11800:

3358:(including auxiliary services). A 7% rate applies to supplies of pharmaceuticals and healthcare products. Exported goods and auxiliary services are zero-rated. For VAT purposes, services that are included in the customs value of imported and exported goods are considered auxiliary services Certain supplies are not subject to VAT, including: issues of securities; insurance services; reorganization of legal entities; transfers and returns of property under operating lease arrangements; currency exchange; and imports and exports with a custom value of less than 150 EUR. VAT-exempt supplies include published periodicals; student notebooks, textbooks, books and certain educational services; certain public transport services; the provision of software products (until January 1. 2023); and the provision of healthcare services by licensed institutions. Registration is required (for residents and non-residents) if value of taxable supplies of goods or services exceeds ₴1 million during any 12-month period. A legal entity may apply for voluntary registration if it has no VATable activities or if the volume

2554:

8107:

80:

8546:

8681:

8498:

5241:

8370:

7034:

5174:

8091:

8626:

5108:

8123:

4645:

7339:

6935:

7651:

5283:

4881:

3475:

7376:

7010:

2252:(NBR) administers VAT. Other rules and acts include Development Surcharge and Levy (Imposition and Collection) Act, 2015; and Value Added Tax and Supplementary Duty Rules, 2016. Anyone who collects VAT becomes a VAT Trustee if they: register and collect a Business Identification Number (BIN) from the NBR; submit VAT returns on time; offer VAT receipts; store all cash-memos; and use the VAT rebate system responsibly. VAT Mentors work in the VAT or Customs department and deal with trustees. The VAT rate is a flat 15%.

8450:

8354:

8187:

5045:

5877:

8514:

7507:

4573:

3573:

2006:

8155:

3705:

5426:

5382:

6829:

8466:

8041:

7672:

6903:

6668:

5827:

4172:

3510:

8658:

7465:

2152:

6142:

5630:

12377:

7579:

7216:

7168:

7076:

4961:

2108:

8434:

6557:

5357:

4700:

7246:

8610:

8386:

7772:

7397:

7147:

6437:

6292:

6055:

6004:

5220:

5087:

4745:

4675:

8482:

6486:

6167:

5496:

4098:

44:

8203:

7292:

6780:

6584:

4067:

8256:

8237:

7814:

7189:

6313:

5777:

5585:

4594:

4769:

8059:

7885:

6850:

6412:

6209:

5697:

5403:

5262:

5003:

4905:

4341:

3612:

8578:

8338:

8290:

8219:

7439:

7418:

6731:

6245:

5196:

5024:

4310:

4237:

1688:

3799:

8402:

8075:

7621:

7529:

6626:

6362:

5898:

5718:

5564:

5308:

4982:

4857:

4790:

4723:

4619:

4526:

3966:

3935:

3643:

8530:

7839:

7793:

7747:

7097:

6507:

6462:

6121:

6097:

5517:

4504:

4479:

4279:

3768:

3740:

3540:

8642:

8139:

7554:

7118:

6387:

5980:

5955:

5848:

5651:

4815:

4036:

3674:

8562:

7864:

7600:

6985:

6804:

6697:

6337:

6188:

5609:

4551:

3900:

7318:

7055:

5676:

5475:

8697:

8594:

8418:

8322:

8306:

7486:

6756:

6605:

6532:

6034:

5543:

5333:

5150:

4836:

4137:

3865:

1676:

8171:

5450:

8274:

6875:

6647:

6271:

6076:

5802:

5129:

2685:, IVA) on 1 January 1980. As of 2010, the general VAT rate was 16%. This rate was applied all over Mexico except for border regions (i.e. the United States border, or Belize and Guatemala), where the rate was 11%. Books, food, and medicines are zero-rated. Some services such as medical care are zero-rated. In 2014 the favorable tax rate for border regions was eliminated and the rate increased to 16% across the country.

4425:

3097:(VAT) of 9% levied on import of goods, as well as most supplies of goods and services. Exemptions are given for the sales and leases of residential properties, importation and local supply of investment precious metals and most financial services. Export of goods and international services are zero-rated. GST is also absorbed by the government for public healthcare services, such as at public hospitals and polyclinics.

4926:

4206:

6956:

3834:

4001:

5919:

5752:

4372:

3055:

meat, fruits, vegetables, dairy and bakery products), children's items, hygiene products, and books. Exported goods, international transport services, supply of specific computer hardware to educational institutions, vessels, and air transport are zero rated. Taxi services have flat-rate tax of 4%. Flat-rate farmers supplying agricultural goods to VAT taxable entities are eligible for a 7% refund.

3131:) is due on any supply of goods or services sold in Spain. The current normal rate is 21% which applies to all goods which do not qualify for a reduced rate or are exempt. There are two lower rates of 10% and 4%. The 10% rate is payable on most drinks, hotel services, and cultural events. The 4% rate is payable on food, books and medicines. An EU directive means that all countries of the

2373:

beverages (between 20.5= – 31.5% for fermented to distilled products), jewellery (15%), pyrotechnic items (50% or more for the first sale or import) or soft drinks with high sugar (18%). AS of 2023, the VAT tax includes majority of services excluding

Education, Health and Transport, as well as taxpayers issuing fee receipts. This tax makes the 41.2% of the total revenue of the country.

