703:, and an annuity to award teachers working on research projects. At periodic intervals, the school system needs to generate a report to the state about the special education program, a report to a federal agency about the school lunch program, and a report to another authority about the research program. Each of these programs has its own unique reporting requirements, so the school system needs a method to separately identify the related revenues and expenditures. This is done by establishing separate funds, each with its own

20:

48:

1937:. City government agencies are not allowed to spend the unexpended balance, even if their expenditures during the now-ended fiscal period were less than their share of the expired appropriation. A new appropriation is necessary to authorize spending in the next fiscal period. (Liabilities incurred at the end of the fiscal period for goods and services ordered, but not yet received, are usually considered

2429:

1141:. These assets and liabilities belong to the government entity as a whole, rather than any specific fund. Although general fixed assets would be part of government-wide financial statements (reporting the entity as a whole), they are not reported in governmental fund statements. Fixed assets and long-term liabilities assigned to a specific enterprise fund are referred to as

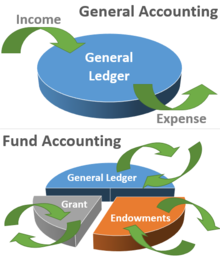

687:), nonprofits can have more than one general ledger (or fund), depending on their financial reporting requirements. An accountant for such an entity must be able to produce reports detailing the expenditures and revenues for each of the organization's individual funds, and reports that summarize the organization's financial activities across all of its funds.

2444:

1061:, such as buildings, equipment and roads. Depending on its use, a fixed asset may instead be financed by a special revenue fund or a proprietary fund. A capital project fund exists only until completion of the project. Fixed assets acquired and long-term debts incurred by a capital project are assigned to the government's

1430:

by the mayor and city council of the City of

Tuscany. For Fiscal Year 2009, which began on July 1, 2008, the Mayor's Office estimated general fund revenues of $ 35 million from property taxes, state grants, parking fines and other sources. The estimate was recorded in the fund's general ledger with a

1075:

funds are used to account for money that will be used to pay the interest and principal of long-term debts. Bonds used by a government to finance major construction projects, to be paid by tax levies over a period of years, require a debt service fund (sometimes titled as "interest and sinking fund")

694:

When using the fund accounting method, an organization is able to therefore separate the financial resources between those immediately available for ongoing operations and those intended for a donor specified reason. This also provides an audit trail that all moneys have been spent for their intended

1944:

Instead of re-applying the unspent balance from the general fund to the same programs, the city council may choose to spend the money on other programs. Alternatively, they may use the balance to cut taxes or pay off a long-term debt. With a large surplus, reducing the tax burden will usually be the

690:

Fund accounting distinguishes between two primary classes of fund.: those funds that have an unrestricted use, that can be spent for any purposes by the organization, and those that have a restricted use. The reason for the restriction can be for a number of different reasons. Examples include legal

1679:

The city spent a total of $ 30 million on its employee payroll, including various taxes, benefits and employee withholding. A portion of the payroll taxes will be paid in the next fiscal period, but modified accrual accounting requires the expenditure to be recorded during the period the liability

1600:

The complexity of an appropriation depends upon the city council's preferences; real-world appropriations can list hundreds of line item amounts. An appropriation is the legal authority for spending given by the city council to the various agencies of the city government. In the example above, the

1192:

The accounting basis applied to fiduciary funds depends upon the needs of a specific fund. If the trust involves a business-like operation, accrual basis accounting would be appropriate to show the fund's profitability. Accrual basis is also appropriate for trust funds using interest and dividends

1609:

During Fiscal Year 2009, the city assessed property owners a total of $ 37 million for property taxes. However, the Mayor's Office expects $ 1 million of this assessment to be difficult or impossible to collect. Revenues of $ 36 million were recognized, because this portion of the assessment was

1388:

The unified budget deficit, a cash-basis measurement, is the equivalent of a checkbook balance. This indicator does not consider long-term consequences, but has historically been the focus of budget reporting by the media. Except for the unified budget deficit, the federal government's financial

1116:

funds are used to account for assets held in trust by the government for the benefit of individuals or other entities. The employee pension fund, created by the State of

Maryland to provide retirement benefits for its employees, is an example of a fiduciary fund. Financial statements may further

1100:

funds are used for operations serving other funds or departments within a government on a cost-reimbursement basis. A printing shop, which takes orders for booklets and forms from other offices and is reimbursed for the cost of each order, would be a suitable application for an internal service

691:

requirements, where the moneys can only be lawfully used for a specific purpose, or a restriction imposed by the donor or provider. These donor/provider restrictions are usually communicated in writing and may be found in the terms of an agreement, government grant, will or gift.

1161:

of accounting used by most businesses requires revenue to be recognized when it is earned and expenses to be recognized when the related benefit is received. Revenues may actually be received during a later period, while expenses may be paid during an earlier or later period.

1051:) funds are required to account for the use of revenue earmarked by law for a particular purpose. An example would be a special revenue fund to record state and federal fuel tax revenues, since by federal and state law the tax revenue can only be spent on transportation uses.

719:

Unrestricted funds are, as their name suggests, unrestricted and therefore organizations do not necessarily need more than a single

General Fund, however many larger organizations use several to help them account for the unrestricted resources. Unrestricted funds may include:

715:

Nonprofit organization's finances are broken into two primary categories, unrestricted and restricted funds. The number of funds in each category can change over time and are determined by the restrictions and reporting requirements by donors, board, or fund providers.

682:

Nonprofit organizations and government agencies have special requirements to show, in financial statements and reports, how money is spent, rather than how much profit was earned. Unlike profit oriented businesses, which use a single set of self-balancing accounts (or

1228:. Since making a profit is not the purpose of a government, a significant surplus generally means a choice between tax cuts or spending increases. A significant deficit will result in spending cuts or borrowing. Ideally, surpluses and deficits should be small.

1367:

used by state and local governments for assets belonging to individuals and other entities, held temporarily by the government. State income taxes withheld from a federal government employee's pay, not yet paid to the state, are an example of deposit

1076:

to account for their repayment. The debts of permanent and proprietary funds are serviced within those funds, rather than by a separate debt service fund. As with capital project funds, once the debt has been retired, the fund ceases to exist.

1085:

should be used to report resources that are legally restricted to the extent that only earnings, and not principal, may be used for purposes that support the reporting government's programs—that is, for the benefit of the government or its

917:

services. Program services are the mission-related activities performed by the organization. Non-program supporting services include the costs of fund-raising events, management and general administration. This is a required section of the

1181:

for modified accrual accounting, are recognized when the related liability is incurred. Expenditures also include purchases of capital assets, and repayments of debt, which are not considered expenses in business accounting.

2154:

3050:

See chapters 15–19 (p. 191–222) for a quick reference to journal entries and math useful for state and local government fund accounting. The "Funds

Characteristics Tree" on p. 191 illustrates relationships between

875:. It shows the net results, by each fund, of the organization's activities during the fiscal year reported. The excess or deficit is shown as a change in fund balances, similar to an increase or decrease in owner's equity.

