169:

83:

recent years is that government bodies share the data with each other. Within several

European nations such as Denmark and Sweden, governments already provide citizens with prefilled return forms, which a citizen would sign if accurate, and if not, can fix the error on their own or prepare returns themselves. In Denmark and Sweden, 97 percent and 74 percent of taxpayers had their forms prefilled by tax authorities respectively in 1999.

29:

75:

A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of income, age, and filing status also play

82:

The time and effort involved in filing a tax return varies from country to country, but governments try to help citizens in different ways. Many governments utilize electronic filling and payment systems that keep a record of a person's history of tax returns and refunds. Another notable change in

145:

reduce the amount of paid to government entities. Tax credits are more impactful than deductions because they directly reduce the amount of tax owed. If a person has $ 500 in tax credits, and the tax owed is $ 500, the tax credits will reduce a person's liability to zero. Tax credits arise from

136:

varies according to filing status. In the United States, the standard deduction is higher for older taxpayers (65 and above). If the taxpayer chooses to itemize, such deductions are recorded on

Schedule A. Itemized deductions should be supported by documentation which the taxpayer retains after

71:

A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years.

176:

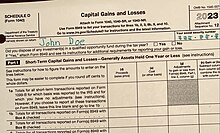

In the United States, a tax schedule is a form that the

Internal Revenue Service (IRS) requires taxpayers to fill out in addition to the tax return. It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.

184:

whereas complex tax returns additionally require a tax schedule to be completed with the tax return. There are different types of schedules such as

Schedule A, Schedule B, Schedule C, Schedule D, Schedule EIC, and Schedule SE. Specific tax forms can be used by

561:

124:. Examples of tax deductions include mortgage interests, student loan interest, contributions to saving plans for retirement etc. In general, taxes paid will be less when the taxpayer chooses the larger of

104:, excluding items which are exempt from tax by law. Wages, salaries, income from retirement plans, dividends, interest and capital gains or losses should be considered as a source of revenue.

384:

616:

437:

534:

120:

are items that are subtracted from taxable income, thereby reducing the tax liability. For organizations, most expenses specifically identified with business tasks are

463:

643:

557:

721:

307:

40:

is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for

358:

380:

612:

433:

189:

or private entities that are required to report information on their tax liabilities, including income earners, businesses, and companies.

695:

79:

The tax return is not necessarily the final calculation; it may be accepted or not accepted as correct by the government authority.

76:

a role. Occasionally, there may be situations where the tax return need not be filed, but is filed anyway to receive a tax refund.

530:

150:

if they care for a child under the age of 13. Education expenses might be treated as a tax credit in some countries, such as the

160:

include estimated tax payments and amounts withheld from your paycheck. If you've overpaid your taxes, you'll receive a refund.

489:

180:

Tax schedules are used by both taxpayers and taxation authorities such as the IRS. Simple tax returns can be filed using the

459:

639:

669:

110:

includes wages, salaries, rental income, dividends, and business profits, after deducting any allowable deductions. In

338:

223:

228:

151:

86:

The length of the completion of a tax return depends on the country, but the world average is almost 232 hours.

253:

273:

56:

114:, the concept of taxable income is central to determining the amount of income tax you are liable to pay.

717:

303:

354:

218:

203:

208:

52:

268:

263:

60:

16:

List of individual's monetary gains and losses over 12 months submitted to government each year

213:

691:

8:

258:

749:

584:

233:

133:

129:

125:

334:

248:

485:

278:

243:

238:

147:

48:

613:"Taxpayers should know the difference between standard and itemized deductions"

511:

47:

Tax returns are usually processed by each country's tax authority, known as a

743:

665:

406:

121:

283:

198:

141:

20:

181:

168:

111:

519:. Department of the Treasury, Internal Revenue Service. p. 22.

186:

28:

101:

582:

599:

Instructions, 1040 and 1040-SR, Tax Year 2023 op cit p. 31

533:. Center on Budget and Policy Priorities. 20 August 2012.

666:"Mastering IRS Tax Form 1040: U.S. Individual Tax Return"

531:"Policy Basics: Where Do Federal Tax Revenues Come From?"