3467:

4022:% (hotels, bars, restaurants and other tourism products, certain foodstuffs, plant protection products and special works of building restoration, home-use utilities: electricity, gas used for cooking and water) or 4% (e.g. grocery staples, daily or periodical press and books, works for the elimination of architectural barriers, some kinds of seeds, fertilizers)

1799:

3952:% (milk and dairy products, cereal products, hotels, tickets to outdoor music events) or 5% (pharmaceutical products, medical equipment, books and periodicals, some meat products, district heating, heating based on renewable sources, live music performance under certain circumstances) or 0% (postal services, medical services, mother's milk, etc.)

2434:

Certain goods and services must be exempt from VAT (for example, postal services, medical care, lending, insurance, betting), and certain other items are exempt from VAT by default, but states may opt to charge VAT on them (such as land and certain financial services). Hungary charges the highest rate, 27%. Only

Denmark has no reduced rate.

4659:% fresh food, medical services, medicines and medical devices, education services, childcare, water and sewerage, government taxes & permits and many government charges, precious metals, second-hand goods and many other types of goods. Rebates for exported goods and GST taxed business inputs are also available

1974:

value-added product to the buyer at the next stage. In the previous examples, if the retailer fails to sell some of its inventory, it suffers a greater financial loss in the VAT scheme, in comparison to the sales tax regulatory system, by having paid a higher wholesale price on the product it wants to sell.

2244:

VAT was introduced in 1991, replacing sales tax and most excise duties. The Value Added Tax Act, 1991 triggered VAT starting on 10 July 1991, which is observed as

National VAT Day. VAT became the largest source of government revenue, totaling about 56%. The standard rate is 15%. Export is zero rated.

2210:

The system is input-output based. Producers are allowed to subtract VAT on their inputs from the VAT they charge on their outputs and report the difference. VAT is purchased quarterly. An exception occurs for taxpayers who state monthly payments. VAT is disbursed to the state's budget on the 20th day

2139:

tax reform policy paper. The assertion that this "border adjustment" would be compatible with the rules of the WTO is controversial; it was alleged that the proposed tax would favour domestically produced goods as they would be taxed less than imports, to a degree varying across sectors. For example,

2987:

In

Finland, the standard rate is 25.5%. A 14% rate is applied on groceries, animal feed, and restaurant and catering services. A 10% rate is applied on books, newspapers and magazines, pharmaceutical products, sports and fitness services, entrance fees to cultural, entertainment and sporting events,

2387:

VAT was implemented in 1984 and is administered by the State

Administration of Taxation. In 2007, VAT revenue was 15.47 billion yuan ($ 2.2 billion), 33.9 percent of China's total tax revenue. The standard rate is 13%. A reduced rate of 9% applies to products such as books and types of oils, and 6%

2206:

The VAT rate is 20%. However, the expanded application is zero VAT for many operations and transactions. That zero VAT is the source of controversies between its trading partners, mainly Russia, which is against the zero VAT and promotes wider use of tax credits. VAT is replaced with fixed payments,

2119:

Under a sales tax system, only businesses selling to the end-user are required to collect tax and bear the accounting cost of collecting the tax. Under VAT, manufacturers and wholesale companies also incur accounting expenses to handle the additional paperwork required for collecting VAT, increasing

2046:

The incidence of VAT may not fall entirely on consumers as traders tend to absorb VAT so as to maintain sales volumes. Conversely, not all cuts in VAT are passed on in lower prices. VAT consequently leads to a deadweight loss if cutting prices pushes a business below the margin of profitability. The

1762:

Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the producer. VAT raises about a fifth of total tax revenues worldwide and among the

7979:

The VAT in Israel is in a state of flux. It was reduced from 18% to 17% in March 2004, to 16.5% in

September 2005, then to 15.5% in July 2006. It was then raised back to 16.5% in July 2009, and lowered to the rate of 16% in January 2010. It was then raised again to 17% on 1 September 2012, and once

6220:

0% for fresh foods, education, healthcare, land public transportation and medicines. Sales and

Services Tax (SST) was reintroduced by the Malaysian Government on 1 September 2018 to replace the Goods and Services Tax (GST) which had only been introduced just over three years before that, on 1 April

2441:

VAT charged by a business is known as "output VAT". VAT paid by a business is known as "input VAT". A business is generally able to recover input VAT to the extent that the input VAT is used to make its taxable outputs. Input VAT is recovered by offsetting it against the output VAT, or, if there is

2433:

Each state must comply with EU VAT law, which requires a minimum standard rate of 15% and one or two reduced rates not to be below 5%. Some EU members have a 0% VAT rate on certain items; these states agreed this as part of their accession (for example, newspapers and certain magazines in

Belgium).

1919:

The manufacturer is responsible for ensuring that their customers (retailers) are only intermediates and not end consumers (otherwise the manufacturer charges the tax). In addition, the retailer tracks what is taxable and what is not, along with the various tax rates in each city where it operates.

