228:

issue bonds that rich people would buy, thereby giving the rich a tangible stake in the success of the national government. Hamilton proposed to pay off the new bonds with revenue from a new tariff on imports. Jefferson originally approved the scheme, but

Madison had turned him around by arguing that federal control of debt would consolidate too much power in the national government. Edling points out that after its passage in 1790, the assumption was accepted. Madison did try to pay speculators below 100%, but they were paid the face value of the state debts they held regardless of how little they paid for them. When Jefferson became president he continued the system. The credit of the U.S. was solidly established at home and abroad, and Hamilton was successful in signing up many of the bondholders in his new Federalist Party. Good credit allowed Jefferson's Treasury Secretary

207:, a controversial part of which involved the federal government assuming state debts incurred during the Revolutionary War. Northern states had accumulated a huge amount of debt during the war, amounting to $ 21.5 million, and wanted the federal government to assume their burden. The Southern states, which had lower or no debts, whose citizens would effectively pay a portion of this debt if the federal government assumed it, were disinclined to accept the proposal. Some states, including Virginia, had already paid off almost half of their debts, and felt that their taxpayers should not be assessed again to bail out the less provident, and further argued that the plan was beyond the constitutional power of the new government.

398:

566:, the United States last had a budget surplus during fiscal year 2001, though the national debt still increased. From fiscal years 2001 to 2009, spending increased by 6.5% of gross domestic product (from 18.2% to 24.7%) while taxes declined by 4.7% of GDP (from 19.5% to 14.8%). Spending increases (expressed as percentage of GDP) were in the following areas: Medicare and Medicaid (1.7%), defense (1.6%), income security such as unemployment benefits and food stamps (1.4%), Social Security (0.6%) and all other categories (1.2%). Revenue reductions were individual income taxes (−3.3%), payroll taxes (−0.5%), corporate income taxes (−0.5%) and other (−0.4%).

63:

579:

555:

55:

71:

84:

707:, or GDP, each year since World War II. The gross federal debt shown below reached 102.7% of GDP at the end of 2012, the most recent figure available; it was the highest percentage since 1945 and the first yearly percentage figure to go over 100% since then. (The gross federal debt in the table includes intra-government debt – that is, money owed by one branch of the federal government to another. When this latter amount is subtracted, the remaining quantity is known as the public debt.)

666:(TARP) and other bailout efforts; $ 100 billion in additional spending for ARRA; and another $ 185 billion due to increases in primary budget categories such as Medicare, Medicaid, unemployment insurance, Social Security, and Defense – including the war effort in Afghanistan and Iraq. This was the highest budget deficit relative to GDP (9.9%) since 1945. The national debt increased by $ 1.9 trillion during FY2009, versus the $ 1.0 trillion increase during 2008.

348:

24:

2658:

491:

165:

1368:

240:, ultimately netted it over $ 13 million. Another result of federal assumption of state debts was to give the federal government much more power by placing the country's most serious financial obligation in the hands of the federal government rather than the state governments. The federal government was able to avoid competing in interest with the States.

658:(CBO) gave the reasons for the higher budget deficit in 2009 ($ 1,410 billion, i.e. $ 1.41 trillion) over that of 2008 ($ 460 billion). The major changes included: declines in tax receipt of $ 320 billion due to the effects of the recession and another $ 100 billion due to tax rate cuts in the stimulus bill (the

425:. The budget controls instituted in the 1990s successfully restrained fiscal action by the Congress and the President and together with economic growth contributed to the budget surpluses at the end of the decade. The surpluses led to a decline in the public debt from about 43% of GDP in 1998 to about 33% by 2001.

329:

increased the debt and by 1936, the public debt had increased to $ 33.7 billion (~$ 582 billion in 2023), approximately 40% of GDP. During its first term, the

Roosevelt administration ran large annual deficits of between 2 and 5% of GDP. By 1939, the debt held by the public had increased to

586:

In June 2012, the

Congressional Budget Office summarized the cause of change between its January 2001 estimate of a $ 5.6 trillion cumulative surplus between 2002 and 2011 and the actual $ 6.1 trillion cumulative deficit that occurred, an unfavorable "turnaround" or debt increase of $ 11.7 trillion.

587:

Tax rate cuts and slower-than-expected growth reduced revenues by $ 6.1 trillion and spending was $ 5.6 trillion higher. Of this total, the CBO attributes 72% to legislated tax rate cuts and spending increases and 27% to economic and technical factors. Of the latter, 56% occurred from 2009 to 2011.

227:

Historian Max M. Edling has explained how assumption worked. It was the critical issue; the location of the capital was a bargaining ploy. Hamilton proposed that the federal

Treasury take over and pay off all the debt that states had incurred to pay for the American Revolution. The Treasury would

389:

lowered tax rates (Reagan slashed the top income tax rate from 70% to 28%, although bills passed in 1982 and 1984 later partially reversed those tax cuts.) and increased military spending, while congressional

Democrats blocked cuts to social programs. As a result, debt as a share of GDP increased

235:

The

Southern states extracted a major concession from Hamilton in the recalculation of their debt under the fiscal plan. For example, in the case of Virginia, a zero-sum arrangement was contrived, in which Virginia paid $ 3.4 million to the federal government, and received exactly that amount in

317:

was elected president in 1920 and believed the federal government should be fiscally managed in a way similar to private sector businesses. He had campaigned in 1920 on the slogan, "Less government in business and more business in government." Under

Harding, federal spending declined from $ 6.3

377:

reformed the budget process to allow

Congress to challenge the president's budget more easily, and, as a consequence, deficits became increasingly difficult to control. National debt held by the public increased from its postwar low of 24.6% of GDP in 1974 to 26.2% in 1980.

318:

billion in 1920 to $ 5 billion in 1921 and $ 3.3 billion in 1922. Over the course of the 1920s, under the leadership of Calvin

Coolidge, the national debt was reduced by one third. The decrease was even greater when the growth in GDP and inflation is taken into account.

295:. The debt was just $ 65 million in 1860, but passed $ 1 billion in 1863 and reached $ 2.7 billion by the end of the war. During the following 47 years, there were 36 surpluses and 11 deficits. During this period 55% of the national debt was paid off.

338:

led to the largest increase in public debt. Public debt rose over 100% of GDP to pay for the mobilization before and during the war. Public debt was $ 251.43 billion or 112% of GDP at the conclusion of the war in 1945 and was $ 260 billion in 1950.

494:

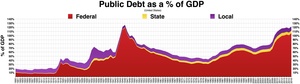

Time series of U.S. public debt overlaid with party affiliation of the

President. The upper graph shows the U.S. public debt in trillions of dollars while the lower graph shows the U.S. public debt as a percentage of GDP. (Data are from the 2009 U.S.

569:

The 2009 spending level was the highest relative to GDP in 40 years, while the tax receipts were the lowest relative to GDP in 40 years. The next highest spending year was 1985 (22.8%), while the next lowest tax year was 2004 (16.1%).

506:, observed a contrast not so much between Republicans and Democrats but between Democrats and "old-style Republicans (Eisenhower and Nixon)" on one hand (decreasing debt) and "new-style Republicans" on the other (increasing debt).

219:. The compromise meant that the state debts were all picked up by the federal Treasury, and the permanent national capital would be located in the South, along the Virginia-Maryland border in what became the District of Columbia.

211:, then a representative from Virginia, led a group of legislators from the South in blocking the provision and prevent the plan from gaining approval. Jefferson supported Madison. The plan was finally adopted as part of the

275:

paid off the entire national debt, the only time in U.S. history that has been accomplished. However, this and other factors, such as the government giving surplus money to state banks, soon led to the

199:

On the founding of the United States, the financial affairs of the new federation were in disarray, exacerbated by an economic crisis in urban commercial centers. In 1790, Secretary of the Treasury

156:, US public debt dramatically increased due to emergency measures aimed at sustaining the economy amidst widespread economic retraction across various industries, alongside high unemployment rates.

3969:

4088:

For example, the $ 862 Billion stimulus of 2009 was passed by Congress under the Obama Administration, but is included in the 2009 debt totals attributed in the chart to George W. Bush.

1375:, which includes obligations to government programs such as Social Security. The top panel shows debt deflated to 2010 dollars; the second panel shows debt as a percentage of GDP.

