purchaser may lose those improvements if they are physically attached to the property and cannot be removed.

716:

Two main methods are used to capture delinquent real property tax: the tax deed sale and the tax lien sale.

556:

251:

72:

411:

246:

1318:

1303:

1006:

591:

54:

39:

700:

posting notice at the local courthouse or other public place designated for official notices, and/or

506:

491:

301:

32:

982:

1059:

746:

governmental entity having weed liens on the property) may, in some cases, claim the excess.

551:

496:

456:

351:

346:

236:

211:

341:

241:

129:

8:

1276:

https://www.bidmiamidade.com/main?unique_id=vEfCeDAD5hGrBWl0dGFpSA&use_this=view_faqs

1036:

694:

561:

486:

201:

184:

753:

Title is generally transferred in a tax deed sale through a form of limited warranty or

1258:"Sun Sentinel Investigation: Tax lien sharks use shell companies to squeeze out locals"

943:

Iowa, which offers a guaranteed 2% per month simple interest return (24% annual return)

516:

356:

311:

79:

566:

521:

376:

306:

216:

196:

140:

125:

1106:

properties cannot be sold, either at the initial auction or over the counter. See

609:

596:

511:

406:

326:

296:

291:

221:

765:). In most jurisdictions, this type of deed is generally insufficient to acquire

1180:

for a tax deed or a legal or administrative proceeding "has existed of record".

835:. Under this method, the stated rate of return offered by the government is the

766:

471:

436:

431:

426:

366:

321:

271:

266:

179:

174:

1123:

Florida

Statutes, Section 197.432(13). Since Florida counties hold their sales

754:

681:

in the US, a tax lien takes priority, eclipsing other liens such as mortgages.

576:

541:

481:

381:

276:

256:

226:

189:

206:

1297:

476:

261:

912:

The foreclosure proceedings, depending on the jurisdiction, may be either:

531:

526:

501:

461:

416:

316:

446:

770:

670:

641:

466:

421:

401:

164:

660:

sale of the property and possibly obtaining the property as a result.

644:) by a governmental entity for unpaid taxes by the property's owner.

119:

769:. Therefore, a purchaser would most likely then need to initiate a

21:

586:

720:

391:

148:

132:

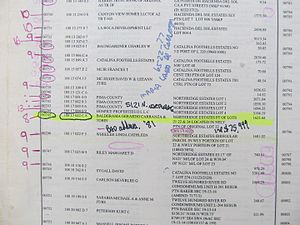

delinquent property tax list for auction by the County Treasurer

854:. Under this method, the investor willing to pay the highest

1039:, in particular, have embraced Internet auctions in interest.

1060:

http://www.statutes.legis.state.tx.us/Docs/TX/htm/TX.34.htm

677:

656:

950:

Arizona, which offers a maximum annual return rate of 16%

732:

In a tax deed sale, the title to each property is sold.

878:. The investor willing to purchase the lien for the

1233:"42-18053. Interest on delinquent taxes; exceptions"

46:. Unsourced material may be challenged and removed.

647:The sale, depending on the jurisdiction, may be a

957:

785:

1295:

933:

695:newspaper designated to publish legal notices

617:

1235:. Arizona State Legislature. Archived from

651:(whereby the actual property is sold) or a

624:

610:

106:Learn how and when to remove this message

901:future sales, and/or criminal charges).

640:is the forced sale of property (usually

124:

1152:Florida Statutes, Sections 197.432(14).

1296:

1197:Florida Statutes, Section 197.432(11),

1209:Florida Statutes, Section 197.432(6).

1110:Florida Statutes, Section 197.432(4).

1083:Florida Statutes, Section 197.432(6).

44:adding citations to reliable sources

15:

1314:State taxation in the United States

1309:Local taxation in the United States

13:

1184:Florida Statutes, Section 197.482.

1170:Florida falls under this category.

14:

1340:

927:(such as bankruptcy) is pending.

819:

727:

155:

20:

1280:

1268:

1250:

1225:

1212:

1200:

1187:

1173:

1164:

1155:

1142:

1132:

31:needs additional citations for

1113:

1096:

1086:

1074:

1065:

1051:

1042:

1029:

1019:

958:Pitfalls of tax lien investing

786:Pitfalls of tax deed investing

719:Both methods operate using an

1:

1012:

881:lowest percent of encumbrance

693:placing a public notice in a

934:Popularity of tax lien sales

807:mortgage or title insurance.