1814:

Using invoices, each seller pays VAT on their sales and passes the buyer an invoice that indicates the amount of tax paid excluding deductions (input tax). Buyers who themselves add value and resell the product pay VAT on their own sales (output tax). The difference between output tax and input tax

11011:

The concept of a value added tax in any form as part of the U.S. tax regime has consistently raised the hackles of

Republican policy makers and even some Democrats because of fears it could add to the tax burden rather than just redistribute it to consumption from earnings. For decades one of the

3310:

A special rate of 3.8% is in use in the hotel industry. Yet other exchanges, including those of medical, educational and cultural services, are tax-exempt; as are goods delivered and services provided abroad. The party providing the service or delivering the goods is liable for the payment of the

3054:

VAT was introduced in 1993. The standard rate is 23%. Items and services eligible for an 8% include certain food products, newspapers, goods and services related to agriculture, medicine, sport, and culture. The complete list is in Annex 3 to the VAT Act. A 5% applies to basic food items (such as

3022:

In Sweden, VAT is 25% for most goods and services, 12% for foods including restaurants, and hotels. It is 6% for printed matter, cultural services, and transport of private persons. Zero-rated services including public (but not private) education, health, dental care. Dance event tickets are 25%,

2445:

People are generally allowed to buy goods in any member country, bring it home, and pay only VAT to the seller. Input VAT paid on VAT-exempt supplies is not recoverable, although a business can increase prices so the customer effectively bears the cost of the "sticking" VAT (the effective rate is

3357:

Value added tax is levied on the supply of goods and service in

Ukraine and on the import and export of goods and auxiliary services. Supplies to and from Crimea are treated as exports and imports for value added tax purposes. The standard VAT rate is 20% for domestic supplies and imported goods

1977:

Each business is responsible for handling the necessary tax paperwork. However, businesses have no obligation to request certifications from purchasers who are not end users, or of providing such certifications to their suppliers, but they incur increased accounting costs for collecting the tax.

2983:

Denmark has the highest VAT, alongside Norway, Sweden, and Croatia. VAT is generally applied at one rate, 25%, with few exceptions. Services such as public transport, health care, newspapers, rent (the lessor can voluntarily register as a VAT payer, except for residential premises), and travel

2372:

VAT was introduced in Chile in 1974 under Decreto Ley 825. From 1998 there was implemented a 18% tax. Since October 2003, the standard VAT rate has been 19%, applying to the majority of goods and some services. However certain items have been subjected to additional tax, for instance, alcoholic

1973:

In the VAT example above, the consumer has paid, and the government received, the same dollar amount as with a sales tax. At each stage of production, the seller collects a tax and the buyer pays that tax. The buyer can then be reimbursed for paying the tax, but only by successfully selling the

2760:

The rate for GST, effective since 1 October 2010 as implemented by the National Party, is 15%. This 15% tax is applied to the final price of the product or service being purchased and goods and services are advertised as GST inclusive. Reduced rate GST (9%) applies to hotel accommodation on a

2568:

The first reduced VAT rate (10 percent) applies to water supplies, passenger transport, admission to cultural and sports events, hotels, restaurants and some foodstuff. The second reduced VAT rate (5 percent) applies to some foodstuff and social services. The super-reduced VAT rate (4 percent)

3069:

The VAT rate is 20% with exemptions for some services (for example, medical care). VAT payers include organizations (industrial and financial, state and municipal enterprises, institutions, business partnerships, insurance companies and banks), enterprises with foreign investments, individual

1915:

So, the consumer pays 10% ($ 0.15) extra, compared to the no taxation scheme, and the government collects this amount. The retailers pay no tax directly, but the retailer has to do the tax-related paperwork. Suppliers and manufacturers have the administrative burden of supplying correct state

2396:

In 1993, a standard rate of 23% and a reduced rate of 5% for non-alcoholic beverages, sewerage, heat, and public transport was introduced. In 2015, rates were revised to 21% for the standard rate, and 15% and 10% reduced rates. The lowest reduced rate primarily targeted baby food, medicines,

2437:

Some areas of states (both overseas and on the European continent) that are outside the EU VAT area, and some non-EU states operate inside the EU VAT area. External areas may have no VAT or may have a rate lower than 15%. Goods and services supplied from external areas to internal areas are

7227:

0% on basic foodstuffs such as bread, additionally on goods donated not for gain; goods or services used for educational purposes, such as school computers; membership contributions to an employee organization (such as labour union dues); and rent paid on a house by a renter to a landlord.

9673:

The tax system in Armenia: Economy: Armenia travel, history, Archeology & Ecology: Tourarmenia: Travel guide to Armenia. THE TAX SYSTEM IN ARMENIA | Economy | Armenia Travel, History, Archeology & Ecology | TourArmenia | Travel Guide to Armenia. (n.d.). Retrieved December 3,

7998:

In the 2014 Budget, the government announced that GST would be introduced in April 2015. Piped water, power supply (the first 200 units per month for domestic consumers), transportation services, education, and health services are tax-exempt. However, many details have not yet been

6916:

0% for senior citizens (all who are aged 60 and above) on medicines, professional fees for physicians, medical and dental services, transportation fares, admission fees charged by theaters and amusement centers, and funeral and burial services after the death of the senior citizen

2082:

Because VAT is included in the price index to which state benefits such as pensions and welfare payments are linked in some countries, as well as public sector pay, some of the apparent revenue is churned – i.e. taxpayers are given the money to pay the tax, reducing net revenue.

