221:

produces no shirts it has incurred those costs. Similarly, even if the total cost of producing 1 shirt is greater than the revenue from selling the shirt, the business would produce the shirt anyway if the revenue were greater than the variable cost. If the revenue that it is receiving is greater than its variable cost but less than its total cost, it will continue to operate while accruing an economic loss. If its total revenue is less than its variable cost in the short run, the business should shut down. If revenue is greater than total cost, this firm will have positive economic profit.

235:

20:

87:, it is necessary to know how costs divide between variable and fixed. This distinction is crucial in forecasting the earnings generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns. In a survey of nearly 200 senior marketing managers, 60 percent responded that they found the "variable and fixed costs" metric very useful.

340:

used in production. However, over a six-month horizon, the factory will be better able to change the amount of labor to fit the desired output, either by using overtime hours, laying off employees, or hiring new employees. Thus, much of their labor becomes a variable cost - though not the cost of the managers, whose salaries are paid regardless of output.

343:

Over a five-year horizon, all costs can become variable costs. The business can decide to shut down and sell off its buildings and equipment if long-run total cost exceeds their long-run total revenue, or to expand and increase the amount of both of them if their long-run total revenue exceeds their

220:

The amount of materials and labor that goes into each shirt increases with the number of shirts produced. In this sense, the cost "varies" as production varies. In the long run, if the business planned to make 0 shirts, it would choose to have 0 machines and 0 rooms, but in the short run, even if it

339:

Over a one-day horizon, a factory's costs might largely consist of fixed costs, not variable. The company must pay for the building, the employee benefits, and the machinery regardless of whether anything is produced that day. The main variable cost will be materials and any energy costs actually

129:, and 8 hours of a laborer's time with 6 yards of cloth to make a shirt, then the cost of labor and cloth increases if two shirts are produced, and those are the variable costs. The facility and equipment are fixed costs, incurred regardless of whether even one shirt is made.

347:

Thus, which costs are classified as variable and which as fixed depends on the time horizon, most simply classified into short run and long run, but really with an entire range of time horizons.

106:. An analytical formula of variable cost as a function of these factors has been derived. It can be used to assess how different factors impact variable cost and total return in an investment.

459:

344:

long-run total cost, which would include their variable costs. It can change its entire labor force, managerial as well as line workers.

530:

499:

41:

are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of

307:

279:

69:, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced.

455:

326:

286:

125:, variable cost would include the direct material, i.e., cloth, and the direct labor. If the business uses a room, a

264:

576:

571:

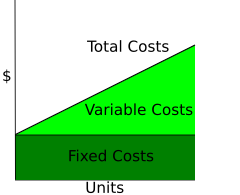

561:

293:

260:

256:

458:. Content used from this source has been licensed under CC-By-SA and GFDL and may be reproduced verbatim. The

566:

95:

275:

245:

249:

540:

300:

8:

462:

endorses the definitions, purposes, and constructs of classes of measures that appear in

397:

392:

62:

61:. However, not all variable costs are direct costs. For example, variable manufacturing

382:

526:

495:

451:

122:

487:

481:

367:

446:

Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010).

437:

Garrison, Noreen, Brewer. Ch 2 - Managerial

Accounting and Costs Concepts, pp 39

425:

Garrison, Noreen, Brewer. Ch 2 - Managerial

Accounting and Costs Concepts, pp 51

416:

Garrison, Noreen, Brewer. Ch 2 - Managerial

Accounting and Costs Concepts, pp 48

556:

126:

66:

491:

550:

114:

Some common examples include sales commission, labor costs, and the costs of

103:

42:

467:

115:

448:

Marketing

Metrics: The Definitive Guide to Measuring Marketing Performance

377:

99:

58:

27:

23:

483:

The Unity of

Science and Economics: A New Foundation of Economic Theory

387:

372:

362:

91:

50:

46:

518:

84:

234:

45:

over all units produced. They can also be considered normal costs.

520:

90:

The level of variable cost is influenced by many factors, such as

76:, while direct material and direct labor are often referred to as

19:

34:. The quantity of output is measured on the horizontal axis.

357:

450:, Upper Saddle River, New Jersey: Pearson Education, Inc.

57:

are costs that can easily be associated with a particular

519:

Garrison, Ray H; Eric W. Noreen; Peter C. Brewer (2009).

49:and variable costs make up the two components of

548:

440:

460:Marketing Accountability Standards Board (MASB)

16:Sum of marginal costs over all units produced

433:

431:

263:. Unsourced material may be challenged and

224:

72:Direct labor and overhead are often called

327:Learn how and when to remove this message

428:

419:

410:

18:

549:

479:

468:Common Language in Marketing Project

261:adding citations to reliable sources

228:

541:Prime Cost Explanation and Examples

525:(13e ed.). McGraw-Hill Irwin.