62:

184:

Except for about a year during 1835–1836, the United States has continuously had a fluctuating public debt since its Constitution went into effect on March 4, 1789. During the

459:

325:

took office in 1933, the public debt was almost $ 20 billion, 20 (~$ 374 billion in 2023)% of GDP. Decreased tax revenues and spending on social programs during the

476:

downgraded the rating of the federal government from AAA to AA+. It was the first time the U.S. had been downgraded since it was originally given a AAA rating on its debt by

1371:

U.S. debt from 1940 to 2011. Red lines indicate the "debt held by the public" and black lines indicate the total national debt or gross public debt. The difference is the

444:

and related significant revenue declines and spending increases, debt held by the public increased to $ 11.917 trillion by the end of July 2013, under the presidency of

311:

to the general public to finance the U.S.'s military effort. The war was followed by 11 consecutive surpluses that saw the debt reduced by 36% by the end of the 1920s.

3156:

3079:

370:

Growth rates in Western countries began to slow in the late-1960s. Beginning in the mid-1970s and afterwards, U.S. national debt began to increase faster than GDP.

374:

3677:

contrast between the Democrats and the old-style Republicans (Eisenhower and Nixon) on the one hand and the new-style Republicans on the other is quite striking.

3471:

3452:

686:

Obama administration officials predicted that these changes will make the debt over ten years look $ 2.7 trillion larger than it would otherwise appear.

4223:

669:

The Obama Administration also made four significant accounting changes to more accurately report total federal government spending. The four changes were:

499:

The President proposes a national budget to Congress, which has final say over the document but rarely appropriates more than what the President requests.

4307:

3976:

4026:

582:

Cause of change between CBO's 2001 projection of a $ 5.6 trillion surplus between 2002–2012 and the $ 6.1 trillion debt increase that actually occurred.

3581:

3183:

4376:

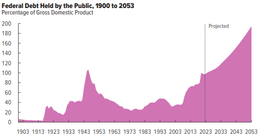

3523:

3295:

3129:

409:'s first term. However, it fell to 34.5% of GDP by the end of Clinton's presidency due in part to decreased military spending, increased taxes (in

4381:

4386:

1349:

Some of the debt included in this chart for each presidential administration may include debt added under the next presidential administration.

673:

Account for the wars in Iraq and Afghanistan ("overseas military contingencies") in the budget, rather than through supplemental appropriations

259:

To reduce the debt, from 1796 to 1811 there were 14 budget surpluses and 2 deficits. There was a sharp increase in the debt as a result of the

2855:

138:

cut tax rates and increased military spending, while it decreased in the 1990s due to reduced military spending, increased taxes, and the

107:(GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

4371:

3813:

3737:

1354:

432:

and increased military spending caused by the wars in the Middle East and a new entitlement Medicare D program. During the presidency of

3788:

480:

in 1917. BBC News reported that Standard & Poor's had "lost confidence" in the ability of the U.S. government to make decisions.

465:

414:

410:

360:

119:

3943:

1379:

Publicly held debt is the gross debt minus intra-governmental obligations (such as the money that the government owes to the two

1335:

530:'s budget deal in 1990 was one of the reasons for improvement of the fiscal situation in 1990s, Bartlett was highly critical of

4272:

3665:

2743:

659:

3052:

594:$ 3.5 trillion – Economic changes (including lower than expected tax revenues and higher safety net spending due to recession)

103:, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to

3495:

3344:

3247:

3026:

307:(1914–1918), reaching $ 25.5 billion at its conclusion. Approximately $ 17 billion in debt was raised through the selling of

3160:

4122:. Addendum: Composite Deflator, p. 26. Divide current dollars by this number to produce value in (constant) FY2000 dollars.

1388:

629:

analyzed this roughly $ 2 trillion "swing", separating the causes into four major categories along with their share:

2738:

251:, and $ 18.3 million were state debts assumed by the federal government, of the $ 21.5 million that had been authorized.

3763:

625:

forecast in each of those years as of June 2009 was approximately $ 1,215 billion (~$ 1.68 trillion in 2023).

2909:

Max M. Edling, "'So immense a power in the affairs of war': Alexander Hamilton and the restoration of public credit."

590:

The difference between the projected and actual debt in 2011, the budget office said, could be attributed largely to:

2894:

2819:

2798:

2723:

2671:

204:

3879:

243:

The debts of the federal government on January 1, 1791 amounted to $ 75,463,476.52, of which about $ 40 million was

3302:

1403:. The government fiscal year runs from October 1 of the previous calendar year to September 30 of the year shown.

4343:

1384:

511:

441:

196:, amassed huge war debts, but lacked the power to repay these obligations through taxation or duties on imports.

146:

232:

to borrow in Europe to finance the Louisiana Purchase in 1803, as well as to borrow to finance the War of 1812.

4311:

4030:

1339:

95:

began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer,

3390:

2697:

663:

397:

321:

Debt held by the public was $ 15.05 billion (~$ 219 billion in 2023) or 16.5% of GDP in 1930. When

3585:

126:. Since then, debt as a share of GDP has consistently risen, with exceptions during the terms of Presidents

4027:"Bureau of the Public Debt/Treasury Direct-Debt changes from September 30, 2008 to September 30, 2009"

3190:

2702:

2676:

1293:

1289:

1261:

1257:

1229:

1225:

1197:

1193:

1165:

1161:

1133:

1129:

1101:

1399:

The table below shows annual federal spending, gross federal debt and gross domestic product for specific

617:

The U.S. budget situation has deteriorated significantly since 2001, when the CBO forecast average annual

355:

The public debt as a percentage of GDP fell rapidly after the end of World War II under the presidency of

3439:

1097:

1069:

1065:

1037:

1033:

1005:

1001:

973:

969:

941:

937:

909:

905:

877:

873:

845:

841:

813:

809:

781:

777:

749:

745:

655:

563:

418:

3530:

3306:

3133:

4097:

3917:

2728:

2692:

1380:

1331:

4215:

4207:

3556:

4240:

2687:

700:

193:

58:

The amount of U.S. public debt, measured as a percentage of GDP from 1900 to 2020, projected to 2050.

373:

The public debt relative to GDP reached a post-World War II low of 24.6% in 1974. In that year, the

99:, after the country's formation in 1776. The United States has continuously experienced fluctuating

422:

139:

3712:

3607:

578:

554:

3861:

473:

428:

In the early 21st century, debt held by the public relative to GDP rose again due in part to the

330:$ 39.65 billion (~$ 682 billion in 2023) or 43% of GDP. The buildup and involvement in

54:

3629:

Fisher, Louis (Nov–Dec 1990). "Federal Budget Doldrums: The Vacuum in Presidential Leadership".

3267:

4053:

3237:

2718:

1327:

704:

534:

for creating budget deficits by reducing tax rates and increasing spending in the early 2000s.

437:

367:(1950–53) was largely financed by taxation and did not lead to an increase in the public debt.

104:

3837:

440:

in September 2001 to $ 6.369 trillion by the end of 2008. In the aftermath of the global

4291:

3690:

2733:

515:

322:

66:

Public debt percent of GDP.Federal, State, and Local debt and a percentage of GDP chart/graph

4001:

3510:

189:

3216:

639:

Policies enacted by President Bush and supported or extended by President Obama (20%); and

8:

4194:. GDP (gross domestic product) in current dollars, p. 194, divided by inflation adjuster.

216:

185:

3000:

2646:: The values for the years 2009, and 2010 represent estimates from the source material.

646:

Several other articles and experts explained the causes of change in the debt position.

37:

Please help update this article to reflect recent events or newly available information.

3947:

3884:

3646:

2978:

2970:

2883:

1400:

503:

390:

from 26.2% in 1980 to 40.9% in 1988, and it continued to rise during the presidency of

292:

212:

200:

168:

3509:

United States Department of the Treasury, Bureau of the Public Debt (December 2010).