1795:, joint director of the French tax authority implemented VAT on 10 April 1954; initially directed at large businesses, it was extended over time to include all business sectors. In France it is the largest source of state finance, accounting for nearly 50% of state revenues.

2403:

There was only one services that shifted from the standard rate to the reduced rate and that were non-regular land passenger bus services. These are not taxi services, which apply a VAT rate of 21%. Books and printed materials, including electronic books, were zero rated.

2266:

VAT was introduced on 1 January 1997 and replaced 11 other taxes. The original rate of 15% was increased to 17.5% in 2011. The rate on restaurant and hotel accommodations is between 10% and 15% while certain foods and goods are zero-rated. The revenue is collected by the

4263:% for processed food, provision of services, and others such as oil and diesel, climate action focused goods and musical instruments and 6% for food products, agricultural services, and other deemed essential products such as farmaceutical products and public transport

2037:

study found that VAT could even be slightly progressive. VAT's effective regressivity can be reduced by applying a lower rate to products that are more likely to be consumed by the poor. Some countries compensate by implementing transfer payments targeted to the poor.

1839:

VAT has no effect on how businesses organize, because the same amount of tax is collected regardless of how many times goods change hands before arriving at the ultimate consumer. By contrast, sales taxes are collected on each transaction, encouraging businesses to

2589:

Value-added tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. From 1 October 2015 the standard rate was decreased to 17%, from 18%. It had been raised from 16% to 17% on 1 September 2012, and to 18% on 2 June 2013.

11197:

3010:

In Norway, the general rate is 25%, 15% on foodstuffs, and 12% on hotels and holiday homes, on some transport services, cinemas. Financial services, health services, social services and educational services, newspapers, books and periodicals are zero-rated.

2992:, an autonomous area, is considered to be outside the EU VAT area, although its VAT rate is the same as for Finland. Goods brought from Åland to Finland or other EU countries are considered to be imports. This enables tax-free sales onboard passenger ships.

1826:

VAT provides an incentive for businesses to register and keep invoices, and it does this in the form of zero-rated goods and VAT exemption on goods not resold. Through registration, a business documents its purchases, making them eligible for a VAT credit.

2752:

GST in New Zealand is designed to be a broad-based system with few exemptions, such as for rents collected on residential rental properties, donations, precious metals and financial services. Because it is broad-based, it collects 31.4% of total taxation,

2668:, GST was reduced to 0% on 1 June 2018. The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018 (Dewan Rakyat). GST was replaced with the Sales Tax and Service Tax starting 1 September 2018.

2628:

The standard rate is 10%. Food, beverages, newspaper subscriptions with certain criteria and other necessities qualify for a rate of 8%. Transactions including land sales or lease, securities sales and the provision of public services are exempt.

2230:. The rate is set at 10%, although many domestically consumed items are effectively zero-rated (GST-free) such as fresh food, education, health services, certain medical products, as well as government charges and fees that are effectively taxes.

3400:

replaced its 6% sales tax with a 10.5% VAT beginning 1 April 2016, leaving in place its 1% municipal sales and use tax. Materials imported for manufacturing are exempt. However, two states enacted a form of VAT in lieu of a business income tax.

11913:

4711:

12% or 0% (including but not limited to exports of goods or services, services to a foreign going vessel providing international commercial services, consumable goods for commercially scheduled foreign going vessels/aircraft, copyright, etc.)

3360:

of its VATable transactions is less than the registration threshold. Although not specifically provided for in the Tax Code, in practice a nonresident entity must register for Ukrainian VAT purposes via representative office and/or PE in

2657:

The existing standard rate for GST effective from 1 April 2015 is 6%. Many domestically consumed items such as fresh foods, water and electricity are zero-rated, while some supplies such as education and health services are GST exempted.

3070:

entrepreneurs, international associations, and foreign entities with operations in the Russian Federation, non-commercial organizations that conduct commercial activities, and those who move goods across the border of the Customs Union.

2407:

Several services were moved from reduced rates to the standard rate. Examples include hairdressers and barbers, bicycle repairs, footwear and clothing repairs, freelance journalists and models, cleaning services, and municipal waste.

2347:

taxes, and items in vending machines as well as alcohol in monopoly stores. Basic groceries, prescription drugs, inward/outbound transportation and medical devices are zero-rated. Other provinces that do not have a HST may have a

9684:

1847:

Another difference is that VAT is collected at the national level, while in countries such as India and the US, sales tax is collected at the point of sale by the local jurisdiction, leading them to prefer the latter method.

