33:

177:

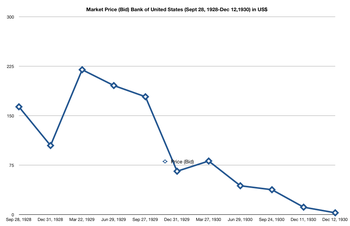

221:, Joseph Broderick, to take over the bank's assets. The stock market reacted negatively with the stock price of the bank, which had traded as high as $ 91.50 during the year (and a lifetime high of $ 231.25 in 1928) dropping from $ 11.50 to $ 3.00 (with a low of $ 2.00). Most other bank stocks also sold off. Broderick tried to arrange a merger with three other banks but the big

282:). Meanwhile, a $ 50 million stockholder suit was launched against the directors of the bank on the grounds of negligence and incompetence, a woman with deposits of $ 20,000 in the bank hanged herself, and the Equity Casualty and Surety Company, which had invested more than $ 1 million in Bank of United States stock, declared bankruptcy.

88:

bank, with the backing of several well-known financiers, because of a disagreement with other members of the management. Though the directors of Public Bank objected to the choice of name, arguing that "ignorant foreigners would believe that the United States government was interested in this bank and that it was a branch of the

132:

The bank grew slowly, with only five branches by 1925. However, after the death of the founder, his son

Bernard, who had been running the bank since 1919, grew the bank rapidly through a series of mergers until it had 62 branches by 1930. In April 1928, it merged with the Central Mercantile Bank and

232:

offered to lend Bank of United States depositors 50% of their deposits. At the same time, the office of the New York State Bureau of

Securities announced that they had been investigating charges that the Bank of United States had sold stock to depositors under a one-year guarantee against loss that

205:

By the midday, a crowd of 20,000 to 25,000 people had gathered and had to be controlled by the police, and by the end of the day 2,500 to 3,000 depositors had withdrawn $ 2,000,000 from the branch. However, most of the 7,000 depositors who came to withdraw their money left their assets in the bank.

111:

and immigrated to the United States at the age of 17. He worked his way up from being a tailor to a garment industry business to being a banker. He founded the Public Bank in 1906 and the Bank of United States in 1913. He died on July 3, 1927. He was also a philanthropist known for his donations to

285:

Among the 608 banks that closed in

November and December 1930, the Bank of United States accounted for a third of the total $ 550 million deposits lost, and it is thought that with its closure, bank failures reached a critical mass. People flocked to withdraw their money from other banks. In turn,

167:

On

December 8, 1930, unable to agree on merger terms, the plan was dropped because, it later emerged, of difficulties in guaranteeing the deposits of Bank of United States, due to complications arising from the legal difficulties of the bank, and because of real estate mortgages and loans held by

87:

The Bank of United States was chartered on June 23, 1913 with a capital of $ 100,000 and a surplus of $ 50,000. The bank was founded by Joseph S. Marcus, a former president of the Public Bank, also of

Delancey Street. Marcus, who was responsible for the building up of Public Bank, started the new

136:

In April 1929, it absorbed the

Colonial Bank and the Bank of the Rockaways. In May 1929, it merged with the Municipal Bank and Trust Company, making the combined Bank of United States the third largest bank in New York City, and twenty-eighth in the United States. With a

594:"FALSE RUMOR LEADS TO TROUBLE AT BANK; Branches of Bank of United States in the Bronx Meet All Withdrawal Demands. LARGE CROWD AT ONE PLACE Long Line of Depositors Paid in Full—Officers Allay the Fears of Others. Other Branches Meet Demands. Conference of Bankers"

712:"RED PLOT TO START BANK RUN REVEALED BY BRODERICK AIDES; Officials Say They Intervened to Halt Drive on an Institution Last Saturday. ALARMISTS TOURED STORES Raids Discussed at Meetings and Use of Soviet Funds in Short Selling Is Hinted. ORGANIZED CAMPAIGN SEEN"