798:

are held to account for resources before they are disbursed according to the donor's instructions. The organisation has little or no discretion over the use of these resources and always equal liabilities in agency

727:– This is the minimum fund needed for unrestricted resources and relates to current as well as non-current assets and related liabilities which can be used at the discretion of the organisation's governing board.

841:. FASB issued a major update in 2016 that changed reporting net assets from three primary categories to two categories, restricted and unrestricted funds and how these are represented on financial statements.

2491:

2957:

When goods or services are received, the amount to be paid is debited to the expenditure account and credited to a liability (payable) account. Hay, p. 63. Transactions involving purchase orders involve

698:

An example may be a local school system in the United States. It receives a grant from its state government to support a new special education initiative, another grant from the federal government for a

1107:

funds are used for services provided to the public on a user charge basis, similar to the operation of a commercial enterprise. Water and sewage utilities are common examples of government enterprises.

739:– Many large non-profit organisations now have shops and other outlets where they raise funds from selling goods and services. The profits from these are then used for the purpose of the organisations.

2749:

786:

are similar to permanent endowment funds except that at a future time or after a specified future event the endowment become available for unrestricted or purpose-restricted use by the organization

1205:(ACFR), the equivalent of a business's financial statements. An ACFR includes a single set of government-wide statements, for the government entity as a whole, and individual fund statements. The

1392:

Net operating (cost)/revenue, an accrual basis measurement, is calculated in the "Statements of

Operations and Changes in Net Position" by comparing revenues with costs. The federal government's

1185:

Proprietary funds, used for business-like activities, usually operate on an accrual basis. Governmental accountants sometimes refer to the accrual basis as "full accrual" to distinguish it from

986:

is an account which may be used for urgent expenditure in anticipation that the money will be approved by

Parliament, or for small payments that were not included in the year's budget estimates.

1813:

At the end of the fiscal year, the actual revenues of $ 36 million were compared with the estimate of $ 35 million. The $ 1 million difference was recorded as a credit to the fund balance.

950:

is the government's main borrowing and lending account. it is closely linked to the consolidated fund, which is balanced daily by means of a transfer to, or from, the national loans fund.

627:

is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes

654:

has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as

2162:

3064:

Federal

Accounting Standards Advisory Board (December 26, 2007). Definitions of elements and basic recognition criteria for accrual-basis financial statements for federal agencies.

792:

are resources provided by donors where the organization has a beneficial interest but is not the sole beneficiary. These may include charitable gift annuities or life income funds.

1260:. However, each federal agency maintains its own self-balancing set of accounts. The general fund is used to account for receipts and payments that do not belong to another fund.

883:

or balance sheet. Similar to the balance sheet of a business, this statement lists the value of assets held and debts owed by the organization at the end of the reporting period.

1490:

was approved by the city council, authorizing the city to spend $ 34 million from the general fund. The appropriation was recorded in fund's general ledger with a debit to

3071:

1377:

The United States government uses accrual basis accounting for all of its funds. Its consolidated annual financial report uses two indicators to measure financial health:

909:

which distributes each expense of the organization into amounts related to the organization's various functions. These functions are segregated into two broad categories:

2044:

1941:, allowing payment at a later date under the current appropriation. Some jurisdictions, however, require the amounts to be included in the following period's budget.)

2930:

In the opening entries for a fiscal year, estimated revenues are recorded with a credit to the fund balance, while appropriations are recorded as a debit. Hay, p. 44.

733:– assets which have been assigned to a specific purpose by the organisation's governing board but are still unrestricted as the board can cancel the desired use.

2753:

2699:

2659:

2611:

937:

is the fund where all date-to-day revenues and expenses of the government are accounted. Each of the devolved governments also have a consolidated fund.

2259:

818:. These are generated in line with the reporting requirements in the country they are based or if they are large enough they may produce them under

2224:

2098:

1873:

The city spent $ 31 million of its $ 34 million appropriation. A credit of $ 3 million was applied to the fund balance for the unspent amount.

2127:

2027:

1601:

city can spend as much as $ 34 million, but smaller appropriation limits have also been established for individual programs and departments.

2531:

2918:

In most jurisdictions, the budget is a legal document authorizing the government to incur debts, collect taxes and spend money. Hay, p. 20.

2132:"Companion Guide for Not-for-profits to the International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs)"

826:. If the organization is small it may use a cash basis accounting, but larger ones generally use accrual basis accounting for their funds.

647:

and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

2131:

3103:

1960:

1954:

1545:

In subsidiary ledgers, the appropriation would be divided into smaller amounts authorized for various departments and programs, such as:

1000:

819:

312:

1933:

When the current fiscal period ended, its appropriation expired. The balance remaining in the general fund at that time is considered

1418:

The following is a simplified example of the fiscal cycle for the general fund of the City of

Tuscany, a fictitious city government.

838:

834:

2191:

297:

1193:

from invested principle amounts to pay for supported programs, because the profitability of those investments would be important.

1966:

1206:

3068:

3043:

2055:

901:

identifies the sources of cash flowing into the organization and the uses of cash flowing out during the reported fiscal year.

1202:

302:

2939:

Subsidiary ledger details are used to provide an appropriate level of budgetary control over government spending. Hay p. 43.

2902:

1284:, means that it conducts a continuing cycle of activity. There are two types of revolving funds in the Federal Funds Group:

1220:

to describe the net results of their operations. The difference between revenues and expenditures during a year is either a

830:

611:

462:

166:

63:

2440:

958:

317:

307:

73:

2351:

1173:

basis. This involves recognizing revenue when it becomes both available and measurable, rather than when it is earned.

369:

3057:

2723:

2375:

2015:

Deloitte

Development LLC (2008). See "Challenges and Opportunities for Investment Funds" on p. 3. Retrieved 2010-05-17

745:– Some organizations hold their non-current assets and related liabilities in a separate fund from the current assets.

2569:

2308:

2001:

1257:

497:

374:

322:

265:

3269:

3096:

891:– just as for profit-making organizations, this shows the change in the organization equity over the year. Under

879:

406:

1302:

funds used by state and local governments for business-like activities conducted primarily with the public. The

674:. Investment accounting, however, is a different system, unrelated to government and nonprofit fund accounting.

3187:

2974:

Closing entries for a government's funds are similar to those of a for-profit business. The totals recorded in

1316:

funds used by state and local governments for business-like activities conducted within the federal government.

887:

359:

2281:

1041:

fund. This fund is used to account for general operations and activities not requiring the use of other funds.

2775:

1133:

State and local governments have two other groups of self-balancing accounts which are not considered funds:

954:

922:

that is an annual informational return required by the

Internal Revenue Service for nonprofit organizations.

895:

the nonprofit organization can choose if it wants to produce this statement or not; some do, and some do not.

1331:

are earmarked for specific programs and purposes in accordance with a statute that designates the fund as a

1270:

used by state and local governments, earmarked for a specific purpose (other than business-like activities).

3264:

3031:

2872:

2860:

2845:

2833:

2821:

2795:

1303:

996:

844:

Nonprofit and governments use the same four standard financial statements as profit-making organizations:

3089:

2730:. Kansas Department of Administration (October 28, 1998). See "Proprietary Funds." Retrieved 2010-03-19

1758:

The Public Works Department spent $ 1 million on supplies and services for maintaining city streets.