333:(Third ed.). Oxford University Press. p. 1823.

41:

94:

A tax return usually includes the following components.

640:"The top 10 tax credits that should be on your radar"

172:

Tax schedule used to report capital gains in the USA

146:

multiple areas. For example, a person may receive a

381:"Does Everyone Need to File an Income Tax Return?"

558:"ITR filing: Computing your total taxable income"

741:

637:

460:"What other countries use return-free filing?"

355:"What Is a Tax Refund and Why Do You Get One?"

513:Instructions, 1040 and 1040-SR, Tax Year 2023

89:

66:

328:

167:

27:

434:"Filing Taxes Could Be Free and Simple"

431:

100:consists of the sources of a citizen's

742:

646:from the original on 30 November 2020

387:from the original on 14 November 2022

615:. Internal Revenue Service irs.gov.

583:Merriam Webster Dictionary op. cit.

537:from the original on 8 November 2020

724:from the original on 22 August 2018

672:from the original on 1 October 2023

555:

13:

564:from the original on 19 March 2022

432:Huseman, Jessica (20 March 2017).

14:

761:

492:from the original on 3 March 2021

440:from the original on 30 June 2022

361:from the original on 9 April 2021

310:from the original on 23 June 2023

224:Tax returns in the United Kingdom

698:from the original on 19 May 2022

638:Jennifer Woods (11 April 2016).

466:from the original on 5 June 2022

229:Tax returns in the United States

710:

684:

658:

631:

619:from the original on 6 May 2022

605:

591:

576:

549:

523:

486:"Time to prepare and pay taxes"

357:. SmartAsset. 22 January 2021.

163:

152:American Opportunity Tax Credit

504:

478:

452:

425:

399:

373:

347:

329:Stevenson, Angus, ed. (2010).

322:

306:. Merriam-Webster Dictionary.

296:

254:Taxation in the United Kingdom

1:

289:

274:Income tax in the Netherlands

57:State Taxation Administration

331:Oxford Dictionary of English

7:

411:Legal Information Institute

192:

10:

766:

304:"income tax return – noun"

90:Components of a tax return

55:in the United States, the

18:

692:"What Is a Tax Schedule?"

204:Tax information reporting

209:Tax returns in Australia

67:Preparing the tax return

53:Internal Revenue Service

19:Not to be confused with

462:. taxpolicycenter.org.

383:. turbotax.intuit.com.

269:Income tax in Singapore

137:filing the tax return.

63:in the United Kingdom.

560:. The Economic Times.

488:. data.worldbank.org.

264:Income tax in Scotland

173:

154:in the United States.

61:HM Revenue and Customs

33:

668:. 11 September 2023.

214:Tax returns in Canada

171:

31:

413:. Cornell Law School

219:Tax returns in India

158:Payments and refunds

718:"Income tax return"

259:Income tax in China

126:itemized deductions

585:"Deduction – noun"

436:. propublica.org.

234:Taxation in Greece

174:

134:standard deduction

130:standard deduction

34:

556:Motiani, Preeti.

249:Taxation in Spain

757:

734:

733:

731:

729:

714:

708:

707:

705:

703:

688:

682:

681:

679:

677:

662:

656:

655:

653:

651:

635:

629:

628:

626:

624:

609:

603:

602:

595:

589:

588:

580:

574:

573:

571:

569:

553:

547:

546:

544:

542:

527:

521:

520:

518:

508:

502:

501:

499:

497:

482:

476:

475:

473:

471:

456:

450:

449:

447:

445:

429:

423:

422:

420:

418:

403:

397:

396:

394:

392:

377:

371:

370:

368:

366:

351:

345:

344:

326:

320:

319:

317:

315:

300:

279:Papal income tax

244:Taxation in Peru

239:Taxation in Iran

148:Child Tax Credit

32:German tax forms

765:

764:

760:

759:

758:

756:

755:

754:

740:

739:

738:

737:

727:

725:

716:

715:

711:

701:

699:

694:. The Balance.