257:

in 1907. Worried city and state officials tried to reassure the public by rushing through the program by which Bank of United States depositors could borrow money against their deposits. Some depositors started to receive their loans on

December 23, 1930 and

160:, Public National Bank and Trust Company, International Bank and Trust Company, and the Bank of United States-began talks to merge, and on November 24 announced that they had agreed to form a mega-bank headed by J. Herbert Case, the President of the

252:

The closing of Bank of United States came as a shock to the banking industry, which had not seen a failure of a large New York bank since the stock market crash of 1929, and the first failure of such magnitude since the failure of the

475:"THREE BANKS VOTE TO UNITE ON APRIL 1; Bank of United States Will Absorb Colonial and Rockaways Institution.WILL RAISE NEW CAPITAL Total to Be $ 20,875,000, Resources at $ 250,000,000—To Sell Sharesin Units With Bankus Stock"

457:"STOCKHOLDERS VOTE BANK MERGER HERE; Cosmopolitan Absorbed by Bank of United States, Which Increases Its Capital. UNION EFFECTIVE MONDAY Combination Accomplished by an Exchange of Shares—Personnel to Remain Unaltered"

730:"BANK OF U.S HEADS SUED FOR $ 50,000,000; Stockholder Charges Neglect and That Huge Profits Went to Officials. ROSOFF AIDS DEPOSITORS Starts $ 1,000,000 Loan Fund With $ 100,000—Three Plans Weighed to Reopen Chelsea"

474:

367:"GIVES ROOF GARDEN FOR JEWISH BLIND; J. S. Marcus Equips Recreation Centre on Top of Bank of United States Building EXCLUSIVELY FOR THEIR USE Association Aims to Hunt Up the Sightless of Their Race and Educate Them"

413:"JOSEPH S. MARCUS, BANKER, DIES AT 65; Founder and President of Bank of United States Began as a Store Clerk. HIS PHILANTHROPIES MANY Israel Orphan Asylum and Beth Israel Hospital Among the Charities He Aided"

366:

262:

reported that throngs of depositors lined up to receive their loans, many arriving hours before the branches opened and many were turned away because they could not be served by the end of the day.

270:

Soon after the closing of the Bank of United States, another bank, the

Chelsea Bank, was taken over by the Superintendent of Banks, amidst allegations attributed to "reliable sources" that the

390:

206:

One person stood in line for two hours to claim his $ 2 account balance. As the news spread, there were smaller runs at several other branches in the Bronx as well as in the

202:

reported that the run was based on a false rumor spread by a small local merchant, a holder of stock in the bank, who claimed that the bank had refused to sell his stock.

807:

321:

901:

916:

92:

in

Washington", the name was approved and the bank came into being. The use of such an appellation was outlawed in 1926 but did not apply retroactively.

72:

906:

145:

payment of $ 2 for 1929, the president of the bank declared the bank to be on a sound footing in a letter to shareholders following the stock

911:

234:

237:

office undertook to examine the bank for possible crimes. Depositors thronged the bank branches but were turned away by mounted police. The

228:

The directors of the bank as well as of other New York banks were optimistic that the bank would reopen in a few weeks, and members of the

881:

225:

banks refused to help, possibly because of anti-semitism. Without the necessary $ 30 million bridge loan, the bank could not be saved.

26:

493:"$ 300,000,000 MERGER OF BANKS APPROVED; Union of Bank of United States and Municipal Made Formal-- Former Increases Capital Stock"

96:

612:"MARKET STAGES RALLY AFTER SELLING FLURRY; Stock of Bank of United States Sinks to $ 3 Bid, $ 7 Asked-- Other Bank Shares Decline"

196:(though there had already been a wave of bank runs in the southeastern part of the U.S., at least as early as November 1930).

896:

891:

792:

249:

reported that gross deposits in the bank had dropped from $ 212 million to $ 160 million between

October 17 and December 11.