1166:

accounting, used by some small businesses, recognizes revenue when received and expenses when paid.)

2900:

Financial Statements of the United States Government for the Years Ended September 30, 2009 and 2008

2024:

751:– If the organization holds his non-current assets in a plant fund then this is used to account for

604:

411:

47:

3151:

2528:

2435:

972:

943:

is a government organisation which has been established as such by means of a trading fund order.

245:

121:

2909:

U.S. Government Accountability Office. See "Statements of Net Cost," p. 39. Retrieved 2010-03-26

962:

636:

537:

472:

196:

2752:. Government Accounting Standards Board, official news release. March 16, 2006. Archived from

780:

or until a specific future date/event or has been used for the purpose for which it was given.

3136:

644:

522:

260:

126:

68:

3017:

829:

Nonprofit organizations in the United States have prepared their financial statements using

3126:

815:

700:

572:

111:

8:

3228:

3192:

3141:

2824:

See "Characteristics of Fund Types," p. 37-38. Office of Management of the Budget (2009).

1487:

1163:

947:

833:(FASB) guidance since 1993. The financial reporting standards are primarily contained in

764:

597:

562:

557:

532:

527:

467:

396:

354:

336:

289:

270:

201:

106:

31:

2962:

accounting, requiring a more complex transaction than the simplified example shown here.

2466:

3218:

3208:

1344:

1158:

983:

976:

814:

Like profit-making organizations, nonprofits and governments will produce Consolidated

632:

401:

236:

191:

1125:

funds; a trust fund generally exists for a longer period of time than an agency fund.

3223:

3156:

3038:

2565:

2012:

1997:

934:

704:

582:

577:

156:

131:

3177:

1403:

1169:

Governmental funds, which are not concerned about profitability, usually rely on a

856:

364:

250:

1793:

1280:

funds used by state and local governments for business-like activities. The term,

3131:

3075:

3061:

3047:

2906:

2899:

2727:

2535:

2031:

776:

the organization is required, by agreement with the donor, to maintain intact in

452:

416:

206:

186:

171:

101:

58:

2750:"Why governmental accounting and financial reporting is—and should be—different"

3161:

2798:

See "Overview of fund types," p. 36. Office of Management of the Budget (2009).

1971:

1201:

State and local governments report the results of their annual operations in a

1079:

966:

684:

628:

457:

425:

136:

2890:

U.S. Government Accountability Office (December 1, 2006). Retrieved 2010-03-26

3258:

3182:

2888:"Understanding Similarities and Differences Between Accual and Cash Deficits"

2548:

773:

769:

752:

567:

430:

349:

344:

181:

2538:

Government Accounting Standards Board (November 2007). Retrieved 2010-03-17.

3238:

3233:

3078:

of the American National Red Cross for the fiscal year ended June 30, 2010.

3054:

2887:

2720:

2400:

2054:. University of California, Santa Barbara. 2004. p. IX. Archived from

1357:

funds. They are, otherwise, identical to public enterprise revolving funds.

995:

The United Kingdom government produces the financial statements called the

940:

502:

241:

1875:

1815:

1760:

1682:

1616:

1500:

1441:

805:

are current assets subject to restrictions assigned by donors or grantors.

19:

2959:

2355:

1058:

755:

that can be used at the discretion of the organization's governing board.

667:

659:

388:

2155:"FASB's New Standard Aims to Improve Not-for-Profit Financial Reporting"

957:

is the government fund holding the UK's reserves of foreign currencies,

23:

Diagram demonstrating the difference between general and fund accounting

3243:

3112:

2863:

See "Trust funds," p. 39-40. Office of Management of the Budget (2009).

1398:

777:

671:

663:

655:

492:

176:

39:

2875:

See "Deposit funds," p. 40. Office of Management of the Budget (2009).

2848:

See "Federal Funds," p. 39. Office of Management of the Budget (2009).

2836:

See "Revolving Fund," p. 8. Office of Management of the Budget (2009).

1256:

Technically, there is just one general fund, under the control of the

2381:

The American National Red Cross, June 30, 2010. Retrieved 2011-03-21.

2309:"What the New FASB Accounting Standards Will Mean for Your Nonprofit"

1112:

2529:"Touring the Financial Statements, Part III: The Governmental Funds"

1413:

999:. They are produced using the annual basis and generated under the

919:

2562:

Accounting for Governmental & Nonprofit Entities, 14th edition

1236:

Federal government accounting uses two broad groups of funds: the

3213:

1994:

Accounting for Governmental and Nonprofit Entities, Sixth edition

1057:

funds are used to account for the construction or acquisition of

1016:

State and local governments use three broad categories of funds:

275:

255:

161:

3032:

State of Maryland Comprehensive Annual Financial Report, FY 2013

2700:

State of Maryland Comprehensive Annual Financial Report, FY 2009

2660:

State of Maryland Comprehensive Annual Financial Report, FY 2009

2612:

State of Maryland Comprehensive Annual Financial Report, FY 2009

3034:

Example of financial statements prepared by a state government.

2225:"A Business Owner's Guide to Consolidated Financial Statements"

1547:

1427:

421:

96:

2590:

Governmental Accounting Standards Board Statement 34, para. 65

3081:

2052:

UCSB Campus Information and Procedure Manual: Fund Accounting

1372:

990:

823:

444:

226:

91:

16:

An accounting system used for special reporting requirements

2776:"What is the Comprehensive Annual Financial Report (CAFR)?"

2251:

892:

809:

231:

3067:

For an example of nonprofit financial reporting, see the

2994:

as a credit (surplus) or debit (deficit). Hay, p. 76-77.

2990:

are reversed with credits. The difference is applied to

1335:. Its statutory designation distinguishes the fund as a

1353:

are business-like activities, designated by statute as

930:

The United Kingdom government has the following funds:

2099:"Investopedia: Cracking the Nonprofit Accounting Code"

2560:

Earl Wilson, Jacqueline Reck, Susan Kattelas (2006).

2274:

925:

3055:

Statement of Federal Financial Accounting Concepts 5

2873:

OMB Circular A-11, Section 20 – "Terms and Concepts"

2861:

OMB Circular A-11, Section 20 – "Terms and Concepts"

2846:

OMB Circular A-11, Section 20 – "Terms and Concepts"

2834:

OMB Circular A-11, Section 20 – "Terms and Concepts"

2822:

OMB Circular A-11, Section 20 – "Terms and Concepts"

2796:

OMB Circular A-11, Section 20 – "Terms and Concepts"

1006:

2695:

2693:

2691:

1128:

1011:

822:(IFRS), an example of this is the UK based charity

695:purpose and thereby released from the restriction.

2817:

2815:

2813:

2662:See "Government-wide Financial Statements," p. 11.

2210:

2208:

975:are accounts which holds the contributions of the

905:In the United States there may also be a separate

3018:"Fund Accounting—Making sense of church finances"

2607:

2605:

1414:Fund accounting fiscal cycle (fictitious example)

3256:

2883:

2881:

2688:

1996:, page 5. Richard D. Irwin, Inc., Homewood, IL.