1957:

Manufacturer and retailer gross margins are a smaller percent of the total perspective. If the cost of raw material production were shown, this would also be true of the raw material supplier's gross margin on a percentage

11655:

4442:% (e.g. food, hotels and restaurants), 6% (e.g. books, passenger transport, cultural events and activities), 0% (e.g. insurance, financial services, health care, dental care, prescription drugs, immovable property)

3281:) is one of the Confederation's principal sources of funding. It is levied at a rate of 8.1 percent on most commercial exchanges of goods and services. Certain exchanges are subject to a reduced VAT of 2.6 percent:

1851:

The main disadvantage of VAT is the extra accounting required by those in the supply chain. However, payment of VAT is made simpler when the VAT system has few, if any, exemptions (such as with GST in New Zealand).

1024:

2285:

VAT was 20% as of 2023. A reduced rate of 9% applies to baby foods and hygiene products, as well as on books. A permanent rate of 9% applies to physical or electronic periodicals, such as newspapers and magazines.

10434:

7921:

HST is a combined federal/provincial sales tax collected in some provinces. GST is a 5% federal sales tax collected separately if there is a PST. 5% of HSTs go to the federal government and the remainder to the

11743:

10908:

5056:

0% on GST or HST for Prescription drugs, medical devices, basic groceries, agricultural/fishing products, exported or foreign goods, services and travel. Other exemptions exist for PSTs and vary by province.

12314:

2225:

The goods and services tax (GST) is a VAT introduced in Australia in 2000. Revenue is redistributed to the states and territories via the Commonwealth Grants Commission process. This works as a program of

1830:

The main benefits of VAT are that in relation to many other forms of taxation, it does not distort firms' production decisions, it is difficult to evade, and it generates a substantial amount of revenue.

8919:

7952:

The reduced rate was 14% until 1 March 2007, when it was lowered to 7%, and later changed to 11%. The reduced rate applies to heating costs, printed matter, restaurant bills, hotel stays, and most food.

11921:

2593:

Certain items, such as exported goods and the provision of certain services to non-residents are zero-rated. VAT on imported goods is levied on value plus customs duty, purchase tax and other levies.

1897:

10085:

2400:

In 2024, a law aimed at reducing the national debt featured return to two rates: a standard rate of 21% and a reduced rate of 12%. Goods and services were redistributed among different tax rates.

1932:

1866:

9508:

12035:

2654:. GST is levied on most transactions in the production process, but is refunded with exception of Blocked Input Tax, to all parties in the chain of production other than the final consumer.

3417:(GET) that is charged on gross business income. Individual counties add a .5% surcharge. Unlike a VAT, rebates are not available, such that items incur the tax each time they are (re)sold.

2245:

Several reduced rates, locally called Truncated Rates, apply to service sectors and range from 1.5% to 10%. The Value Added Tax and Supplementary Duty Act of 2012 automated administration.

2464:(UAE) on 1 January 2018 implemented VAT. For companies whose annual revenues exceed $ 102,000 (Dhs 375,000), registration is mandatory. GCC countries agreed to an introductory rate of 5%.

1986:

The simplified examples assume incorrectly that taxes are non-distortionary: the same number of widgets were made and sold both before and after the introduction of the tax. However, the

10417:

6226:

7940:

12303:

McLure, Charles E. (1993) "The Brazilian Tax Assignment Problem: Ends, Means, and Constraints", in A Reforma Fiscal no Brasil (São Paulo: Fundaçäo Instituto de Pesquisas Econômicas).

11486:

2343:

Advertised and posted prices generally exclude taxes, which are calculated at the time of payment; common exceptions are motor fuels, the posted prices for which include sales and

2099:

Compliance costs are seen as a burden on business. In the UK, compliance costs for VAT have been estimated to be about 4% of the yield, with greater impacts on smaller businesses.

10353:

2569:

applies to TV licenses, newspapers, periodicals, books and medical equipment for the disabled. A zero VAT rate (0 percent) applies to intra-community and international transport.

11880:

9361:

7729:, public transport, children's clothing, books and periodicals. Also 0% for new building construction (but standard rate for building demolition, modifications, renovation etc.)

2055:

VAT offers distinctive opportunities for evasion and fraud, especially through abuse of the credit and refund mechanism. VAT overclaim fraud reached as high as 34% in Romania.

9085:

11024:

11753:

3332:

VAT in Taiwan is 5%. It is levied on all goods and services. Exceptions include exports, vessels, aircraft used in international transportation, and deep-sea fishing boats.

1759:

because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions.

11962:

2495:

2761:

long-term basis (longer than 4 weeks). Zero rate GST (0%) applies to exports and related services; financial services; land transactions; international transportation.

11857:

10916:

8927:

1751:), is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a

12344:

Serra, J. and J. Afonso. 1999. "Fiscal Federalism Brazilian Style: Some Reflections", Paper presented to Forum of Federations, Mont Tremblant, Canada, October 1999.

9381:

3407:

used a form of VAT known as the "Single Business Tax" (SBT) from 1975 until voter-initiated legislation repealed it, replaced by the Michigan Business Tax in 2008.

3106:

The standard rate is 20%. A 10% rate primarily applies to essential goods such as (healthy) food, medicine, and books. A 5 % rate covers building renovation.