13:

65:costs are variable costs that are

14:

588:

233:

123:business which produces clothing

473:

1:

511:

7:

350:

109:

10:

593:

492:10.1007/978-1-4939-3466-9

404:

225:Variable costs over time

151:Cloth (Direct Materials)

466:as part of its ongoing

577:Management cybernetics

35:

572:Corporate development

562:Management accounting

522:Managerial Accounting

22:

567:Production economics

257:improve this section

168:Labor (Direct Labor)

543:by Play Accounting.

480:Chen, Jing (2016).

398:Contribution margin

393:Total revenue share

202:Facility (overhead)

96:duration of project

383:Semi variable cost

36:

532:978-0-07-337961-6

501:978-1-4939-3464-5

464:Marketing Metrics

337:

336:

329:

311:

218:

217:

26:disaggregated as

584:

537:

536:

506:

505:

477:

471:

444:

438:

435:

426:

423:

417:

414:

332:

325:

321:

318:

312:

310:

269:

237:

229:

132:

131:

592:

591:

587:

586:

585:

583:

582:

581:

547:

546:

533:

517:

514:

509:

502:

478:

474:

445:

441:

436:

429:

424:

420:

415:

411:

407:

402:

368:Cost accounting

353:

333:

322:

316:

313:

276:"Variable cost"

270:

268:

254:

238:

227:

112:

74:conversion cost

17:

12:

11:

5:

590:

580:

579:

574:

569:

564:

559:

545:

544:

538:

531:

513:

510:

508:

507:

500:

472:

439:

427:

418:

408:

406:

403:

401:

400:

395:

390:

385:

380:

375:

370:

365:

360:

354:

352:

349:

335:

334:

241:

239:

232:

226:

223:

216:

215:

212:

209:

206:

203:

199:

198:

195:

192:

189:

186:

182:

181:

178:

175:

172:

169:

165:

164:

161:

158:

155:

152:

148:

147:

144:

141:

138:

135:

127:sewing machine

111:

108:

67:indirect costs

43:marginal costs

39:Variable costs

32:Variable Costs

15:

9:

6:

4:

3:

2:

589:

578:

575:

573:

570:

568:

565:

563:

560:

558:

555:

554:

552:

542:

539:

534:

528:

524:

523:

516:

515:

503:

497:

493:

489:

485:

484:

476:

469:

465:

461:

457:

456:0-13-705829-2

453:

449:

443:

434:

432:

422:

413:

409:

399:

396:

394:

391:

389:

386:

384:

381:

379:

376:

374:

371:

369:

366:

364:

361:

359:

356:

355:

348:

345:

341:

331:

328:

320:

317:November 2023

309:

306:

302:

299:

295:

292:

288:

285:

281:

278: –

277:

273:

272:Find sources:

266:

262:

258:

252:

251:

247:

242:This section

240:

236:

231:

230:

222:

213:

210:

207:

204:

201:

200:

196:

193:

190:

187:

184:

183:

179:

176:

173:

170:

167:

166:

162:

159:

156:

153:

150:

149:

145:

142:

139:

136:

134:

133:

130:

128:

124:

119:

117:

116:raw materials

107:

105:

104:discount rate

101:

97:

93:

88:

86:

81:

79:

75:

70:

68:

64:

60:

56:

52:

48:

44:

40:

33:

29:

25:

21:

521:

486:. Springer.

482:

475:

463:

447:

442:

421:

412:

346:

342:

338:

323:

314:

304:

297:

290:

283:

271:

255:Please help

243:

219:

120:

113:

89:

82:

77:

73:

71:

55:Direct costs

54:

38:

37:

31:

378:Cost driver

100:uncertainty

59:cost object

47:Fixed costs

28:Fixed Costs

24:Total Costs

551:Categories

512:References

388:Total cost

373:Cost curve

363:Fixed cost

287:newspapers

197:1 machine

92:fixed cost

78:prime cost

51:total cost

244:does not

194:1 machine

191:1 machine

188:1 machine

185:Equipment

146:3 shirts

85:marketing

351:See also

143:2 shirts

137:0 shirts

110:Examples

63:overhead

301:scholar

265:removed

250:sources

214:1 room

140:1 shirt

529:

498:

454:

303:

296:

289:

282:

274:

211:1 room

208:1 room

205:1 room

180:24hrs

163:18yds

121:For a

557:Costs

405:Notes

308:JSTOR

294:books

177:16hrs

160:12yds

30:plus

527:ISBN

496:ISBN

452:ISBN

358:Cost

280:news

248:any

246:cite

174:8hrs

171:0hrs

157:6yds

154:0yds

102:and

488:doi

259:by

83:In

553::

494:.

430:^

118:.

98:,

94:,

80:.

53:.

535:.

504:.

490::

470:.

330:)

324:(

319:)

315:(

305:·

298:·

291:·

284:·

267:.

253:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.