7:

1000:

10:

1345:

1161:e.g., Arizona and Colorado

1007:Archon Information Systems

663:

117:

592:Private electronic market

711:

287:Generalized second-price

118:Not to be confused with

1324:Real estate terminology

282:Generalized first-price

983:certificate of deposit

876:Bid Down the Ownership

337:Simultaneous ascending

133:

1329:Governmental auctions

833:Bid Down the Interest

757:(sometimes styled as

372:Vickrey–Clarke–Groves

128:

870:Rotational Selection

848:Arizona and Florida)

252:Discriminatory price

130:Pima County, Arizona

40:improve this article

562:Revenue equivalence

247:Deferred-acceptance

332:Sealed first-price

134:

1319:Real property law

1304:Tax noncompliance

1148:For example, see

634:

633:

412:Cancellation hunt

362:Value of revenues

232:Click-box bidding

116:

115:

108:

90:

1336:

1288:

1284:

1278:

1272:

1266:

1265:

1260:. Archived from

1254:

1248:

1247:

1245:

1244:

1229:

1223:

1216:

1210:

1204:

1198:

1191:

1185:

1177:

1171:

1168:

1162:

1159:

1153:

1146:

1140:

1136:

1130:

1117:

1111:

1100:

1094:

1090:

1084:

1078:

1072:

1069:

1063:

1055:

1049:

1046:

1040:

1037:Florida counties

1033:

1027:

1023:

864:Random Selection

626:

619:

612:

557:Price of anarchy

407:Calor licitantis

159:

136:

135:

111:

104:

100:

97:

91:

89:

48:

24:

16:

1344:

1343:

1339:

1338:

1337:

1335:

1334:

1333:

1294:

1293:

1292:

1291:

1285:

1281:

1273:

1269:

1264:on May 6, 2013.

1256:

1255:

1251:

1242:

1240:

1231:

1230:

1226:

1217:

1213:

1205:

1201:

1192:

1188:

1178:

1174:

1169:

1165:

1160:

1156:

1147:

1143:

1137:

1133:

1118:

1114:

1101:

1097:

1093:method is used.

1091:

1087:

1079:

1075:

1070:

1066:

1056:

1052:

1047:

1043:

1034:

1030:

1024:

1020:

1015:

1003:

960:

936:

894:lien holder is

822:

788:

767:title insurance

730:

714:

666:

630:

601:

571:

536:

441:

437:Tacit collusion

386:

302:Multi-attribute

123:

112:

101:

95:

92:

49:

47:

37:

25:

12:

11:

5:

1342:

1332:

1331:

1326:

1321:

1316:

1311:

1306:

1290:

1289:

1279:

1267:

1249:

1224:

1211:

1199:

1186:

1172:

1163:

1154:

1141:

1131:

1112:

1095:

1085:

1073:

1064:

1050:

1041:

1028:

1017:

1016:

1014:

1011:

1010:

1009:

1002:

999:

998:

997:

993:

990:

989:costs of sale.

986:

979:

975:

971:

967:

959:

956:

952:

951:

948:

944:

935:

932:

921:

920:

917:

887:

886:

873:

867:

861:

849:

821:

818:

817:

816:

812:

808:

804:

800:

787:

784:

763:Sheriff's Deed

755:quitclaim deed

729:

726:

713:

710:

705:

704:

701:

698:

691:

665:

662:

632:

631:

629:

628:

621:

614:

606:

603:

602:

600:

599:

594:

589:

583:

580:

579:

573:

572:

570:

569:

567:Winner's curse

564:

559:

554:

548:

545:

544:

538:

537:

535:

534:

529:

524:

519:

514:

509:

504:

499:

494:

489:

484:

479:

474:

469:

464:

459:

453:

450:

449:

443:

442:

440:

439:

434:

429:

424:

419:

414:

409:

404:

398:

395:

394:

388:

387:

385:

384:

379:

374:

369:

364:

359:

354:

349:

344:

339:

334:

329:

324:

319:

314:

309:

304:

299:

294:

289:

284:

279:

274:

269:

264:

259:

254:

249:

244:

239:

234:

229:

224:

219:

214:

209:

204:

199:

194:

193:

192:

187:

182:

171:

168:

167:

161:

160:

152:

151:

145:

144:

114:

113:

28:

26:

19:

9:

6:

4:

3:

2:

1341:

1330:

1327:

1325:

1322:

1320:

1317:

1315:

1312:

1310:

1307:

1305:

1302:

1301:

1299:

1283:

1277:

1271:

1263:

1259:

1253:

1239:on 2015-09-19

1238:

1234:

1228:

1220:

1215:

1208:

1203:

1196:

1190:

1183:

1176:

1167:

1158:

1151:

1145:

1135:

1128:

1127:

1122:

1116:

1109:

1105:

1099:

1089:

1082:

1077:

1068:

1061:

1054:

1045:

1038:

1032:

1022:

1018:

1008:

1005:

1004:

994:

991:

987:

984:

980:

976:

972:

970:future sales.