6568:

0% (donated goods and services sold by non-profits, financial services, rental payments for residential properties, supply of fine metals, and penalty interest).

2123:

The American Manufacturing Trade Action Coalition in the United States consider VAT charges on US products and rebates for products from other countries to be an

3452:

All organizations and individuals producing and trading VAT taxable goods and services pay VAT, regardless of whether they have Vietnam-resident establishments.

8931:

2074:. Similar fraud possibilities exist inside a country. To avoid this, countries such as Sweden hold the major owner of a limited company personally responsible.

12294:

Bird, Richard M. and P.-P. Gendron .2000. "CVAT, VIVAT and Dual VAT; Vertical 'Sharing' and Interstate Trade", International Tax and Public Finance, 7: 753–61.

11659:

1764:

4115:% on certain wines, 8% on public utilities, or 3% on books and press, food (including restaurant meals), children's clothing, hotel stays, and public transit

11091:

Puerto Rico's adoption of a VAT represents a major shift in tax policy and renders the Commonwealth as the first U.S. jurisdiction to adopt this tax regime.

11050:

8813:

3433:

proposal. A national subtraction-method VAT, often referred to as a "flat tax", has been repeatedly proposed as a replacement of the corporate income tax.

3003:), newspapers and magazines, books; hot water, electricity and oil for heating houses, food for human consumption (but not alcoholic beverages), access to

12291:

Bird, Richard M. and P.-P. Gendron .1998. "Dual VATs and Cross-border Trade: Two Problems, One Solution?" International Tax and Public Finance, 5: 429–42.

9282:

12306:

McLure, Charles E. 2000. "Implementing Subnational VATs on Internal Trade: The Compensating VAT (CVAT)", International Tax and Public Finance, 7: 723–40.

2135:, advocate either changing WTO rules relating to VAT or rebating VAT charged on US exporters. A business tax rebate for exports was proposed in the 2016

9536:

11896:

3186:

The VAT component of the tax revenue SARS collected in 2017/18 can be further broken down into Domestic VAT and Imported VAT, as per the table below:

1844:

to reduce the number of transactions and thereby reduce the amount of tax. For this reason, VAT has been gaining favor over traditional sales taxes.

11147:

12039:

11586:

10047:

4562:

5% which applies to the import and supply of certain goods (products of the Basic Basket listed in Annex I of the VAT Code and agricultural inputs)

11560:

11442:

10390:

9228:

12269:

11338:

11303:

12351:(1996) "Brazil: Fiscal Federalism and Value Added Tax Reform", Working Paper No. 11, National Institute of Public Finance and Policy, New Delhi

12354:

Silvani, Carlos and Paulo dos Santos (1996) "Administrative Aspects of Brazil's Consumption Tax Reform", International VAT Monitor, 7: 123–32.

11944:

2716:

2050. VAT was implemented in 1998 and is the major source of government revenue. It is administered by the Inland Revenue Department of Nepal.

2508:

2131:, and estimated this disadvantage to US producers and service providers to be $ 518 billion in 2008 alone. US politicians such as congressman

10800:

1370:

10855:

10111:

7989:

The introduction of a goods and sales tax of 3% on 6 May 2008 was to replace revenue from Company Income Tax following a reduction in rates.

7310:

has been in effect in Sri Lanka since 2001. On the 2001 budget, the rates have been revised to 12% and 0% from the previous 20%, 12% and 0%

2047:

effect can be seen when VAT is cut or abolished. Sweden reduced VAT on restaurant meals from 25% to 12.5%, creating 11,000 additional jobs.

1783:

Germany and France were the first countries to implement a VAT, enacting a general consumption tax during World War I. German industrialist

11504:

11278:

9685:

Armenia to change VAT rules covering digital services supplied by non-residents. Vertex, Inc. (2022, March 14). Retrieved December 3, 2022

11721:

10626:

4734:

0% (pharmacies and medical services, road transport, education service, Oil and gas derivatives, Vegetables and fruits, National exports)

3303:

Newspapers, magazines, books and other printed products without advertising character of the kinds to be stipulated by the Federal Council

9576:

11826:

11384:

10987: 1991) ("Although in Europe and Latin America VAT's are common,...in the United States they are much studied but little used.").

10350:

2207:

which are utilized for many taxpayers, operations, and transactions. Legislation is based largely on the EU VAT Directive's principles.

10647:

11534:

12288:

Ahmed, Ehtisham and Nicholas Stern. 1991. The Theory and Practice of Tax Reform in Developing Countries (Cambridge University Press).

1227:

10998:

9074:

4515:

The reduced VAT rate in Algeria is currently 9%. It applies to basic goods and services such as food, medicine, and transportation.

3317:(short scale) on CHF 866 billion of taxable sales. In 2013 the revenue and sales were CHF 10.3 billion and 858 billion respectively.

1908:

The manufacturer charges the retailer $ 1.20, checking that the retailer is not a consumer, leaving the same gross margin of $ 0.20.

10327:

5863:

0% (fruits and vegetables, tourism services for foreign citizens, intellectual property, diamonds, flights and apartments renting)

1940:

The manufacturer spends ($ 1 × 1.10) = $ 1.10 to buy raw materials, and the seller of the raw materials pays the government $ 0.10.