3340:

3243:

3080:"PolitiFact: Fla. senator says Jan. 8, 1835, is the only day U.S. has been debt free"

2982:

2890:

2815:

2794:

737:

601:(EGTRRA and JGTRRA), primarily tax rate cuts but also some smaller spending increases

527:

391:

314:

153:

3638:

3233:

3056:

2962:

2791:

Hamilton, Adams, Jefferson: The Politics of Enlightenment and the American Founding

2681:

523:

381:

Debt held by the public relative to GDP rose rapidly again in the 1980s. President

326:

96:

4292:"Short-Term Costs of Long-Run Fiscal Stupidity – Grasping Reality with Both Hands"

3691:"Short-Term Costs of Long-Run Fiscal Stupidity – Grasping Reality with Both Hands"

3030:

4244:

2713:

356:

335:

229:

75:

70:

83:

4252:

4170:. Gross Federal Debt in current dollars, p. 127, divided by inflation adjuster.

543:

531:

522:

attributed the increase in the national debt since the 1980s to the policy of "

519:

507:

433:

351:

U.S. federal debt held by the public as a percentage of GDP, from 1940 to 2012.

272:

2966:

4365:

598:

518:

for the increase of national debt during the 1980s. Former Treasury official

469:

429:

401:

Gross US Federal Debt as a Percentage of GDP, by political party of President

382:

277:

244:

237:

208:

135:

123:

110:

The United States public debt as a percentage of GDP reached its peak during

3491:

2663:

445:

406:

405:

Debt held by the public reached a high of 49.5% of GDP at the beginning of

331:

308:

248:

131:

127:

115:

111:

3001:"When the U.S. paid off the entire national debt (and why it didn't last)"

558:

Causes of change in Federal spending as % GDP 2001–2009 from CBO Data

3414:

3360:

1323:

386:

304:

260:

100:

79:

The Federal Government has over 6:1 debt to revenue ratio as of Q3 2022

2776:

2762:

347:

3902:

3107:

2974:

2953:

Trescott, Paul (1955). "Federal-State Financial Relations, 1790–1860".

2914:

2708:

613:$ 0.9 trillion – Obama stimulus and tax cuts (ARRA and Tax Act of 2010)

477:

364:

3650:

2777:"The 2020 Long-Term Budget Outlook | Congressional Budget Office"

2763:"The 2020 Long-Term Budget Outlook | Congressional Budget Office"

288:

In 1836 debt began again (the debt on January 1, 1836 was $ 37,000).

149:, driven by significant tax revenue declines and spending increases.

236:

federal compensation. The revision of Virginia's debt, coupled with

4308:"United States Deficit & Debt During Presidents from 1969–2019"

4146:. Outlays in current dollars, p. 26, divided by inflation adjuster.

3642:

3415:"Congressional Budget Office – Historical Data on the Federal Debt"

3361:"Congressional Budget Office – Historical Data on the Federal Debt"

2847:

621:

of approximately $ 850 billion from 2009 to 2012. The average

4247:, including interactive historical graphs and relationship to GDP.

610:$ 1.4 trillion – Incremental interest due to higher debt balances

490:

4327:

3296:"Federal Debt Held by the Public as a Share of GDP (1797–2010)"

291:

Another sharp increase in the debt occurred as a result of the

263:. In the 20 years following that war, there were 18 surpluses.

3492:

Federal Debt: Answers to Frequently Asked Questions: An Update

3029:. Bureau of the Public Debt. November 18, 2013. Archived from

682:

Anticipate inevitable expenditures for natural disaster relief

460:

United States federal government credit-rating downgrade, 2011

2844:

First Report of the Public Credit, issued on January 9, 1790.

604:$ 1.5 trillion – Increased non-defense discretionary spending

164:

3862:"The Budget and Economic Outlook: Fiscal Years 2010 to 2020"

3582:"S&P, in historical move, downgrades U.S. credit rating"

676:

Assume the Alternative Minimum Tax is indexed for inflation;

87:

Federal, State & Local debt almost $ 32 trillion in 2021

483:

4237:

4182:. GDP (gross domestic product) in current dollars, p. 194.

1352:

For net jobs changes over the corresponding periods, see:

4328:"U.S. National Debt Graph: What the Press Won't Tell You"

3440:

FactCheck.org : The Budget and Deficit Under Clinton

2833:

The American Political Tradition and the Men Who Made It.

1394:

1367:

280:, in which the government had to resume borrowing money.

203:

pushed for Congress to pass a financial plan, called the

4098:

Frontline – Ten Trillion and Counting: Defining the Debt

375:

Congressional Budget and Impoundment Control Act of 1974

3337:

Why Budgets Matter: Budget Policy and American Politics

4273:"Comparing Debt-to-GDP Ratios with Presidential Terms"

3666:"Comparing Debt-to-GDP Ratios with Presidential Terms"

3184:"Making dollars and sense of the U.S. government debt"

436:, debt held by the public increased from $ 3.339

359:, as the U.S. and the rest of the world experienced a

679:

Account for the full costs of Medicare reimbursements

3554:

3261:

3259:

3154:

2653:

4045:

3975:. Pew Charitable Trusts. April 2011. Archived from

3102:

3100:

3098:

3096:

546:; that is, government spending exceeding revenues.

537:

298:

3903:"Changes in CBO's Baseline Projections Since 2001"

2943:Staloff, 2005, pp. 96, 313; Ellis, 2000, pp. 73–74

2882:

3941:

3918:"Americas Sea of Red Ink Was Years in the Making"

3764:"Starve the Beast: Just Bull, not Good Economics"

3256:

4363:

4158:. Gross Federal Debt in current dollars, p. 127.

3867:. Congressional Budget Office. January 26, 2010.

3093:

421:), and increased tax revenue resulting from the

3935:

3838:"Debt to the Penny | U.S. Treasury Fiscal Data"

3266:Cooper, Michael; Story, Louise (27 July 2011).

3130:"Warren G. Harding US President – 1921–23"

2885:Founding Brothers: The Revolutionary Generation

451:

3472:"Barbara Boxer's blatant rewriting of history"

514:, blamed the "ideological tax-cutters" of the

334:during the presidencies of F.D. Roosevelt and

266:

4344:"Democrats are the real fiscal conservatives"

4305:

3628:

3505:

3503:

3110:. Congressional Budget Office. August 5, 2010

3053:"Bureau of the Public Debt: The 19th Century"

1330:– Table 7.1 Federal Debt at the End of Year

607:$ 1.4 trillion – Wars in Afghanistan and Iraq

114:'s first presidential term, amidst and after

4054:"Obama Bans Gimmicks, and Deficit Will Rise"

3905:. Congressional Budget Office. June 7, 2012.

2856:"Who Is the Euro Zone's Alexander Hamilton?"

1385:Old-Age, Survivors, and Disability Insurance

61:

4289:

4270:

3814:"A Budget Deal That Did Reduce the Deficit"

3688:

3663:

3524:"CBO Historical Tables – 1970 to 2010"

3265:

1355:Jobs created during U.S. presidential terms

3897:

3895:

3789:"We Need A Party of Fiscal Responsibility"

3516:

3513:TreasuryDirect. Retrieved August 26, 2012.

3500:

3487:

3485:

3077:

134:. Public debt surged during the 1980s, as

4341:

4250:

3915:

3511:"The debt to the penny and who holds it".

3384:

3382:

3331:

3329:

3327:

731:Change in debt (in billions of dollars)

689:

636:Policies enacted by President Bush (33%);

466:United States debt-ceiling crisis of 2011

122:, reaching a low in 1973 under President

4377:Government finances in the United States

4310:. Blog.scott.willeke.com. Archived from

4002:"CBO Monthly Budget Review-October 2009"

3877:

3811:

3786:

3761:

3735:

3710:

3704:

3584:. Xinhua. August 6, 2011. Archived from

3391:"Taxes: What people forget about Reagan"

3232:

3181:

3155:Thomas E. Woods, Jr. (October 8, 2009).

2952:

2946:

2874:

1366:

642:New policies from President Obama (10%).

577:

553:

542:Public debt is the cumulative result of

489:

484:Changes in debt by political affiliation

396:

346:

163:

93:history of the United States public debt

82:

69:

53:

4325:

3892:

3482:

3469:

3450:

3290:

3288:

2853:

633:Recessions or the business cycle (37%);

222:

145:Public debt sharply rose following the

4382:Financial history of the United States

4364:

4253:"U.S. Federal Deficits and Presidents"

4224:Budget of the United States Government

4216:Budget of the United States Government

4208:Budget of the United States Government

4102:

4071:

4051:

3942:Charlie Rose Show (November 3, 2009).

3555:Democracy in America (July 27, 2011).