2810:

2401:"Return of Organization Exempt From Income Tax"

2260:"FASB modifies not-for-profit accounting rules"

2205:

2096:

1426:The fiscal cycle begins with the approval of a

1306:Fund is an example of a public enterprise fund.

3015:

2856:

2854:

2602:

2300:

3097:

2878:

2681:

2679:

2677:

2515:

2513:

1389:statements rely on accrual basis accounting.

965:. It can be used to manage the value of the

605:

2346:

2344:

2306:

1988:

1986:

1209:establishes standards for ACFR preparation.

2851:

2773:

1961:Federal Accounting Standards Advisory Board

1955:International Financial Reporting Standards

1231:

1001:International Financial Reporting Standards

820:International Financial Reporting Standards

313:International Financial Reporting Standards

3104:

3090:

2674:

2547:Fixed assets are sometimes referred to as

2510:

2430:"Exchequer and Audit Departments Act 1866"

2186:

2184:

2182:

2180:

853:statement of support, revenue and expenses

710:

612:

598:

2970:

2968:

2926:

2924:

2614:See "Fund Financial Statements," p. 12-13

2341:

2307:McCaimbridge, Ruth (September 13, 2016).

2192:"Oxfam Annual Report and Account 2014/15"

2122:

2120:

2118:

1983:

1410:reported by state and local governments.

743:Plant (Land, building and equipment) fund

2092:

2090:

2088:

2086:

2084:

2045:"Profit versus Non-Profit Organizations"

2034:Green Trader Funds. Retrieved 2010-05-17

1373:Accounting basis and financial reporting

991:Accounting basis and financial reporting

810:Accounting basis and financial reporting

18:

2942:

2393:

2242:

2177:

1967:Governmental Accounting Standards Board

1674:

1207:Governmental Accounting Standards Board

3257:

2965:

2921:

2352:"Whole of Government Accounts 2013–14"

2257:

2115:

1247:

1196:

1117:distinguish fiduciary funds as either

859:of a business, but may use terms like

639:and by governments. In this method, a

3085:

2498:. Office of Public Sector Information

2081:

1753:

1604:

1203:annual comprehensive financial report

303:Generally-accepted auditing standards

2147:

2126:

1322:

831:Financial Accounting Standards Board

643:consists of a self-balancing set of

2551:, a broader term than fixed assets.

2467:"Government Trading Funds Act 1973"

2441:Office of Public Sector Information

1152:

1003:like any other large organisation.

318:International Standards on Auditing

13:

1808:

1421:

926:United Kingdom governmental system

14:

3281:

3069:Consolidated Financial Statements

3009:

2702:See "Basis of Accounting," p. 48.

2377:Consolidated Financial Statements

1310:Intragovernmental revolving funds

1258:United States Treasury Department

1212:Governments do not use the terms

1007:United States governmental system

849:Statement of financial activities

375:Notes to the financial statements

2097:Jonas Elmerraji (June 1, 2007).

1129:Fixed assets and long-term debts

1012:State and local government funds

907:Statement of functional expenses

323:Management Accounting Principles

46:

3016:John R. Throop (July 1, 2006).

2997:

2982:are reversed with debits while

2951:

2933:

2912:

2893:

2866:

2839:

2827:

2801:

2789:

2767:

2742:

2733:

2714:

2705:

2665:

2653:

2644:

2635:

2626:

2617:

2593:

2584:

2575:

2554:

2541:

2522:

2484:

2459:

2422:

2384:

2369:

2332:

2323:

2258:Tysiac, Ken (August 18, 2016).

2217:

880:Statement of financial position

855:. This statement resembles the

3188:Statement of changes in equity

3111:

2072:

2037:

2018:

2006:

1649:Estimated uncollectible taxes

888:Statement of changes in equity

759:Restricted funds may include:

662:and/or real estate held in an

1:

2492:"Contingencies Fund Act 1974"

2194:. oxfam.org.uk. 31 March 2015

1977:

1347:is an example of trust funds.

1093:funds include the following.

1034:funds include the following.

955:Exchange Equalisation Account

790:Annuity and Life-Income Funds

298:Generally-accepted principles

3037:Tim Riley (April 28, 2014).

1886:

1883:

1880:

1826:

1823:

1820:

1771:

1768:

1765:

1693:

1690:

1687:

1627:

1624:

1621:

1511:

1508:

1505:

1452:

1449:

1446:

1394:net operating (cost)/revenue

1383:net operating (cost)/revenue

997:Whole of Government Accounts

768:are used to account for the

7:

2496:The UK Statute Law Database

1948:

1926:

1920:

1913:

1907:

1897:

1866:

1860:

1853:

1847:

1837:

1801:

1792:

1782:

1746:

1740:

1733:

1727:

1720:

1714:

1704:

1667:

1661:

1654:

1648:

1638:

1614:within the current period.

1593:

1585:

1577:

1569:

1561:

1553:

1538:

1532:

1522:

1479:

1473:

1463:

1290:intragovernmental revolving

784:Endowment funds – temporary

765:Endowment funds – permanent

749:Current fund – unrestricted

677:

10:

3286:

2778:. Property Rights Research

2410:. Internal Revenue Service

1894:

1834:

1779:

1701:

1635:

1590:

1582:

1574:

1566:

1558:

1550:

1519:

1460:

1189:accrual basis accounting.

1147:fund long-term liabilities

803:Current funds – restricted

3201:

3170:

3119:

2905:February 2, 2011, at the

2282:"What is Fund Accounting"

2013:IFRS for Investment Funds

969:on international markets.

796:Agency or Custodian funds

167:Constant purchasing power

64:Constant purchasing power

2262:. Journal of Accountancy

1612:available and measurable

1232:Federal government funds

1177:, a term preferred over

973:National Insurance Funds

498:Accounting organizations

486:People and organizations

3152:Governmental accounting

2564:. p. 163. McGraw-Hill.

2436:UK Statute Law Database

2161:. AICPA. Archived from

2025:Hedge Funds Accounting.

1396:is comparable with the

1296:Public enterprise funds

1139:general long-term debts

899:Statement of cash flows

711:Nonprofit organizations

637:nonprofit organizations

246:Amortization (business)

3270:Accounting terminology

2721:Accounts & Reports

1406:by a business, or the

1379:unified budget deficit

963:special drawing rights

24:

3137:Management accounting

3040:The Accountancy Model

2311:. Nonprofit Quarterly

1351:Trust Revolving Funds

1268:special revenue funds

370:Management discussion

22:

3127:Financial accounting

3020:. Christianity Today

1992:Leon E. Hay (1980).