1092:

1087:

11695:

10980:

528:

12309:

Muller, Nichole. 2007. Indisches Recht mit Schwerpunkt auf gewerblichem Rechtsschutz im Rahmen eines Projektgeschäfts in Indien,

11443:Áfa kulcsok és a tevékenység közérdekű vagy egyéb sajátos jellegére tekintettel adómentes tevékenységek köre 2015. január 1-jétől

10231:

9796:

12319:

Muller, Nichole. 2007. Indian law with emphasis on commercial legal insurance within the scope of a project business in India.

10721:

8264:

3168:

or ITP. The tax is levied by the autonomous regional governments and therefore varies by region. The rate varies from 6% to 8%.

3160:

As of January 1, 2013, new properties are taxed at a reduced rate of 10%. Second-hand properties are not subject to VAT, but a

2565:, or IVA) is a consumption tax charged at a standard rate of 22 percent, which came in on 1 July 2013 (previously 21 percent).

1441:

1034:

255:

12009:

11109:

3816:% (groceries, restaurants) or 10% (medicines, cultural services and events, passenger transport, hotels, books and magazines)

3046:

The VAT rate is 12%. Senior citizens are exempted from paying VAT for most goods and some services for personal consumption.

1911:

The retailer charges the consumer ($ 1.50 × 1.10) = $ 1.65 and pays the government $ 0.15, leaving the gross margin of $ 0.30.

523:

12331:

10769:

3. Налогообложение производится по налоговой ставке 18 процентов в случаях, не указанных в пунктах 1, 2 и 4 настоящей статьи.

8971:

8831:

3437:

3371:

2625:

VAT was implemented in Japan in 1989. Tax authorities debated VAT in the 1960s and 1970s but decided against it at the time.

2482:

VAT was introduced on 1 April 2005. Of the then 28 states, eight did not immediately introduce VAT. Rates were 5% and 14.5%.

10370:

12127:

6573:

2734:

2727:

2519:) is levied at the rate of 11% at point of sales. Sales and services tax are exempt from cottage economies and industries.

2022:, meaning that the poor pay more, as a percentage of their income, relative to the wealthier individuals, given the higher

1997:

shifts leftward. Consequently, the quantity of a good purchased decreases, and/or the price at which it is sold increases.

1641:

822:

10022:

8669:

are collected by most states and some cities, counties, and Native American reservations. The federal government collects

1969:

by the manufacturer is $ 1.20 minus $ 1.00, thus the tax payable by the manufacturer is ($ 1.20 – $ 1.00) × 10% = $ 0.02).

10612:

9385:

9011:

3179:

2397:

vaccines, books, and music shops, while maintaining a similar redistribution of goods and services for the other rates.

1818:

Using accounts, the tax is calculated as a percentage of the difference between sales and purchases from taxed accounts.

1768:

1516:

11633:

9178:

2446:

lower than the headline rate and depends on the balance between previously taxed input and labour at the exempt stage).

12363:

12114:

7205:

4664:

3086:

3080:

2553:

2427:

2220:

1718:

1581:

704:

216:

12300:

Keen, Michael and S. Smith .1996. "The Future of Value-added Tax in the European Union", Economic Policy, 23: 375–411.

11430:

11075:"Examining Puerto Rico Tax Regime Changes: Addition of Value Added Tax and Amendments to Sales and Use, Income Taxes"

9081:

7200:

0% for public healthcare services, such as at public hospitals and polyclinics, with GST absorbed by the government.

6234:

2647:

2639:

1042:

790:

12357:

Tait, Alan A. (1988) Value Added Tax: International Practice and Problems (Washington: International Monetary Fund).

8892:

Helgason, Agnar Freyr (2017). "Unleashing the 'money machine': the domestic political foundations of VAT adoption".

5076:

5069:

2349:

10912:

10527:

9543:

8666:

7735:

4191:

0% for products and services that are already taxed in other countries or systems, for excise goods, and for fish.

3441:

3391:

3385:

3306:

Services of radio and television companies (exception: the normal rate applies for services of a commercial nature)

2430:. The EU VAT asks where supply and consumption occurs, which determines which state collects VAT and at what rate.

2136:

507:

11172:

10495:

9896:

11673:

8670:

5062:

3266:

3259:

2665:

2295:

689:

285:

2988:

passenger transport services, accommodation services, and royalties for television and public radio activities.

2304:

Goods and Services Tax (GST) is a national sales tax introduced in 1991 at a rate of 7%, later reduced to 5%. A

10781:

9007:

3494:

2491:

2423:

2417:

2029:

Defenders reply that relating taxation levels to income is an arbitrary standard and that the VAT is in fact a

2023:

1646:

1365:

10172:

9295:

9234:(Report). OECD Taxation Working Papers. Organisation for Economic Co-Operation and Development (OECD). 2022.