968:

965:

964:

963:

955:

949:

945:

942:

941:

940:

931:

928:

924:

918:

915:

914:

913:

910:

906:

902:

899:

898:

891:

883:

882:

877:

874:

871:

868:

865:

862:

859:

858:

853:

850:

846:

845:

840:

839:

834:

831:

830:

829:

826:

820:Tax lien sale

813:

809:

805:

801:

798:

793:

792:

791:

783:

779:

775:

772:

768:

764:

760:

756:

751:

747:

743:

740:

739:

733:

728:Tax deed sale

725:

722:

717:

709:

702:

699:

696:

692:

688:

687:

686:

682:

679:

674:

672:

661:

658:

654:

653:tax lien sale

650:

649:tax deed sale

645:

643:

639:

627:

622:

620:

615:

613:

608:

607:

605:

604:

598:

595:

593:

590:

588:

585:

584:

582:

581:

578:

575:

574:

568:

565:

563:

560:

558:

555:

553:

552:Digital goods

550:

549:

547:

546:

543:

540:

539:

533:

530:

528:

525:

523:

520:

518:

515:

513:

510:

508:

505:

503:

500:

498:

495:

493:

490:

488:

485:

483:

480:

478:

475:

473:

470:

468:

465:

463:

460:

458:

455:

454:

452:

451:

448:

445:

444:

438:

435:

433:

430:

428:

425:

423:

420:

418:

415:

413:

410:

408:

405:

403:

400:

399:

397:

396:

393:

390:

389:

383:

380:

378:

375:

373:

370:

368:

365:

363:

360:

358:

355:

353:

352:Uniform price

350:

348:

347:Traffic light

345:

343:

340:

338:

335:

333:

330:

328:

325:

323:

320:

318:

315:

313:

310:

308:

305:

303:

300:

298:

295:

293:

290:

288:

285:

283:

280:

278:

275:

273:

270:

268:

265:

263:

260:

258:

255:

253:

250:

248:

245:

243:

240:

238:

237:Combinatorial

235:

233:

230:

228:

225:

223:

220:

218:

215:

213:

212:Best/not best

210:

208:

207:Barter double

205:

203:

200:

198:

195:

191:

188:

186:

183:

181:

178:

177:

176:

173:

172:

170:

169:

166:

163:

162:

158:

154:

153:

150:

147:

146:

142:

138:

137:

131:

127:

121:

110:

107:

99:

96:February 2018

88:

85:

81:

78:

74:

71:

67:

64:

60:

57: –

56:

52:

51:Find sources:

45:

41:

35:

34:

29:This article

27:

23:

18:

17:

1282:

1270:

1262:the original

1252:

1241:. Retrieved

1237:the original

1227:

1214:

1202:

1189:

1175:

1166:

1157:

1144:

1134:

1125:

1124:

1115:

1103:

1098:

1088:

1076:

1067:

1053:

1044:

1031:

1021:

961:

953:

937:

929:

925:

922:

911:

907:

903:

896:

895:

892:

888:

880:

879:

875:

869:

863:

856:

855:

851:

843:

842:

837:

836:

832:

827:

823:

796:

789:

780:

776:

762:

758:

752:

748:

744:

737:

736:

734:

731:

718:

715:

706:

683:

675:

667:

652:

648:

646:

637:

635:

487:Domain names

342:Single-price

242:Common value

102:

93:

83:

76:

69:

62:

50:

38:Please help

33:verification

30:

771:quiet title

671:New England

655:(whereby a

642:real estate

202:Anglo-Dutch

185:Bidding fee

1298:Categories

1243:2015-08-22

1013:References

996:worthless.

978:be repaid.

811:worthless.

457:Algorithms

357:Unique bid

312:No-reserve

66:newspapers

55:"Tax sale"

1104:homestead

981:Unlike a

690:property,

522:Virginity

377:Walrasian

307:Multiunit

217:Brazilian

197:Amsterdam

120:Sales tax

1001:See also

759:Tax Deed

638:tax sale

597:Software

587:Ebidding

512:Spectrum

477:Children

447:Contexts

327:Scottish

297:Knapsack

292:Japanese

222:Calcutta

149:Auctions

141:a series

139:Part of

1287:return.

1222:holder.

857:premium

852:Premium

838:maximum

738:highest

721:auction

664:General

492:Flowers

482:Players

472:Charity

432:Suicide

427:Sniping

422:Rigging

402:Shading

392:Bidding

367:Vickrey

322:Reverse

272:Forward

267:English

180:Chinese

175:All-pay

80:scholar

1026:added.

844:lowest

577:Online

542:Theory

517:Stamps

507:Slaves

382:Yankee

277:French

257:Double

227:Candle

190:Dollar

82:

75:

68:

61:

53:

1126:after

803:sale.

712:Sales

532:Wives

497:Loans

462:Autos

262:Dutch

165:Types

87:JSTOR

73:books

678:lien

657:lien

527:Wine

502:Scam

417:Jump

317:Rank

59:news

947:0%)

897:not

797:all

761:or

467:Art

42:by

1300::

636:A

143:on

1246:.

697:,

625:e

618:t

611:v

122:.

109:)

103:(

98:)

94:(

84:·

77:·

70:·

63:·

36:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.