866:

729:

693:

611:

593:

572:

532:"$ 1,000,000,000 UNION OF BANKS COMPLETED; Manufacturers, Public National, International and United States Agree on Terms"

531:

412:

765:

747:

711:

660:

549:

513:

492:

456:

21:

This article is about a commercial bank in New York that failed in 1930. For the central bank of the United States, see

886:

343:"HIGH-TITLED BANK CAN HOLD ITS NAME; Its Rivals Argued East Side Would Think "Bank of United States" Was Government's"

218:

161:

815:

514:"PRESIDENT OF BANK REVIEWS ITS GROWTH; Bernard K. Marcus Sends Letter to Stockholders of Bank of United States"

921:

862:

342:

254:

157:

271:

185:

133:

Trust Company with Bernard Marcus as the president. In August 1928, it absorbed the Cosmopolitan Bank.

113:

294:

150:

852:

430:

229:

100:

188:

branch in the Bronx seeking to withdraw their money, and started what is usually considered the

217:

The next day, fearing a run on the bank, the directors decided to close the bank and asked the

89:

391:"Streetscapes: The Bank of the United States in the Bronx; The First Domino In the Depression"

293:

After the bank's collapse in 1932, the bank building on Delancey Street was taken over by the

642:

287:

104:

766:"SURETY COMPANY CLOSES.; Failure of Casualty Concern Laid to Bank of United States Losses"

32:

8:

168:

subsidiaries of the bank. Two days later, there was a run on a Bronx branch of the bank.

121:

116:

and for the Hebrew Association for the Blind. His son, Bernard K. Marcus, a graduate of

198:

180:

Bid price for the Bank of United States. Quarter ends 1928–1930 + Dec. 11 and 12, 1930

788:

238:

117:

748:"DEPOSITOR HANGS HERSELF; Woman Who Had $ 20,000 in Bank of U.S. Is Found a Suicide"

193:

76:

858:

646:

45:

22:

146:

630:

245:, began legal action to recover $ 1.5 million which the city had in the bank.

875:

207:

53:

49:

279:

275:

242:

60:

222:

124:, joined the bank as cashier in 1913 and became vice president in 1918.

138:

68:

36:

Crowds form outside the Bank of United States when it failed in 1931.

211:

189:

142:

64:

290:. In that month alone, over 300 banks around the country failed.

176:

108:

814:. American Public Media. September 15, 2008. Archived from

286:

the banks called in loans and sold assets in order to stay

56:

836:

Sanders, R. (2013). "Delancy, Grand & Essex Streets".

855:. Photo of the Bank of the United States on Delancey St.

588:

586:

573:"BANK OF U.S. CLOSES DOORS; STATE TAKES OVER AFFAIRS"

274:

was actively trying to create a run on the bank (the

25:. For federal and other private banks in the US, see

184:

On December 10, 1930, a large crowd gathered at the

583:

873:

71:branch is said to have started the collapse of

629:Gordon, John Steele (November–December 2018).

508:

506:

407:

405:

403:

44:, founded by Joseph S. Marcus in 1913 at 77

902:Defunct companies based in New York (state)

808:"Where will Lehman failure fit in history?"

384:

382:

380:

917:1930 disestablishments in New York (state)

567:

565:

563:

337:

335:

27:Bank of the United States (disambiguation)

503:

400:

316:

314:

156:In mid-1930, four leading New York banks-

782:

377:

175:

31:

560:

361:

359:

332:

322:"MERGER OF 2 BANKS LINKS $ 175,000,000"

874:

678:"PERFECTS PROGRAM TO AID DEPOSITORS",

628:

311:

907:Great Depression in the United States

859:Clippings about Bank of United States

550:"PROPOSAL TO MERGE 4 BANKS ABANDONED"

389:Gray, Christopher (August 18, 1991),

95:The founder, Joseph S. Marcus, was a

912:1913 establishments in New York City

694:"THRONGS AT BANK GET LOANS ON FUNDS"

388:

356:

99:to the United States. Born in Telz,

230:New York Clearing House Association

13:

882:Defunct banks of the United States

853:Bank of the United States building

107:in 1862, Marcus went to school in

14:

933:

846:

783:Ferguson, Niall (October 2009),

233:they had not been honoring. The

219:New York Superintendent of Banks

162:Federal Reserve Bank of New York

830:

800:

776:

758:

740:

722:

704:

686:

671:

653:

622:

604:

542:

524:

485:

467:

449:

423:

278:was also accused of financing

1:

445:– via Internet Archive.