3453:"Fact checking the NBC Florida debate"

3388:

3379:

3355:

3353:

3324:

3214:

3078:Sharockman, Aaron (January 11, 2010).

2994:

2992:

2744:Deficit reduction in the United States

1395:Federal spending, federal debt and GDP

660:American Recovery and Reinvestment Act

4387:History of the United States by topic

3880:"The Fiscal Legacy of George W. Bush"

3762:Bartlett, Bruce (November 26, 2010).

3713:"Four Deformations of the Apocalypse"

3496:U.S. Government Accountability Office

3389:Sahadi, Jeanne (September 12, 2010).

3148:

3108:"Historical Data on the Federal Debt"

2998:

2880:

1362:

725:Debt-to-GDP ratio at start of period

694:

662:or ARRA); $ 245 billion for the

342:

4134:. Outlays in current dollars, p. 26.

4052:Calmes, Jackie (February 20, 2009).

4029:. Treasurydirect.gov. Archived from

3285:

3268:"Q. and A. on the U.S. Debt Ceiling"

3215:Austin, D. Andrew (April 29, 2008).

1389:Social Security Disability Insurance

17:

4238:United States National Debt Tracker

3738:"Tax Cuts And 'Starving The Beast'"

3451:Kessler, Glenn (January 24, 2012).

3350:

3208:

2989:

2854:Stelzer, Irwin (January 10, 2011).

2739:Appropriations bill (United States)

728:Debt-to-GDP ratio at end of period

13:

4372:National debt of the United States

4342:Leonhardt, David (15 April 2018).

14:

4398:

4271:Brad DeLong (November 20, 2009).

4231:

3916:Leonhardt, David (June 9, 2009).

3878:Bartlett, Bruce (June 12, 2012).

3812:Bartlett, Bruce (June 25, 2010).

3787:Bartlett, Bruce (April 9, 2009).

3711:Stockman, David (July 31, 2010).

3664:Brad DeLong (November 20, 2009).

3608:"No credible plan to cut US debt"

3182:Davidson, Paul (April 25, 2010).

2724:Unemployment in the United States

2672:First Report on the Public Credit

394:, reaching 48.3% of GDP in 1992.

205:First Report on the Public Credit

173:First Report on the Public Credit

3303:Government Accountability Office

2999:Smith, Robert (April 15, 2011).

2656:

649:

573:

549:

538:Causes of recent changes in debt

299:World War I and Great Depression

254:

159:

22:

4306:Scott Willeke (March 2, 2010).

4185:

4173:

4161:

4149:

4137:

4125:

4113:

4091:

4082:

4019:

3994:

3962:

3909:

3871:

3854:

3830:

3805:

3780:

3755:

3736:Bartlett, Bruce (May 7, 2011).

3729:

3682:

3657:

3622:

3600:

3574:

3548:

3470:Kessler, Glenn (July 1, 2011).

3463:

3444:

3433:

3407:

3226:

3175:

3122:

3071:

3045:

3019:

2955:The Journal of Economic History

2937:

2928:

2919:

512:Office of Management and Budget

283:

2903:

2838:

2835:New York: A. A. Knopf. p. 125.

2825:

2814:. Harper & Row, New York.

2804:

2783:

2769:

2755:

271:On January 8, 1835, president

1:

4200:

2698:2011 U.S. debt ceiling crisis

664:Troubled Asset Relief Program

118:. It rapidly declined in the

3631:Public Administration Review

2703:Government budget by country

2677:United States federal budget

734:Change in debt-to-GDP ratio

452:2011 credit rating downgrade

363:. Unlike previous wars, the

303:Debt increased again during

7:

4290:Brad DeLong (May 1, 2008).

4222:

4214:

4206:

4191:

4179:

4167:

4155:

4143:

4131:

4119:

4108:

4077:

3689:Brad DeLong (May 1, 2008).

3557:"There never was a surplus"

2889:. Vintage. pp. 48–52.

2831:Hofstadter, Richard. 1948.

2793:. Hill and Wang, New York.

2649:

1381:Social Security Trust Funds

656:Congressional Budget Office

564:Congressional Budget Office

442:financial crisis of 2007–08

361:post-war economic expansion

267:Payment of US national debt

10:

4403:

3339:. Penn State Press, 2004.

3242:. New Society Publishers.

2911:William and Mary Quarterly

2812:The Federalists: 1789–1801

2729:List of U.S. state budgets

2693:United States fiscal cliff

1324:CBO Historical Budget Page

457:

3217:"CRS Report for Congress"

2967:10.1017/S0022050700057685

2881:Ellis, Joseph J. (2002).

2688:United States public debt

1420:

1417:

1414:

1411:

1408:

1328:Whitehouse FY 2012 Budget

510:, former director of the

194:Articles of Confederation

31:This article needs to be

3944:"Peter Orszag Interview"

2925:Staloff, 2005, pp. 96–97

2749:

179:

147:2007–08 financial crisis

120:post-World War II period

74:Federal debt to revenue

3842:fiscaldata.treasury.gov

2789:Staloff, Darren. 2005.

1418:Gross domestic product

464:On August 5, 2011, the

238:Potomac residence issue

3970:"The Great Debt Shift"

2913:64#2 (2007): 287–326.

2810:Miller, John C. 1960.

2719:Modern Monetary Theory

2712:, documentary film by

1376:

1373:intragovernmental debt

713:Congressional session

705:gross domestic product

690:Historical debt levels

583:

559:

496:

402:

352:

176:

105:gross domestic product

88:

80:

67:

59:

3610:. BBC. August 6, 2011

3136:on September 27, 2011

2734:Continuing resolution

1370:

699:This table lists the

654:In October 2009, the

581:

557:

526:". While noting that

516:Reagan administration

493:

474:Standard & Poor's

400:

350:

323:Franklin D. Roosevelt

167:

86:

73:

65:

57:

4294:. Delong.typepad.com

3693:. Delong.typepad.com

3335:Dennis S. Ippolito.

3157:"Depression of 1920"

2779:. 21 September 2020.

2765:. 21 September 2020.

223:The assumption issue

190:Continental Congress

4226:, Fiscal Year 2012.

4218:, Fiscal Year 2009.

4210:, Fiscal Year 2007.

3950:on January 11, 2012

3536:on January 12, 2012

3476:The Washington Post

3457:The Washington Post

3163:on October 13, 2009

2860:Wall Street Journal

1421:Inflation adjuster

703:as a percentage of

502:Economic historian

247:, $ 12 million was

217:Funding Act of 1790

186:American Revolution

4348:The New York Times

4243:2023-05-11 at the

4058:The New York Times

3922:The New York Times

3885:The New York Times

3272:The New York Times

3196:on August 11, 2017

3059:on October 9, 2014

2934:Ellis, 2000, p. 73

1377:

1363:Publicly held debt

789:Roosevelt, Truman

722:President's party

695:Gross federal debt

627:The New York Times

584:

560:

504:J. Bradford DeLong

497:

403:

353:

343:After World War II

213:Compromise of 1790

201:Alexander Hamilton

177:

169:Alexander Hamilton

89:

81:

68:

60:

4007:. October 7, 2009

3588:on March 15, 2012

3345:978-0-271-02260-4

3249:978-0-86571-695-7

3239:The End of Growth

3234:Heinberg, Richard

2641:

2640:

1412:Federal spending

1387:program, and the

1320:

1319:

917:Kennedy, Johnson

738:percentage points

701:U.S. federal debt

597:$ 1.6 trillion –

562:According to the

528:George H. W. Bush

407:President Clinton

392:George H. W. Bush

387:economic policies

315:Warren G. Harding

175:, January 9, 1790

154:COVID-19 pandemic

52:

51:

4394:

4358:

4356:

4354:

4338:

4336:

4335:

4322:

4320:

4319:

4302:

4300:

4299:

4286:

4284:

4283:

4267:

4265:

4263:

4257:home.adelphi.edu

4227:

4219:

4211:

4195:

4189:

4183:

4177:

4171:

4165:

4159:

4153:

4147:

4141:

4135:

4129:

4123:

4117:

4111:

4106:

4100:

4095:

4089:

4086:

4080:

4075:

4069:

4068:

4066:

4064:

4049:

4043:

4042:

4040:

4038:

4023:

4017:

4016:

4014:

4012:

4006:

3998:

3992:

3991:

3989:

3987:

3981:

3974:

3966:

3960:

3959:

3957:

3955:

3946:. Archived from

3939:

3933:

3932:

3930:

3928:

3913:

3907:

3906:

3899:

3890:

3889:

3875:

3869:

3868:

3866:

3858:

3852:

3851:

3849:

3848:

3834:

3828:

3827:

3825:

3824:

3818:The Fiscal Times

3809:

3803:

3802:

3800:

3799:

3784:

3778:

3777:

3775:

3774:

3768:The Fiscal Times

3759:

3753:

3752:

3750:

3748:

3733:

3727:

3726:

3724:

3723:

3708:

3702:

3701:

3699:

3698:

3686:

3680:

3679:

3674:

3673:

3661:

3655:

3654:

3626:

3620:

3619:

3617:

3615:

3604:

3598:

3597:

3595:

3593:

3578:

3572:

3571:

3569:

3567:

3552:

3546:

3545:

3543:

3541:

3535:

3529:. Archived from

3528:

3520:

3514:

3507:

3498:

3489:

3480:

3479:

3467:

3461:

3460:

3448:

3442:

3437:

3431:

3430:

3428:

3426:

3411:

3405:

3404:

3402:

3401:

3386:

3377:

3376:

3374:

3372:

3357:

3348:

3333:

3322:

3321:

3319:

3317:

3311:

3305:. Archived from

3300:

3292:

3283:

3282:

3280:

3278:

3263:

3254:

3253:

3230:

3224:

3223:

3221:

3212:

3206:

3205:

3203:

3201:

3195:

3189:. Archived from

3188:

3179:

3173:

3172:

3170:

3168:

3159:. Archived from

3152:

3146:

3145:

3143:

3141:

3132:. Archived from

3126:

3120:

3119:

3117:

3115:

3104:

3091:

3090:

3088:

3086:

3075:

3069:

3068:

3066:

3064:

3055:. Archived from

3049:

3043:

3042:

3040:

3038:

3033:on March 6, 2016

3023:

3017:

3016:

3014:

3012:

2996:

2987:

2986:

2950:

2944:

2941:

2935:

2932:

2926:

2923:

2917:

2907:

2901:

2900:

2888:

2878:

2872:

2871:

2869:

2867:

2851:

2845:

2842:

2836:

2829:

2823:

2808:

2802:

2787:

2781:

2780:

2773:

2767:

2766:

2759:

2682:Starve the beast

2666:

2661:

2660:

2659:

1406:

1405:

710:

709:

524:starve the beast

327:Great Depression

97:Michael Hillegas

47:

44:

38:

26:

25:

18:

4402:

4401:

4397:

4396:

4395:

4393:

4392:

4391:

4362:

4361:

4352:

4350:

4333:

4331:

4317:

4315:

4314:on May 29, 2010

4297:

4295:

4281:

4279:

4261:

4259:

4251:Stephen Bloch.

4245:Wayback Machine

4234:

4203:

4198:

4190:

4186:

4178:

4174:

4166:

4162:

4154:

4150:

4142:

4138:

4130:

4126:

4118:

4114:

4107:

4103:

4096:

4092:

4087:

4083:

4076:

4072:

4062:

4060:

4050:

4046:

4036:

4034:

4033:on June 3, 2012

4025:

4024:

4020:

4010:

4008:

4004:

4000:

3999:

3995:

3985:

3983:

3979:

3972:

3968:

3967:

3963:

3953:

3951:

3940:

3936:

3926:

3924:

3914:

3910:

3901:

3900:

3893:

3876:

3872:

3864:

3860:

3859:

3855:

3846:

3844:

3836:

3835:

3831:

3822:

3820:

3810:

3806:

3797:

3795:

3785:

3781:

3772:

3770:

3760:

3756:

3746:

3744:

3734:

3730:

3721:

3719:

3709:

3705:

3696:

3694:

3687:

3683:

3671:

3669:

3668:. Seeking Alpha

3662:

3658:

3627:

3623:

3613:

3611:

3606:

3605:

3601:

3591:

3589:

3580:

3579:

3575:

3565:

3563:

3553:

3549:

3539:

3537:

3533:

3526:

3522:

3521:

3517:

3508:

3501:

3490:

3483:

3468:

3464:

3449:

3445:

3438:

3434:

3424:

3422:

3413:

3412:

3408:

3399:

3397:

3387:

3380:

3370:

3368:

3359:

3358:

3351:

3334:

3325:

3315:

3313:

3312:on May 26, 2012

3309:

3298:

3294:

3293:

3286:

3276:

3274:

3264:

3257:

3250:

3236:(August 2011).

3231:

3227:

3219:

3213:

3209:

3199:

3197:

3193:

3186:

3180:

3176:

3166:

3164:

3153:

3149:

3139:

3137:

3128:

3127:

3123:

3113:

3111:

3106:

3105:

3094:

3084:

3082:

3076:

3072:

3062:

3060:

3051:

3050:

3046:

3036:

3034:

3025:

3024:

3020:

3010:

3008:

2997:

2990:

2951:

2947:

2942:

2938:

2933:

2929:

2924:

2920:

2908:

2904:

2897:

2879:

2875:

2865:

2863:

2852:

2848:

2843:

2839:

2830:

2826:

2809:

2805:

2788:

2784:

2775:

2774:

2770:

2761:

2760:

2756:

2752:

2714:Patrick Creadon

2662:

2657:

2655:

2652:

1397:

1365:

735:

697:

692:

652:

576:

552:

544:budget deficits

540:

486:

462:

454:

357:Harry S. Truman

345:

336:Harry S. Truman

301:

286:

269:

257:

230:Albert Gallatin

225:

182:

162:

78:

48:

42:

39:

36:

27:

23:

12:

11:

5:

4400:

4390:

4389:

4384:

4379:

4374:

4360:

4359:

4339:

4323:

4303:

4287:

4268:

4248:

4233:

4232:External links

4230:

4229:

4228:

4220:

4212:

4202:

4199:

4197:

4196:

4184:

4172:

4168:Budget FY 2009

4160:

4156:Budget FY 2009

4148:

4136:

4124:

4112:

4109:Budget FY 2009

4101:

4090:

4081:

4070:

4044:

4018:

3993:

3982:on May 5, 2011

3961:

3934:

3908:

3891:

3870:

3853:

3829:

3804:

3779:

3754:

3728:

3717:New York Times

3703:

3681:

3656:

3643:10.2307/976984

3637:(6): 693–700.

3621:

3599:

3573:

3547:

3515:

3499:

3481:

3462:

3443:

3432:

3406:

3378:

3349:

3323:

3284:

3255:

3248:

3225:

3207:

3174:

3147:

3121:

3092:

3070:

3044:

3018:

2988:

2945:

2936:

2927:

2918:

2902:

2895:

2873:

2846:

2837:

2824:

2803:

2782:

2768:

2753:

2751:

2748:

2747:

2746:

2741:

2736:

2731:

2726:

2721:

2716:

2705:

2700:

2695:

2690:

2685:

2679:

2674:

2668:

2667:

2651:

2648:

2639:

2638:

2635:

2632:

2629:

2626:

2623:

2620:

2617:

2614:

2611:

2608:

2604:

2603:

2600:

2597:

2594:

2591:

2588:

2585:

2582:

2579:

2576:

2573:

2569:

2568:

2565:

2562:

2559:

2556:

2553:

2550:

2547:

2544:

2541:

2538:

2534:

2533:

2530:

2527:

2524:

2521:

2518:

2515:

2512:

2509:

2506:

2503:

2499:

2498:

2495:

2492:

2489:

2486:

2483:

2480:

2477:

2474:

2471:

2468:

2464:

2463:

2460:

2457:

2454:

2451:

2448:

2445:

2442:

2439:

2436:

2433:

2429:

2428:

2425:

2422:

2419:

2416:

2413:

2410:

2407:

2404:

2401:

2398:

2394:

2393:

2390:

2387:

2384:

2381:

2378:

2375:

2372:

2369:

2366:

2363:

2359:

2358:

2355:

2352:

2349:

2346:

2343:

2340:

2337:

2334:

2331:

2328:

2324:

2323:

2320:

2317:

2314:

2311:

2308:

2305:

2302:

2299:

2296:

2293:

2289:

2288:

2285:

2282:

2279:

2276:

2273:

2270:

2267:

2264:

2261:

2258:

2254:

2253:

2250:

2247:

2244:

2241:

2238:

2235:

2232:

2229:

2226:

2223:

2219:

2218:

2215:

2212:

2209:

2206:

2203:

2200:

2197:

2194:

2191:

2188:

2184:

2183:

2180:

2177:

2174:

2171:

2168:

2165:

2162:

2159:

2156:

2153:

2149:

2148:

2145:

2142:

2139:

2136:

2133:

2130:

2127:

2124:

2121:

2118:

2114:

2113:

2110:

2107:

2104:

2101:

2098:

2095:

2092:

2089:

2086:

2083:

2079:

2078:

2075:

2072:

2069:

2066:

2063:

2060:

2057:

2054:

2051:

2048:

2044:

2043:

2040:

2037:

2034:

2031:

2028:

2025:

2022:

2019:

2016:

2013:

2009:

2008:

2005:

2002:

1999:

1996:

1993:

1990:

1987:

1984:

1981:

1978:

1974:

1973:

1970:

1967:

1964:

1961:

1958:

1955:

1952:

1949:

1946:

1943:

1939:

1938:

1935:

1932:

1929:

1926:

1923:

1920:

1917:

1914:

1911:

1908:

1904:

1903:

1900:

1897:

1894:

1891:

1888:

1885:

1882:

1879:

1876:

1873:

1869:

1868:

1865:

1862:

1859:

1856:

1853:

1850:

1847:

1844:

1841:

1838:

1834:

1833:

1830:

1827:

1824:

1821:

1818:

1815:

1812:

1809:

1806:

1803:

1799:

1798:

1795:

1792:

1789:

1786:

1783:

1780:

1777:

1774:

1771:

1768:

1764:

1763:

1760:

1757:

1754:

1751:

1748:

1745:

1742:

1739:

1736:

1733:

1729:

1728:

1725:

1722:

1719:

1716:

1713:

1710:

1707:

1704:

1701:

1698:

1694:

1693:

1690:

1687:

1684:

1681:

1678:

1675:

1672:

1669:

1666:

1663:

1659:

1658:

1655:

1652:

1649:

1646:

1643:

1640:

1637:

1634:

1631:

1628:

1624:

1623:

1620:

1617:

1614:

1611:

1608:

1605:

1602:

1599:

1596:

1593:

1589:

1588:

1585:

1582:

1579:

1576:

1573:

1570:

1567:

1564:

1561:

1558:

1554:

1553:

1550:

1547:

1544:

1541:

1538:

1535:

1532:

1529:

1526:

1523:

1519:

1518:

1515:

1512:

1509:

1506:

1503:

1500:

1497:

1494:

1491:

1488:

1484:

1483:

1480:

1478:

1475:

1472:

1470:

1467:

1464:

1462:

1459:

1456:

1452:

1451:

1448:

1445:

1442:

1439:

1436:

1433:

1430:

1427:

1423:

1422:

1419:

1416:

1413:

1410:

1396:

1393:

1364:

1361:

1360:

1359:

1350:

1318:

1317:

1314:

1311:

1308:

1305:

1302:

1299:

1296:

1286:

1285:

1282:

1279:

1276:

1273:

1270:

1267:

1264:

1254:

1253:

1250:

1247:

1244:

1241:

1238:

1235:

1232:

1222:

1221:

1218:

1215:

1212:

1209:

1206:

1203:

1200:

1190:

1189:

1186:

1183:

1180:

1177:

1174:

1171:

1168:

1158:

1157:

1154:

1151:

1148:

1145:

1142:

1139:

1136:

1126:

1125:

1122:

1119:

1116:

1113:

1110:

1107:

1104:

1094:

1093:

1090:

1087:

1084:

1081:

1078:

1075:

1072:

1062:

1061:

1058:

1055:

1052:

1049:

1046:

1043:

1040:

1030:

1029:

1026:

1023:

1020:

1017:

1014:

1011:

1008:

998:

997:

994:

991:

988:

985:

982:

979:

976:

966:

965:

962:

959:

956:

953:

950:

947:

944:

934:

933:

930:

927:

924:

921:

918:

915:

912:

902:

901:

898:

895:

892:

889:

886:

883:

880:

870:

869:

866:

863:

860:

857:

854:

851:

848:

838:

837:

834:

831:

828:

825:

822:

819:

816:

806:

805:

802:

799:

796:

793:

790:

787:

784:

774:

773:

770:

767:

764:

761:

758:

755:

752:

742:

741:

732:

729:

726:

723:

720:

717:

714:

696:

693:

691:

688:

684:

683:

680:

677:

674:

651:

648:

644:

643:

640:

637:

634:

615:

614:

611:

608:

605:

602:

595:

575:

572:

551:

548:

539:

536:

532:George W. Bush

520:Bruce Bartlett

508:David Stockman

485:

482:

458:Main article:

453:

450:

434:George W. Bush

344:

341:

300:

297:

285:

282:

273:Andrew Jackson

268:

265:

256:

253:

224:

221:

181:

178:

161:

158:

50:

49:

30:

28:

21:

9:

6:

4:

3:

2:

4399:

4388:

4385:

4383:

4380:

4378:

4375:

4373:

4370:

4369:

4367:

4349:

4345:

4340:

4329:

4326:Steve Stoft.

4324:

4313:

4309:

4304:

4293:

4288:

4278:

4277:Seeking Alpha

4274:

4269:

4258:

4254:

4249:

4246:

4242:

4239:

4236:

4235:

4225:

4221:

4217:

4213:

4209:

4205:

4204:

4193:

4192:Budget FY2009

4188:

4181:

4180:Budget FY2009

4176:

4169:

4164:

4157:

4152:

4145:

4144:Budget FY2009

4140:

4133:

4132:Budget FY2009

4128:

4121:

4120:Budget FY2009

4116:

4110:

4105:

4099:

4094:

4085:

4079:

4078:Budget FY2007

4074:

4059:

4055:

4048:

4032:

4028:

4022:

4003:

3997:

3978:

3971:

3965:

3949:

3945:

3938:

3923:

3919:

3912:

3904:

3898:

3896:

3887:

3886:

3881:

3874:

3863:

3857:

3843:

3839:

3833:

3819:

3815:

3808:

3794:

3790:

3783:

3769:

3765:

3758:

3743:

3739:

3732:

3718:

3714:

3707:

3692:

3685:

3678:

3667:

3660:

3652:

3648:

3644:

3640:

3636:

3632:

3625:

3609:

3603:

3587:

3583:

3577:

3562:

3561:The Economist

3558:

3551:

3532:

3525:

3519:

3512:

3506:

3504:

3497:

3493:

3488:

3486:

3477:

3473:

3466:

3458:

3454:

3447:

3441:

3436:

3420:

3416:

3410:

3396:

3392:

3385:

3383:

3366:

3362:

3356:

3354:

3346:

3342:

3338:

3332:

3330:

3328:

3308:

3304:

3297:

3291:

3289:

3273:

3269:

3262:

3260:

3251:

3245:

3241:

3240:

3235:

3229:

3218:

3211:

3192:

3185:

3178:

3162:

3158:

3151:

3135:

3131:

3125:

3109:

3103:

3101:

3099:

3097:

3081:

3074:

3058:

3054:

3048:

3032:

3028:

3027:"Our History"

3022:

3006:

3002:

2995:

2993:

2984:

2980:

2976:

2972:

2968:

2964:

2961:(3): 227–45.