1675:Payroll expenditures

1135:general fixed assets

1063:General Fixed Assets

816:Financial Statements

701:school lunch program

337:Financial statements

290:Accounting standards

3265:Types of accounting

3229:Capital expenditure

3193:Cash flow statement

3142:Forensic accounting

1848:Estimated revenues

1461:Estimated revenues

1363:are similar to the

1312:are similar to the

1298:are similar to the

1276:are similar to the

1266:are similar to the

1248:Federal funds group

1238:federal funds group

1197:Financial reporting

948:National Loans Fund

772:amount of gifts or

563:Earnings management

533:Positive accounting

407:Double-entry system

397:Bank reconciliation

202:Revenue recognition

3219:Cost of goods sold

3209:Debits and credits

3074:2014-08-02 at the

3060:2013-05-14 at the

3046:2016-11-06 at the

2988:estimated revenues

2726:2013-07-08 at the

2534:2012-04-04 at the

2471:legislation.gov.uk

2288:. Aplos. July 2014

2165:on 7 November 2019

2030:2018-06-13 at the

1945:preferred choice.

1754:Other expenditures

1605:Recording revenues

1559:Police department

1433:estimated revenues

1345:Highway Trust Fund

984:Contingencies Fund

977:National Insurance

538:Sarbanes–Oxley Act

473:Sarbanes–Oxley Act

402:Debits and credits

237:Cost of goods sold

192:Matching principle

25:

3252:

3251:

3224:Operating expense

3157:Social accounting

2774:Gerald R. Klatt.

1931:

1930:

1871:

1870:

1806:

1805:

1751:

1750:

1741:Benefits payable

1672:

1671:

1636:Taxes receivable

1598:

1597:

1543:

1542:

1484:

1483:

1408:surplus/(deficit)

1399:net income/(loss)

1323:Trust funds group

1286:public enterprise

1242:trust funds group

1143:fund fixed assets

935:Consolidated Fund

705:chart of accounts

635:, and is used by

622:

621:

583:Two sets of books

578:Off-balance-sheet

220:Selected accounts

157:Accounting period

3277:

3178:Income statement

3106:

3099:

3092:

3083:

3082:

3028:

3026:

3025:

3004:

3001:

2995:

2972:

2963:

2955:

2949:

2946:

2940:

2937:

2931:

2928:

2919:

2916:

2910:

2897:

2891:

2885:

2876:

2870:

2864:

2858:

2849:

2843:

2837:

2831:

2825:

2819:

2808:

2805:

2799:

2793:

2787:

2786:

2784:

2783:

2771:

2765:

2764:

2762:

2761:

2746:

2740:

2737:

2731:

2718:

2712:

2709:

2703:

2697:

2686:

2683:

2672:

2669:

2663:

2657:

2651:

2648:

2642:

2639:

2633:

2630:

2624:

2621:

2615:

2609:

2600:

2597:

2591:

2588:

2582:

2579:

2573:

2558:

2552:

2545:

2539:

2526:

2520:

2517:

2508:

2507:

2505:

2503:

2488:

2482:

2481:

2479:

2478:

2463:

2457:

2456:

2454:

2452:

2447:on 5 August 2012

2443:. Archived from

2426:

2420:

2419:

2417:

2415:

2405:

2397:

2391:

2388:

2382:

2373:

2367:

2366:

2364:

2362:

2348:

2339:

2336:

2330:

2329:Hay, p. 622, 642

2327:

2321:

2320:

2318:

2316:

2304:

2298:

2297:

2295:

2293:

2278:

2272:

2271:

2269:

2267:

2255:

2249:

2246:

2240:

2239:

2237:

2236:

2221:

2215:

2212:

2203:

2202:

2200:

2199:

2188:

2175:

2174:

2172:

2170:

2151:

2145:

2144:

2142:

2141:

2136:

2130:(October 2015).

2124:

2113:

2112:

2110:

2109:

2094:

2079:

2076:

2070:

2069:

2067:

2066:

2060:

2049:

2041:

2035:

2022:

2016:

2010:

2004:

1990:

1876:

1816:

1761:

1683:

1617:

1551:Fire department

1548:

1501:

1494:and a credit to

1442:

1435:and a credit to

1404:income statement

1314:internal service

1171:modified accrual

1153:Accounting basis

1098:Internal service

1055:Capital projects

857:income statement

614:

607:

600:

50:

27:

26:

3285:

3284:

3280:

3279:

3278:

3276:

3275:

3274:

3255:

3254:

3253:

3248:

3197:

3166:

3147:Fund accounting

3132:Cost accounting

3115:

3110:

3076:Wayback Machine

3062:Wayback Machine

3048:Wayback Machine

3023:

3021:

3012:

3007:

3002:

2998:

2973:

2966:

2956:

2952:

2947:

2943:

2938:

2934:

2929:

2922:

2917:

2913:

2907:Wayback Machine

2898:

2894:

2886:

2879:

2871:

2867:

2859:

2852:

2844:

2840:

2832:

2828:

2820:

2811:

2807:Hay, p. 476-477

2806:

2802:

2794:

2790:

2781:

2779:

2772:

2768:

2759:

2757:

2748:

2747:

2743:

2738:

2734:

2728:Wayback Machine

2719:

2715:

2711:Hay, p. 225-226

2710:

2706:

2698:

2689:

2684:

2675:

2670:

2666:

2658:

2654:

2649:

2645:

2640:

2636:

2631:

2627:

2622:

2618:

2610:

2603:

2598:

2594:

2589:

2585:

2581:Hay, p. 164-165

2580:

2576:

2559:

2555:

2546:

2542:

2536:Wayback Machine

2527:

2523:

2518:

2511:

2501:

2499:

2490:

2489:

2485:

2476:

2474:

2473:. UK Government

2465:

2464:

2460:

2450:

2448:

2428:

2427:

2423:

2413:

2411:

2403:

2399:

2398:

2394:

2390:Hay, p. 622-625

2389:

2385:

2374:

2370:

2360:

2358:

2350:

2349:

2342:

2338:Hay, p. 648-649

2337:

2333:

2328:

2324:

2314:

2312:

2305:

2301:

2291:

2289:

2280:

2279:

2275:

2265:

2263:

2256:

2252:

2247:

2243:

2234:

2232:

2223:

2222:

2218:

2214:Hay, p. 609-610

2213:

2206:

2197:

2195:

2190:

2189:

2178:

2168:

2166:

2153:

2152:

2148:

2139:

2137:

2134:

2125:

2116:

2107:

2105:

2095:

2082:

2078:Hay, p. 4-5, 9.