690:

689:

685:

675:

673:

664:

663:

659:

649:

647:

636:

632:

622:

620:

611:

610:

606:

597:

596:

592:

581:

577:

567:

565:

554:

550:

540:

538:

529:

528:

524:

516:

510:

509:

505:

495:

493:

484:

483:

479:

469:

467:

458:

457:

453:

443:

441:

430:

426:

416:

414:

405:

404:

400:

390:

388:

379:

378:

374:

364:

362:

353:

352:

348:

341:

327:

323:

313:

311:

302:

301:

297:

292:

195:

166:

92:

69:

49:revenue service

24:

17:

12:

11:

5:

763:

753:

752:

736:

735:

720:. ato.gov.au.

709:

683:

657:

630:

604:

590:

575:

548:

522:

503:

477:

451:

424:

398:

372:

346:

339:

321:

294:

293:

291:

288:

287:

286:

281:

276:

271:

266:

261:

256:

251:

246:

241:

236:

231:

226:

221:

216:

211:

206:

201:

194:

191:

165:

162:

108:Taxable income

91:

88:

68:

65:

59:in China, and

51:, such as the

15:

9:

6:

4:

3:

2:

762:

751:

748:

747:

745:

723:

719:

713:

697:

693:

687:

671:

667:

661:

645:

641:

634:

618:

614:

608:

600:

594:

586:

579:

563:

559:

552:

536:

532:

526:

515:

514:

507:

491:

487:

481:

465:

461:

455:

439:

435:

428:

412:

408:

402:

386:

382:

376:

360:

356:

350:

342:

340:9780199571123

336:

332:

325:

309:

305:

299:

295:

285:

282:

280:

277:

275:

272:

270:

267:

265:

262:

260:

257:

255:

252:

250:

247:

245:

242:

240:

237:

235:

232:

230:

227:

225:

222:

220:

217:

215:

212:

210:

207:

205:

202:

200:

197:

196:

190:

188:

183:

178:

170:

161:

159:

155:

153:

149:

144:

143:

138:

135:

131:

127:

123:

119:

115:

113:

109:

105:

103:

99:

95:

87:

84:

80:

77:

73:

64:

62:

58:

54:

50:

45:

43:

39:

30:

26:

22:

726:. Retrieved

712:

700:. Retrieved

686:

674:. Retrieved

660:

648:. Retrieved

633:

621:. Retrieved

607:

598:

593:

578:

566:. Retrieved

551:

539:. Retrieved

525:

512:

506:

494:. Retrieved

480:

468:. Retrieved

454:

442:. Retrieved

427:

415:. Retrieved

410:

407:"Tax Return"

401:

389:. Retrieved

375:

363:. Retrieved

349:

330:

324:

312:. Retrieved

298:

179:

175:

164:Tax schedule

157:

156:

140:

139:

117:

116:

107:

106:

97:

96:

93:

85:

81:

78:

74:

70:

46:

37:

35:

25:

676:29 November

284:Tax evasion

199:Tax revenue

142:Tax credits

650:2 November

541:1 November

290:References

122:deductible

118:Deductions

38:tax return

21:Tax refund

750:Tax forms

728:22 August

187:taxpayers

182:Form 1040

112:Australia

744:Category

722:Archived

702:19 March

696:Archived

670:Archived

644:Archived

642:. CNBC.

623:19 March

617:Archived

568:19 March

562:Archived

535:Archived

496:27 March

490:Archived

464:Archived

438:Archived

391:28 March

385:Archived

365:28 March

359:Archived

308:Archived

193:See also

470:30 June

444:30 June

128:or the

102:revenue

417:14 May

337:

314:13 May

132:. The

98:Income

517:(PDF)

730:2018

704:2022

678:2023

652:2020

625:2022

570:2022

543:2020

498:2021

472:2022

446:2022

419:2024

393:2021

367:2021

335:ISBN

316:2024

42:tax

746::

409:.

44:.

36:A

732:.

706:.

680:.

654:.

627:.

601:.

587:.

572:.

545:.

500:.

474:.

448:.

421:.

395:.

369:.

343:.

318:.

23:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.