2960:

2956:

2949:

2940:

2931:

2922:

2916:

2912:

2906:

2898:

2896:0-375-70524-4

2892:

2887:

2886:

2877:

2861:

2857:

2850:

2841:

2834:

2828:

2821:

2820:9781577660316

2817:

2813:

2807:

2800:

2799:0-8090-7784-1

2796:

2792:

2786:

2778:

2772:

2764:

2758:

2754:

2745:

2742:

2740:

2737:

2735:

2732:

2730:

2727:

2725:

2722:

2720:

2717:

2715:

2711:

2710:

2706:

2704:

2701:

2699:

2696:

2694:

2691:

2689:

2686:

2683:

2680:

2678:

2675:

2673:

2670:

2669:

2665:

2654:

2647:

2645:

2636:

2633:

2630:

2627:

2624:

2621:

2618:

2615:

2612:

2609:

2606:

2605:

2601:

2598:

2595:

2592:

2589:

2586:

2583:

2580:

2577:

2574:

2571:

2570:

2566:

2563:

2560:

2557:

2554:

2551:

2548:

2545:

2542:

2539:

2536:

2535:

2531:

2528:

2525:

2522:

2519:

2516:

2513:

2510:

2507:

2504:

2501:

2500:

2496:

2493:

2490:

2487:

2484:

2481:

2478:

2475:

2472:

2469:

2466:

2465:

2461:

2458:

2455:

2452:

2449:

2446:

2443:

2440:

2437:

2434:

2431:

2430:

2426:

2423:

2420:

2417:

2414:

2411:

2408:

2405:

2402:

2399:

2396:

2395:

2391:

2388:

2385:

2382:

2379:

2376:

2373:

2370:

2367:

2364:

2361:

2360:

2356:

2353:

2350:

2347:

2344:

2341:

2338:

2335:

2332:

2329:

2326:

2325:

2321:

2318:

2315:

2312:

2309:

2306:

2303:

2300:

2297:

2294:

2291:

2290:

2286:

2283:

2280:

2277:

2274:

2271:

2268:

2265:

2262:

2259:

2256:

2255:

2251:

2248:

2245:

2242:

2239:

2236:

2233:

2230:

2227:

2224:

2221:

2220:

2216:

2213:

2210:

2207:

2204:

2201:

2198:

2195:

2192:

2189:

2186:

2185:

2181:

2178:

2175:

2172:

2169:

2166:

2163:

2160:

2157:

2154:

2151:

2150:

2146:

2143:

2140:

2137:

2134:

2131:

2128:

2125:

2122:

2119:

2116:

2115:

2111:

2108:

2105:

2102:

2099:

2096:

2093:

2090:

2087:

2084:

2081:

2080:

2076:

2073:

2070:

2067:

2064:

2061:

2058:

2055:

2052:

2049:

2046:

2045:

2041:

2038:

2035:

2032:

2029:

2026:

2023:

2020:

2017:

2014:

2011:

2010:

2006:

2003:

2000:

1997:

1994:

1991:

1988:

1985:

1982:

1979:

1976:

1975:

1971:

1968:

1965:

1962:

1959:

1956:

1953:

1950:

1947:

1944:

1941:

1940:

1936:

1933:

1930:

1927:

1924:

1921:

1918:

1915:

1912:

1909:

1906:

1905:

1901:

1898:

1895:

1892:

1889:

1886:

1883:

1880:

1877:

1874:

1871:

1870:

1866:

1863:

1860:

1857:

1854:

1851:

1848:

1845:

1842:

1839:

1836:

1835:

1831:

1828:

1825:

1822:

1819:

1816:

1813:

1810:

1807:

1804:

1801:

1800:

1796:

1793:

1790:

1787:

1784:

1781:

1778:

1775:

1772:

1769:

1766:

1765:

1761:

1758:

1755:

1752:

1749:

1746:

1743:

1740:

1737:

1734:

1731:

1730:

1726:

1723:

1720:

1717:

1714:

1711:

1708:

1705:

1702:

1699:

1696:

1695:

1691:

1688:

1685:

1682:

1679:

1676:

1673:

1670:

1667:

1664:

1661:

1660:

1656:

1653:

1650:

1647:

1644:

1641:

1638:

1635:

1632:

1629:

1626:

1625:

1621:

1618:

1615:

1612:

1609:

1606:

1603:

1600:

1597:

1594:

1591:

1590:

1586:

1583:

1580:

1577:

1574:

1571:

1568:

1565:

1562:

1559:

1556:

1555:

1551:

1548:

1545:

1542:

1539:

1536:

1533:

1530:

1527:

1524:

1521:

1520:

1516:

1513:

1510:

1507:

1504:

1501:

1498:

1495:

1492:

1489:

1486:

1485:

1481:

1479:

1476:

1473:

1471:

1468:

1465:

1463:

1460:

1457:

1454:

1453:

1449:

1446:

1443:

1440:

1437:

1434:

1431:

1428:

1425:

1424:

1415:Federal debt

1407:

1404:

1402:

1392:

1390:

1386:

1382:

1374:

1369:

1357:

1356:

1351:

1348:

1347:

1346:

1343:

1341:

1337:

1333:

1329:

1325:

1315:

1312:

1309:

1306:

1303:

1300:

1297:

1295:

1291:

1288:

1287:

1283:

1280:

1277:

1274:

1271:

1268:

1265:

1263:

1259:

1256:

1255:

1251:

1248:

1245:

1242:

1239:

1236:

1233:

1231:

1227:

1224:

1223:

1219:

1216:

1213:

1210:

1207:

1204:

1201:

1199:

1195:

1192:

1191:

1187:

1184:

1181:

1178:

1175:

1172:

1169:

1167:

1163:

1160:

1159:

1155:

1152:

1149:

1146:

1143:

1140:

1137:

1135:

1131:

1128:

1127:

1123:

1120:

1117:

1114:

1111:

1108:

1105:

1103:

1099:

1096:

1095:

1091:

1088:

1085:

1082:

1079:

1076:

1073:

1071:

1067:

1064:

1063:

1059:

1056:

1053:

1050:

1047:

1044:

1041:

1039:

1035:

1032:

1031:

1027:

1024:

1021:

1018:

1015:

1012:

1009:

1007:

1003:

1000:

999:

995:

992:

989:

986:

983:

980:

977:

975:

971:

968:

967:

963:

960:

957:

954:

951:

948:

945:

943:

939:

936:

935:

931:

928:

925:

922:

919:

916:

913:

911:

907:

904:

903:

899:

896:

893:

890:

887:

884:

881:

879:

875:

872:

871:

867:

864:

861:

858:

855:

852:

849:

847:

843:

840:

839:

835:

832:

829:

826:

823:

820:

817:

815:

811:

808:

807:

803:

800:

797:

794:

791:

788:

785:

783:

779:

776:

775:

771:

768:

765:

762:

759:

756:

753:

751:

747:

744:

743:

739:

733:

730:

727:

724:

721:

718:

715:

712:

711:

708:

706:

702:

687:

681:

678:

675:

672:

671:

670:

667:

665:

661:

657:

650:2008 vs. 2009

647:

641:

638:

635:

632:

631:

630:

628:

624:

620:

612:

609:

606:

603:

600:

599:Bush Tax Cuts

596:

593:

592:

591:

588:

580:

574:2001 vs. 2011

571:

567:

565:

556:

550:2001 vs. 2009

547:

545:

535:

533:

529:

525:

521:

517:

513:

509:

505:

500:

492:

488:

481:

479:

475:

471:

470:credit rating

467:

461:

456:

449:

447:

443:

439:

435:

431:

430:Bush tax cuts

426:

424:

420:

416:

412:

408:

399:

395:

393:

388:

384:

383:Ronald Reagan

379:

376:

371:

368:

366:

362:

358:

349:

340:

337:

333:

328:

324:

319:

316:

312:

310:

309:Liberty Bonds

306:

296:

294:

289:

281:

279:

278:Panic of 1837

274:

264:

262:

255:1790s to 1834

252:

250:

246:

245:domestic debt

241:

239:

233:

231:

220:

218:

214:

210:

209:James Madison

206:

202:

197:

195:

191:

187:

174:

170:

166:

160:Early history

157:

155:

150:

148:

143:

141:

140:economic boom

137:

136:Ronald Reagan

133:

129:

125:

124:Richard Nixon

121:

117:

113:

108:

106:

102:

98:

94:

85:

77:

72:

64:

56:

46:

34:

29:

20:

19:

16:

4351:. Retrieved

4347:

4332:. Retrieved

4330:. Zfacts.com

4316:. Retrieved

4312:the original

4296:. Retrieved

4280:. Retrieved

4276:

4260:. Retrieved

4256:

4187:

4175:

4163:

4151:

4139:

4127:

4115:

4104:

4093:

4084:

4073:

4061:. Retrieved

4057:

4047:

4035:. Retrieved

4031:the original

4021:

4009:. Retrieved

3996:

3984:. Retrieved

3977:the original

3964:

3952:. Retrieved

3948:the original

3937:

3925:. Retrieved

3921:

3911:

3883:

3873:

3856:

3845:. Retrieved

3841:

3832:

3821:. Retrieved

3817:

3807:

3796:. Retrieved

3792:

3782:

3771:. Retrieved

3767:

3757:

3745:. Retrieved

3741:

3731:

3720:. Retrieved

3716:

3706:

3695:. Retrieved

3684:

3676:

3670:. Retrieved

3659:

3634:

3630:

3624:

3612:. Retrieved

3602:

3590:. Retrieved

3586:the original

3576:

3564:. Retrieved

3560:

3550:

3538:. Retrieved

3531:the original

3518:

3475:

3465:

3456:

3446:

3435:

3423:. Retrieved

3418:

3409:

3398:. Retrieved

3394:

3369:. Retrieved

3364:

3347:. pp. 185–86

3336:

3314:. Retrieved

3307:the original

3275:. Retrieved

3271:

3238:

3228:

3210:

3200:December 15,

3198:. Retrieved

3191:the original

3177:

3165:. Retrieved

3161:the original

3150:

3138:. Retrieved

3134:the original

3124:

3112:. Retrieved

3083:. Retrieved

3073:

3061:. Retrieved

3057:the original

3047:

3037:February 21,

3035:. Retrieved

3031:the original

3021:

3009:. Retrieved

3005:Planet Money

3004:

2958:

2954:

2948:

2939:

2930:

2921:

2910:

2905:

2884:

2876:

2864:. Retrieved

2859:

2849:

2840:

2832:

2827:

2811:

2806:

2790:

2785:

2771:

2757:

2707:

2664:Money portal

2643:

2642:

1409:Fiscal year

1401:fiscal years

1398:

1378:

1372:

1353:

1344:

1321:

1013:Nixon, Ford

698:

685:

668:

653:

645:

626:

622:

618:

616:

589:

585:

568:

561:

541:

501:

498:

487:

463:

455:

446:Barack Obama

427:

404:

380:

372:

369:

354:

332:World War II

320:

313:

302:

290:

287:

284:1836 to 1910

270:

258:

249:foreign debt

242:

234:

226:

198:

192:, under the

183:

172:

151:

144:

132:Bill Clinton

128:Jimmy Carter

116:World War II

112:Harry Truman

109:

92:

90:

40:

32:

15:

3747:October 22,

3140:January 25,

3011:January 15,

2866:January 10,

1304:Democratic

1272:Republican

1240:Republican

1208:Democratic

1176:Democratic

1144:Republican

1112:Republican

1080:Republican

1048:Democratic

1016:Republican

984:Republican

952:Democratic

920:Democratic

888:Republican

885:Eisenhower

856:Republican

853:Eisenhower

824:Democratic

792:Democratic

760:Democratic

305:World War I

261:War of 1812

152:During the

101:public debt

4366:Categories

4334:2010-08-09

4318:2010-08-09

4298:2010-08-09

4282:2010-08-09

4201:References

3847:2022-09-01

3823:2012-03-14

3798:2012-03-14

3793:Forbes.com

3773:2011-10-22

3742:Forbes.com

3722:2010-08-09

3697:2010-08-09

3672:2010-08-09

3566:January 1,

3425:January 3,

3400:2011-08-30

3371:January 3,

3114:August 25,

2709:I.O.U.S.A.

1391:program).

1340:Senate.gov

1298:2009–2013

1266:2005–2009

1234:2001–2005

1202:1997–2001

1170:1993–1997

1138:1989–1993

1106:1985–1989

1074:1981–1985

1042:1977–1981

1010:1973–1977

978:1969–1973

946:1965–1969

914:1961–1965

882:1957–1961

850:1953–1957

818:1949–1953

786:1945–1949

757:Roosevelt

754:1941–1945

719:President

423:1990s boom

365:Korean War

4262:August 9,

3614:August 8,

3592:August 8,

3395:CNN Money

3316:April 16,

2983:153625533

2631:$ 11,297

2628:$ 14,508

2619:$ 11,875

2596:$ 11,529

2593:$ 14,097

2584:$ 10,413

2561:$ 11,553

2558:$ 14,312

2526:$ 11,329

2523:$ 13,668

2491:$ 11,024

2488:$ 13,016

2456:$ 10,717

2453:$ 12,238

2421:$ 10,441

2418:$ 11,500

2386:$ 10,099

2383:$ 10,809

2348:$ 10,377

2313:$ 10,058

1447:Adjusted

1444:Billions

1438:Adjusted

1435:Billions

1429:Adjusted

1426:Billions

1322:(Source:

1141:Bush Sr.

619:surpluses

293:Civil War

215:, as the

43:July 2020

4241:Archived

3277:13 March

3085:July 15,

3063:July 15,

2915:in JSTOR

2862:. Agenda

2822:. p. 37.

2801:. p. 69.

2684:(policy)

2650:See also

2622:$ 9,247

2613:$ 2,392

2610:$ 3,091

2587:$ 8,218

2578:$ 2,452

2575:$ 3,107

2552:$ 7,793

2549:$ 9,654

2543:$ 2,366

2540:$ 2,931

2517:$ 7,419

2514:$ 8,951

2508:$ 2,263

2505:$ 2,730

2482:$ 7,158

2479:$ 8,451

2473:$ 2,249

2470:$ 2,655

2447:$ 6,923

2444:$ 7,905

2438:$ 2,165

2435:$ 2,472

2412:$ 6,677

2409:$ 7,354

2403:$ 2,082

2400:$ 2,293

2377:$ 6,316

2374:$ 6,760

2368:$ 2,018

2365:$ 2,160

2351:$ 9,954

2342:$ 5,945

2339:$ 6,198

2333:$ 1,929

2330:$ 2,011

2316:$ 9,829

2307:$ 5,638

2304:$ 5,769

2298:$ 1,821

2295:$ 1,863

2281:$ 9,710

2278:$ 9,710

2272:$ 5,628

2269:$ 5,628

2263:$ 1,789

2260:$ 1,789

2246:$ 9,361

2243:$ 9,125

2237:$ 5,750

2234:$ 5,605

2228:$ 1,746

2225:$ 1,702

2211:$ 8,985

2208:$ 8,628

2202:$ 5,704

2199:$ 5,478

2193:$ 1,721

2190:$ 1,653

2176:$ 8,606

2173:$ 8,182

2167:$ 5,647

2164:$ 5,369

2158:$ 1,684

2155:$ 1,601

2141:$ 8,248

2138:$ 7,694

2132:$ 5,554

2129:$ 5,181

2123:$ 1,673

2120:$ 1,561

2106:$ 8,033

2103:$ 7,326

2097:$ 5,395

2094:$ 4,920

2088:$ 1,662

2085:$ 1,516

2071:$ 7,820

2068:$ 6,961

2062:$ 5,216

2059:$ 4,643

2053:$ 1,642

2050:$ 1,462

2036:$ 7,536

2033:$ 6,576

2027:$ 4,987

2024:$ 4,351

2018:$ 1,615

2015:$ 1,410

2001:$ 7,334

1998:$ 6,240

1992:$ 4,703

1989:$ 4,001

1983:$ 1,624

1980:$ 1,382

1966:$ 7,215

1963:$ 5,935

1957:$ 4,374

1954:$ 3,598

1948:$ 1,610

1945:$ 1,324

1931:$ 7,277

1928:$ 5,735

1922:$ 4,067

1919:$ 3,206

1913:$ 1,590

1910:$ 1,253

1896:$ 7,077

1893:$ 5,401

1887:$ 3,757

1884:$ 2,867

1878:$ 1,499

1875:$ 1,144

1861:$ 6,806

1858:$ 5,009

1852:$ 3,534

1849:$ 2,601

1843:$ 1,447

1840:$ 1,065

1826:$ 6,506

1823:$ 4,647

1817:$ 3,283

1814:$ 2,345

1808:$ 1,406

1805:$ 1,004

1791:$ 6,352

1788:$ 4,412

1782:$ 3,052

1779:$ 2,120

1773:$ 1,426

1756:$ 6,108

1753:$ 4,142

1747:$ 2,680

1744:$ 1,817

1738:$ 1,396

1721:$ 5,858

1718:$ 3,840

1712:$ 2,386

1709:$ 1,564

1703:$ 1,300

1686:$ 5,510

1683:$ 3,441

1677:$ 2,195

1674:$ 1,371