300:

897:Banks based in New York City

892:Banks disestablished in 1930

265:

82:

7:

863:20th Century Press Archives

631:"The Bank of United States"

431:"The Bank of United States"

255:Knickerbocker Trust Company

158:Manufacturers Trust Company

10:

938:

352:, p. 7, June 24, 1913

272:Communist Party of America

171:

20:

887:Banks established in 1913

295:Hebrew Publishing Company

127:

787:, Penguin, p. 163,

437:. July 1920. p. 125

181:

90:United States Treasury

37:

840:. Dover Publications.

818:on September 27, 2011

179:

42:Bank of United States

35:

922:History of the Bronx

435:The Bankers Magazine

114:Beth Israel Hospital

16:Former American bank

838:The Lower East Side

785:The Ascent of Money

736:, December 31, 1930

718:, December 26, 1930

700:, December 23, 1930

682:, December 15, 1930

667:, December 13, 1930

635:ABA Banking Journal

618:, December 12, 1930

600:, December 11, 1930

579:, December 12, 1930

538:, November 25, 1930

235:District Attorney's

122:Columbia University

770:The New York Times

752:The New York Times

734:The New York Times

716:The New York Times

698:The New York Times

680:The New York Times

665:The New York Times

661:"THE BANK FAILURE"

616:The New York Times

598:The New York Times

577:The New York Times

556:, December 9, 1930

554:The New York Times

536:The New York Times

520:, February 2, 1930

518:The New York Times

497:The New York Times

479:The New York Times

461:The New York Times

417:The New York Times

395:The New York Times

371:The New York Times

350:The New York Times

326:The New York Times

260:The New York Times

247:The New York Times

199:The New York Times

186:Southern Boulevard

182:

38:

794:978-986-173-584-9

772:, January 1, 1930

754:, January 1, 1931

463:, August 22, 1928

239:Mayor of New York

192:that started the

118:Worcester Academy

929:

841:

834:

828:

827:

825:

823:

804:

798:

797:

780:

774:

773:

762:

756:

755:

744:

738:

737:

726:

720:

719:

708:

702:

701:

690:

684:

683:

675:

669:

668:

657:

651:

650:

626:

620:

619:

608:

602:

601:

590:

581:

580:

569:

558:

557:

546:

540:

539:

528:

522:

521:

510:

501:

500:

489:

483:

482:

481:, March 26, 1929

471:

465:

464:

453:

447:

446:

444:

442:

427:

421:

420:

409:

398:

397:

386:

375:

374:

363:

354:

353:

347:

339:

330:

329:

328:, April 27, 1928

318:

194:Great Depression

97:Jewish immigrant

77:Great Depression

937:

936:

932:

931:

930:

928:

927:

926:

872:

871:

849:

844:

835:

831:

821:

819:

806:

805:

801:

795:

781:

777:

764:

763:

759:

746:

745:

741:

728:

727:

723:

710:

709:

705:

692:

691:

687:

677:

676:

672:

659:

658:

654:

627:

623:

610:

609:

605:

592:

591:

584:

571:

570:

561:

548:

547:

543:

530:

529:

525:

512:

511:

504:

491:

490:

486:

473:

472:

468:

455:

454:

450:

440:

438:

429:

428:

424:

411:

410:

401:

387:

378:

365:

364:

357:

345:

341:

340:

333:

320:

319:

312:

303:

268:

174:

130:

85:

46:Delancey Street

30:

23:Federal Reserve

17:

12:

11:

5:

935:

925:

924:

919:

914:

909:

904:

899:

894:

889:

884:

870:

869:

856:

848:

847:External links

845:

843:

842:

829:

799:

793:

775:

757:

739:

721:

703:

685:

670:

652:

621:

603:

582:

559:

541:

523:

502:

499:, May 10, 1929

484:

466:

448:

422:

419:, July 4, 1927

399:

376:

373:, June 7, 1915

355:

331:

309:

302:

299:

267:

264:

173:

170:

147:market failure

141:of $ 60 and a

129:

126:

84:

81:

15:

9:

6:

4:

3:

2:

934:

923:

920:

918:

915:

913:

910:

908:

905:

903:

900:

898:

895:

893:

890:

888:

885:

883:

880:

879:

877:

868:

864:

860:

857:

854:

851:

850:

839:

833:

817:

813:

809:

803:

796:

790:

786:

779:

771:

767:

761:

753:

749:

743:

735:

731:

725:

717:

713:

707:

699:

695:

689:

681:

674:

666:

662:

656:

648:

644:

640:

636:

632:

625:

617:

613:

607:

599:

595:

589:

587:

578:

574:

568:

566:

564:

555:

551:

545:

537:

533:

527:

519:

515:

509:

507:

498:

494:

488:

480:

476:

470:

462:

458:

452:

436:

432:

426:

418:

414:

408:

406:

404:

396:

392:

385:

383:

381:

372:

368:

362:

360:

351:

344:

338:

336:

327:

323:

317:

315:

310:

308:

307:

298:

296:

291:

289:

283:

281:

280:short sellers

277:

273:

263:

261:

256:

250:

248:

244:

240:

236:

231:

226:

224:

220:

215:

213:

209:

208:East New York

203:

201:

200:

195:

191:

187:

178:

169:

165:

163:

159:

154:

152:

151:Black Tuesday

148:

144:

140:

134:

125:

123:

119:

115:

110:

106:

102:

98:

93:

91:

80:

78:

74:

70:

66:

63:in 1931. The

62:

58:

55:

54:New York City

51:

50:New York City

47:

43:

34:

28:

24:

19:

837:

832:

820:. Retrieved

816:the original

811:

802:

784:

778:

769:

760:

751:

742:

733:

724:

715:

706:

697:

688:

679:

673:

664:

655:

638:

634:

624:

615:

606:

597:

576:

553:

544:

535:

526:

517:

496:

487:

478:

469:

460:

451:

441:December 18,

439:. Retrieved

434:

425:

416:

394:

370:

349:

325:

305:

304:

292:

284:

276:Soviet Union

269:

259:

251:

246:

243:Jimmy Walker

227:

216:

204:

197:

183:

166:

155:

135:

131:

94:

86:

41:

39:

18:

822:January 11,

812:Marketplace

223:Wall Street

210:section of

101:Brandenburg

75:during the

876:Categories

647:2160290916

301:References

139:book value

641:(6): 58.

266:Aftermath

83:Formation

643:ProQuest

212:Brooklyn

190:bank run

143:dividend

65:bank run

52:, was a

865:of the

861:in the

172:Failure

105:Germany

73:banking

67:on its

791:

645:

288:liquid

128:Growth

61:failed

346:(PDF)

306:Notes

109:Essen

69:Bronx

59:that

824:2010

789:ISBN

443:2019

120:and

112:the

57:bank

40:The

867:ZBW

639:110

149:on

48:in

878::

810:.

768:,

750:,

732:,

714:,

696:,

663:,

637:.

633:.

614:,

596:,

585:^

575:,

562:^

552:,

534:,

516:,

505:^

495:,

477:,

459:,

433:.

415:,

402:^

393:,

379:^

369:,

358:^

348:,

334:^

324:,

313:^

297:.

241:,

214:.

164:.

153:.

103:,

79:.

826:.

649:.

29:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.