2077:

2073:

2064:

2062:

2058:

2047:

2043:

2042:

2038:

2032:Wayback Machine

2023:

2019:

2011:

2007:

1991:

1984:

1980:

1951:

1924:

1911:

1901:

1895:Appropriations

1881:Ledger account

1864:

1851:

1841:

1821:Ledger account

1811:

1809:Closing entries

1799:

1786:

1766:Ledger account

1756:

1744:

1731:

1718:

1708:

1688:Ledger account

1677:

1665:

1652:

1642:

1622:Ledger account

1607:

1591:Mayor's office

1583:Transportation

1536:

1533:Appropriations

1526:

1506:Ledger account

1477:

1467:

1447:Ledger account

1424:

1422:Opening entries

1416:

1402:reported on an

1375:

1325:

1274:Revolving funds

1250:

1234:

1199:

1155:

1131:

1067:Long-Term Debts

1045:Special revenue

1014:

1009:

993:

928:

812:

731:Designated fund

713:

680:

666:fund such as a

652:fund accounting

625:Fund accounting

618:

589:

588:

587:

552:

544:

543:

542:

517:

509:

508:

507:

487:

479:

478:

477:

447:

437:

436:

435:

391:

381:

380:

379:

339:

329:

328:

327:

292:

282:

281:

280:

221:

213:

212:

211:

207:Unit of account

187:Historical cost

172:Economic entity

151:

143:

142:

141:

86:

78:

59:Historical cost

17:

12:

11:

5:

3283:

3273:

3272:

3267:

3250:

3249:

3247:

3246:

3241:

3236:

3231:

3226:

3221:

3216:

3211:

3205:

3203:

3199:

3198:

3196:

3195:

3190:

3185:

3180:

3174:

3172:

3168:

3167:

3165:

3164:

3162:Tax accounting

3159:

3154:

3149:

3144:

3139:

3134:

3129:

3123:

3121:

3117:

3116:

3109:

3108:

3101:

3094:

3086:

3080:

3079:

3065:

3052:

3035:

3029:

3011:

3010:External links

3008:

3006:

3005:

3003:Hay, p. 20-21.

2996:

2980:appropriations

2964:

2950:

2941:

2932:

2920:

2911:

2892:

2877:

2865:

2850:

2838:

2826:

2809:

2800:

2788:

2766:

2741:

2732:

2713:

2704:

2687:

2673:

2664:

2652:

2643:

2634:

2625:

2616:

2601:

2592:

2583:

2574:

2553:

2549:capital assets

2540:

2521:

2509:

2483:

2458:

2421:

2392:

2383:

2368:

2340:

2331:

2322:

2299:

2273:

2250:

2241:

2216:

2204:

2176:

2146:

2114:

2080:

2071:

2036:

2017:

2005:

1981:

1979:

1976:

1975:

1974:

1972:Permanent fund

1969:

1965:United States

1963:

1959:United States

1957:

1950:

1947:

1929:

1928:

1925:

1922:

1919:

1916:

1915:

1912:

1909:

1906:

1903:

1902:

1899:

1896:

1893:

1889:

1888:

1885:

1882:

1879:

1869:

1868:

1865:

1862:

1859:

1856:

1855:

1852:

1849:

1846:

1843:

1842:

1839:

1836:

1833:

1829:

1828:

1825:

1822:

1819:

1810:

1807:

1804:

1803:

1800:

1797:

1791:

1788:

1787:

1784:

1781:

1778:

1774:

1773:

1770:

1767:

1764:

1755:

1752:

1749:

1748:

1745:

1742:

1739:

1736:

1735:

1732:

1729:

1728:Taxes payable

1726:

1723:

1722:

1719:

1716:

1715:Wages payable

1713:

1710:

1709:

1706:

1703:

1700:

1696:

1695:

1692:

1689:

1686:

1680:was incurred.

1676:

1673:

1670:

1669:

1666:

1663:

1660:

1657:

1656:

1653:

1650:

1647:

1644:

1643:

1640:

1637:

1634:

1630:

1629:

1626:

1623:

1620:

1606:

1603:

1596:

1595:

1592:

1588:

1587:

1584:

1580:

1579:

1576:

1572:

1571:

1568:

1564:

1563:

1560:

1556:

1555:

1552:

1541:

1540:

1537:

1534:

1531:

1528:

1527:

1524:

1521:

1518:

1514:

1513:

1510:

1507:

1504:

1496:appropriations

1482:

1481:

1478:

1475:

1472:

1469:

1468:

1465:

1462:

1459:

1455:

1454:

1451:

1448:

1445:

1423:

1420:

1415:

1412:

1374:

1371:

1370:

1369:

1358:

1348:

1339:rather than a

1324:

1321:

1320:

1319:

1318:

1317:

1307:

1304:Postal Service

1271:

1261:

1249:

1246:

1233:

1230:

1198:

1195:

1154:

1151:

1130:

1127:

1109:

1108:

1102:

1088:

1087:

1077:

1070:

1052:

1042:

1013:

1010:

1008:

1005:

992:

989:

988:

987:

980:

970:

967:pound sterling

951:

944:

938:

927:

924:

903:

902:

896:

884:

876:

811:

808:

807:

806:

800:

793:

787:

781:

757:

756:

753:current assets

746:

740:

734:

728:

712:

709:

685:general ledger

679:

676:

629:accountability

620:

619:

617:

616:

609:

602:

594:

591:

590:

586:

585:

580:

575:

570:

565:

560:

554:

553:

550:

549:

546:

545:

541:

540:

535:

530:

525:

519:

518:

515:

514:

511:

510:

506:

505:

500:

495:

489:

488:

485:

484:

481:

480:

476:

475:

470:

465:

460:

455:

449:

448:

443:

442:

439:

438:

434:

433:

428:

426:General ledger

419:

414:

409:

404:

399:

393:

392:

387:

386:

383:

382:

378:

377:

372:

367:

362:

357:

352:

347:

341:

340:

335:

334:

331:

330:

326:

325:

320:

315:

310:

305:

300:

294:

293:

288:

287:

284:

283:

279:

278:

273:

268:

263:

258:

253:

248:

239:

234:

229:

223:

222:

219:

218:

215:

214:

210:

209:

204:

199:

194:

189:

184:

179:

174:

169:

164:

159:

153:

152:

149:

148:

145:

144:

140:

139:

134:

129:

124:

119:

114:

109:

104:

99:

94:

88:

87:

84:

83:

80:

79:

77:

76:

71:

66:

61:

55:

52:

51:

43:

42:

36:

35:

15:

9:

6:

4:

3:

2:

3282:

3271:

3268:

3266:

3263:

3262:

3260:

3245:

3242:

3240:

3237:

3235:

3232:

3230:

3227:

3225:

3222:

3220:

3217:

3215:

3212:

3210:

3207:

3206:

3204:

3200:

3194:

3191:

3189:

3186:

3184:

3183:Balance sheet

3181:

3179:

3176:

3175:

3173:

3169:

3163:

3160:

3158:

3155:

3153:

3150:

3148:

3145:

3143:

3140:

3138:

3135:

3133:

3130:

3128:

3125:

3124:

3122:

3118:

3114:

3107:

3102:

3100:

3095:

3093:

3088:

3087:

3084:

3077:

3073:

3070:

3066:

3063:

3059:

3056:

3053:

3049:

3045:

3042:

3041:

3036:

3033:

3030:

3019:

3014:

3013:

3000:

2993:

2989:

2985:

2981:

2977:

2971:

2969:

2961:

2954:

2945:

2936:

2927:

2925:

2915:

2908:

2904:

2901:

2896:

2889:

2884:

2882:

2874:

2869:

2862:

2857:

2855:

2847:

2842:

2835:

2830:

2823:

2818:

2816:

2814:

2804:

2797:

2792:

2777:

2770:

2756:on 2010-11-22

2755:

2751:

2745:

2736:

2729:

2725:

2722:

2717:

2708:

2701:

2696:

2694:

2692:

2682:

2680:

2678:

2668:

2661:

2656:

2647:

2638:

2629:

2620:

2613:

2608:

2606:

2596:

2587:

2578:

2571:

2570:0-07-310095-1

2567:

2563:

2557:

2550:

2544:

2537:

2533:

2530:

2525:

2516:

2514:

2497:

2493:

2487:

2472:

2468:

2462:

2446:

2442:

2438:

2437:

2431:

2425:

2409:

2402:

2396:

2387:

2380:

2378:

2372:

2357:

2353:

2347:

2345:

2335:

2326:

2310:

2303:

2287:

2283:

2277:

2261:

2254:

2245:

2230:

2226:

2220:

2211:

2209:

2193:

2187:

2185:

2183:

2181:

2164:

2160:

2156:

2150:

2133:

2129:

2123:

2121:

2119:

2104:

2100:

2093:

2091:

2089:

2087:

2085:

2075:

2061:on 2010-12-14

2057:

2053:

2046:

2040:

2033:

2029:

2026:

2021:

2014:

2009:

2003:

2002:0-256-02329-8

1999:

1995:

1989:

1987:

1982:

1973:

1970:

1968:

1964:

1962:

1958:

1956:

1953:

1952:

1946:

1942:

1940:

1936:

1923:

1921:Fund balance

1918:

1917:

1914:$ 31,000,000

1910:

1908:Expenditures

1905:

1904:

1900:

1898:$ 34,000,000

1891:

1890:

1878:

1877:

1874:

1863:

1861:Fund balance

1858:

1857:

1854:$ 35,000,000

1850:

1845:

1844:

1840:

1838:$ 36,000,000

1831:

1830:

1818:

1817:

1814:

1798:

1795:

1790:

1789:

1785:

1780:Expenditures

1776:

1775:

1763:

1762:

1759:

1743:

1738:

1737:

1730:

1725:

1724:

1721:$ 20,000,000

1717:

1712:

1711:

1707:

1705:$ 30,000,000

1702:Expenditures

1698:

1697:

1685:

1684:

1681:

1668:$ 36,000,000

1664:

1659:

1658:

1651:

1646:

1645:

1641:

1639:$ 37,000,000

1632:

1631:

1619:

1618:

1615:

1613:

1602:

1589:

1581:

1575:Public works

1573:

1570:$ 10,000,000

1565:

1557:

1549:

1546:

1539:$ 34,000,000

1535:

1530:

1529:

1525:

1523:$ 34,000,000

1520:Fund balance

1516:

1515:

1503:

1502:

1499:

1497:

1493:

1489:

1488:appropriation

1480:$ 35,000,000

1476:

1474:Fund balance

1471:

1470:

1466:

1464:$ 35,000,000

1457:

1456:

1444:

1443:

1440:

1438:

1434:

1429:

1419:

1411:

1409:

1405:

1401:

1400:

1395:

1390:

1386:

1384:

1380:

1366:

1362:

1361:Deposit funds

1359:

1356:

1352:

1349:

1346:

1342:

1338:

1334:

1330:

1327:

1326:

1315:

1311:

1308:

1305:

1301:

1297:

1294:

1293:

1291:

1287:

1283:

1279:

1275:

1272:

1269:

1265:

1264:Special funds

1262:

1259:

1255:

1254:General fund.

1252:

1251:

1245:

1243:

1239:

1229:

1227:

1223:

1219:

1215:

1210:

1208:

1204:

1194:

1190:

1188:

1183:

1180:

1176:

1172:

1167:

1165:

1160:

1159:accrual basis

1150:

1148:

1144:

1140:

1136:

1126:

1124:

1120:

1115:

1114:

1106:

1103:

1099:

1096:

1095:

1094:

1092:

1084:

1082:

1078:

1074:

1071:

1068:

1064:

1060:

1056:

1053:

1050:

1046:

1043:

1040:

1037:

1036:

1035:

1033:

1029:

1027:

1023:

1019:

1004:

1002:

998:

985:

981:

978:

974:

971:

968:

964:

960:

956:

952:

949:

945:

942:

939:

936:

933:

932:

931:

923:

921:

916:

913:services and

912:

908:

900:

897:

894:

890:

889:

885:

882:

881:

877:

874:

870:

866:

862:

858:

854:

850:

847:

846:

845:

842:

840:

836:

832:

827:

825:

821:

817:

804:

801:

797:

794:

791:

788:

785:

782:

779:

775:

771:

767:

766:

762:

761:

760:

754:

750:

747:

744:

741:

738:

737:Trading funds

735:

732:

729:

726:

723:

722:

721:

717:

708:

706:

702:

696:

692:

688:

686:

675:

673:

669:

665:

661:

657:

653:

648:

646:

642:

638:

634:

633:profitability

630:

626:

615:

610:

608:

603:

601:

596:

595:

593:

592:

584:

581:

579:

576:

574:

571:

569:

568:Error account

566:

564:

561:

559:

556:

555:

548:

547:

539:

536:

534:

531:

529:

526:

524:

521:

520:

513:

512:

504:

501:

499:

496:

494:

491:

490:

483:

482:

474:

471:

469:

466:

464:

461:

459:

456:

454:

451:

450:

446:

441:

440:

432:

431:Trial balance

429:

427:

423:

420:

418:

415:

413:

412:FIFO and LIFO

410:

408:

405:

403:

400:

398:

395:

394:

390:

385:

384:

376:

373:

371:

368:

366:

363:

361:

358:

356:

353:

351:

350:Balance sheet

348:

346:

345:Annual report

343:

342:

338:

333:

332:

324:

321:

319:

316:

314:

311:

309:

306:

304:

301:

299:

296:

295:

291:

286:

285:

277:

274:

272:

269:

267:

264:

262:

259:

257:

254:

252:

249:

247:

243:

240:

238:

235:

233:

230:

228:

225:

224:

217:

216:

208:

205:

203:

200:

198:

195:

193:

190:

188:

185:

183:

182:Going concern

180:

178:

175:

173:

170:

168:

165:

163:

160:

158:

155:

154:

147:

146:

138:

135:

133:

130:

128:

125:

123:

120:

118:

115:

113:

110:

108:

105:

103:

100:

98:

95:

93:

90:

89:

82:

81:

75:

72:

70:

67:

65:

62:

60:

57:

56:

54:

53:

49:

45:

44:

41:

38:

37:

33:

29:

28:

21:

3239:Gross income

3234:Depreciation

3146:

3039:

3022:. Retrieved

2999:

2992:fund balance

2991:

2987:

2984:expenditures

2983:

2979:

2975:

2953:

2944:

2935:

2914:

2895:

2868:

2841:

2829:

2803:

2791:

2780:. Retrieved

2769:

2758:. Retrieved

2754:the original

2744:

2735:

2716:

2707:

2667:

2655:

2646:

2637:

2628:

2619:

2595:

2586:

2577:

2561:

2556:

2543:

2524:

2500:. Retrieved

2495:

2486:

2475:. Retrieved

2470:

2461:

2449:. Retrieved

2445:the original

2433:

2424:

2412:. Retrieved

2407:

2395:

2386:

2376:

2371:

2359:. Retrieved

2334:

2325:

2313:. Retrieved

2302:

2290:. Retrieved

2285:

2276:

2264:. Retrieved

2253:

2244:

2233:. Retrieved

2231:. 2021-11-08

2228:

2219:

2196:. Retrieved

2167:. Retrieved

2163:the original

2158:

2149:

2138:. Retrieved

2106:. Retrieved

2102:

2074:

2063:. Retrieved

2056:the original

2051:

2039:

2020:

2008:

1993:

1943:

1938:

1934:

1932:

1927:$ 3,000,000

1872:

1867:$ 1,000,000

1812:

1802:$ 1,000,000

1783:$ 1,000,000

1757:

1747:$ 5,000,000

1734:$ 5,000,000

1678:

1655:$ 1,000,000

1611:

1608:

1599:

1594:$ 4,000,000

1586:$ 4,000,000

1578:$ 6,000,000

1562:$ 5,000,000

1554:$ 5,000,000

1544:

1495:

1492:fund balance

1491:

1485:

1437:fund balance

1436:

1432:

1425:

1417:

1407:

1397:

1393:

1391:

1387:

1382:

1378:

1376:

1365:agency funds

1364:

1360:

1354:

1350:

1340:

1336:

1332:

1328:

1313:

1309:

1299:

1295:

1289:

1285:

1281:

1277:

1273:

1267:

1263:

1253:

1241:

1237:

1235:

1225:

1221:

1217:

1213:

1211:

1200:

1191:

1186:

1184:

1178:

1175:Expenditures

1174:

1170:

1168:

1156:

1146:

1142:

1138:

1134:

1132:

1122:

1118:

1111:

1110:

1104:

1097:

1090:

1089:

1080:

1073:Debt service

1072:

1066:

1062:

1059:fixed assets

1054:

1048:

1044:

1038:

1032:Governmental

1031:

1030:

1025:

1021:

1018:governmental

1017:

1015:

994:

941:Trading fund

929:

914:

910:

906:

904:

898:

886:

878:

872:

868:

867:rather than

864:

860:

852:

848:

843:

828:

813:

802:

795:

789:

783:

763:

758:

748:

742:

736:

730:

725:General fund

724:

718:

714:

697:

693:

689:

681:

651:

649:

640:

631:rather than

624:

623:

503:Luca Pacioli

424: /

244: /

242:Depreciation

150:Key concepts

122:Governmental

116:

2960:encumbrance

2948:Hay, p. 687

2739:Hay, p. 292

2641:Hay, p. 291

2632:Hay, p. 286

2623:Hay, p. 247

2599:Hay, p. 232

2356:HM Treasury

2248:Hay, p. 622

1329:Trust funds

1278:Proprietary

1091:Proprietary

1022:proprietary

668:mutual fund

660:commodities

516:Development

493:Accountants

389:Bookkeeping

308:Convergence

266:Liabilities

197:Materiality

85:Major types

3259:Categories

3244:Net income

3171:Statements

3113:Accounting

3024:2010-03-15

2782:2011-03-21

2760:2011-03-21

2671:Hay, p. 10

2477:2016-10-29

2235:2022-02-11

2198:2016-10-29

2140:2016-10-29

2108:2010-03-19

2103:Forbes.com

2065:2011-03-28

1978:References

1935:unexpended

1343:fund. The

1300:enterprise

1288:funds and

1164:Cash basis

1105:Enterprise

1086:citizenry.

1024:funds and

915:supporting

778:perpetuity

672:hedge fund

664:investment

656:securities

650:The label

551:Misconduct

177:Fair value

127:Management

69:Management

40:Accounting

2685:Hay, p. 8

2650:Hay, p. 7

2519:Hay, p. 6

2286:Aplos.com

2229:Today CFO

2159:AICPA.org

1835:Revenues

1662:Revenues

1431:debit to

1282:revolving

1113:Fiduciary

1081:Permanent

1026:fiduciary

799:accounts.

770:principal

573:Hollywood

453:Financial

355:Cash-flow

112:Financial

3072:Archived

3058:Archived

3044:Archived

2976:revenues

2903:Archived

2724:Archived

2532:Archived

2028:Archived

1949:See also

1939:expended

1796:payable

1794:Vouchers

1567:Schools

1240:and the

1187:modified

1179:expenses

920:Form 990

678:Overview

645:accounts

558:Creative

528:Research

458:Internal

445:Auditing

261:Goodwill

256:Expenses

107:Forensic

32:a series

30:Part of

3214:Revenue

2414:9 March

2408:IRS.gov

2315:9 March

2292:9 March

2266:9 March

2169:9 March

1887:Credit

1827:Credit

1772:Credit

1694:Credit

1628:Credit

1512:Credit

1453:Credit

1341:special

1292:funds.

1226:deficit

1222:surplus

1049:special

1039:General

1028:funds.

1020:funds,

979:Scheme.

911:program

865:deficit

523:History

417:Journal

276:Revenue

162:Accrual

3051:funds.

2568:

2502:11 May

2451:11 May

2379:, p. 5

2361:15 May

2000:

1884:Debit

1824:Debit

1769:Debit

1691:Debit

1625:Debit

1509:Debit

1450:Debit

1428:budget

1368:funds.

1214:profit

1123:agency

961:, and

869:profit

861:excess

835:FAS117

774:grants

468:Report

422:Ledger

365:Income

360:Equity

271:Profit

251:Equity

227:Assets

132:Social

97:Budget

3202:Terms

2404:(PDF)

2135:(PDF)

2059:(PDF)

2048:(PDF)

1355:trust

1337:trust

1333:trust

1224:or a

1119:trust

1101:fund.

1083:funds

839:FIN43

824:Oxfam

463:Firms

92:Audit

3120:Type

2986:and

2978:and

2566:ISBN

2504:2010

2453:2010

2434:The

2416:2018

2363:2016

2317:2018

2294:2018

2268:2018

2171:2018

2128:ACCA

1998:ISBN

1381:and

1218:loss

1216:and

1157:The

1145:and

1137:and

1065:and

1047:(or

982:The

959:gold

953:The

946:The

893:IFRS

873:loss

837:and

641:fund

232:Cash

117:Fund

102:Cost

1486:An

1121:or

871:or

863:or

851:or

670:or

137:Tax

74:Tax

3261::

2967:^

2923:^

2880:^

2853:^

2812:^

2690:^

2676:^

2604:^

2512:^

2494:.

2469:.

2439:.

2432:.

2406:.

2354:.

2343:^

2284:.

2227:.

2207:^

2179:^

2157:.

2117:^

2101:.

2083:^

2050:.

1985:^

1892:7

1832:6

1777:5

1699:4

1633:3

1517:2

1498:.

1458:1

1439:.

1385:.

1244:.

1149:.

707:.

658:,

34:on

3105:e

3098:t

3091:v

3027:.

2785:.

2763:.

2572:.

2506:.

2480:.

2455:.

2418:.

2365:.

2319:.

2296:.

2270:.

2238:.

2201:.

2173:.

2143:.

2111:.

2068:.

1162:(

1069:.

613:e

606:t

599:v

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.