5741:

2477:

1772:

1651:

610:

79:

9547:

12217:

11893:

11775:

10931:

10655:

9332:

8009:

2995:

In Iceland, VAT is 24% for most goods and services. An 11% rate is applied for hotel and guesthouse stays,

1349:

640:

11148:"Tax Reform, Border Adjustability, and Territoriality: When tax and fiscal policy meets political reality"

10746:

9870:

12273:

11454:

10984:

8963:

8863:

3350:

1787:

proposed the concept in 1918. The modern variation of VAT was first implemented by France in 1954 in its

1591:

1561:

11611:

10137:

10072:

12401:

9138:"Does the Value-Added Tax Add Value? Lessons Using Administrative Data from a Diverse Set of Countries"

8790:

8049:

2582:

2268:

1884:

The widget retailer then sells the widget to a widget consumer for $ 1.50, at a gross margin of $ 0.30.

972:

444:

11401:

10570:

10250:

3886:% for foodstuffs (except luxury-), books, flowers etc., 0% for postage stamps. (Heligoland always 0%)

3559:

13% for plants, live animals and animal food, art, wine (if bought directly from the winemaker), etc.

2127:. AMTAC claims that so-called "border tax disadvantage" is the greatest contributing factor to the US

11369:

11345:

11310:

10827:"Podávanie alkoholu v rámci reštauračných a stravovacích služieb bude podliehať 20 % sadzbe DPH"

9781:

9758:

9704:

3116:

2546:

2249:

1019:

597:

554:

405:

260:

109:

31:

11256:

11012:

most hotly debated tax policy topics, a VAT imposes a sales tax at every stage where value is added.

9042:

8012:

has the power to raise the tax to 12% after 1 January 2006. The tax was raised to 12% on 1 February.

1961:

Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the

11987:

10826:

8227:

3455:

Vietnam has three VAT rates: 0 percent, 5 percent and 10 percent. 10 percent is the standard rate.

2455:

1611:

1029:

513:

8944:

la TVA représente 125,4 milliards d'euros, soit 49,7% des recettes fiscales nettes de l'État.

5788:

11%, 0% for primary groceries, medical services, financial services, education and also insurance

2261:

10859:

7718:

7695:

4391:

3376:

The VAT rate is 20%. Some goods and services have a reduced rate of 5% or 0%. Others are exempt.

2701:

2695:

2128:

1626:

1566:

1077:

1072:

694:

575:

226:

12381:

12297:

Keen, Michael and S. Smith .2000. "Viva VIVAT!" International Tax and Public Finance, 7: 741–51.

11612:"Pravilnik o spremembah in dopolnitvah Pravilnika o izvajanju Zakona o davku na dodano vrednost"

9467:

11717:

3557:% for rental for the purpose of habitation, food, garbage collection, most transportation, etc.

2754:

2239:

1943:

The manufacturer charges the retailer ($ 1.20 × 1.10) = $ 1.32 and pays the government ($ 0.12

1811:

VAT can be accounts-based or invoice-based. All countries except Japan use the invoice method.

1711:

1536:

1421:

1416:

1012:

591:

410:

11381:

10314:

10285:

10216:

9604:"Do Value-Added Taxes Affect International Trade Flows? Evidence from 30 Years of Tax Reforms"

7389:營業稅 yíng yè shuì (business tax) / 加值型營業稅 jiā zhí xíng yíng yè shuì (value-added business tax)

12364:

Saudi Arabia Increases Value Added Tax (VAT) will be increase to 15% from 5% as of July 2020.

11176:

10546:"Exempt supplies (GST on exempt, zero-rated, special supplies and receiving remote services)"

9655:

9407:

9264:

8957:

2227:

2124:

1616:

1541:

1506:

1491:

1411:

1401:

645:

565:

560:

481:

2336:

has a de facto 14.975% HST: it follows the same rules as the GST, and both are collected by

1905:

The manufacturer spends $ 1.00 for the raw materials, certifying it is not a final consumer.

10545:

10470:

9996:

9946:

9136:

Brockmeyer, Anne; Mascagni, Giulia; Nair, Vedanth; Waseem, Mazhar; Almunia, Miguel (2024).

8757:

4952:

Imposto sobre serviço de qualquer natureza (tax over any service) – City tax

2773:

2461:

2325:

2305:

2299:

2280:

1993:

suggests that any tax raises the cost of the product for someone. In raising the cost, the

1950:

The retailer charges the consumer ($ 1.50 × 1.10) = $ 1.65 and pays the government ($ 0.15

1841:

1791:

colony. Assessing the experiment as successful, France introduced it domestically in 1958.

1636:

1601:

1576:

1456:

1436:

603:

280:

141:

35:

10420:

Section - "Is electronic filing of periodic VAT/GST returns mandatory or optional?", p. 11

9971:

1881:

The widget is sold wholesale to a widget retailer for $ 1.20, at a gross margin of $ 0.20.

8:

12145:

11074:

10339:

10180:

8956:

Bodin, Jean-Paul; Ebril, Liam P.; Keen, Michael; Summers, Victoria P. (5 November 2001).

4947:

Imposto sobre circulação e serviços (tax over commercialization and services) – State Tax

2704:(VAT) is an indirect tax levied on the value creation or addition. The concept of VAT in

2201:

1784:

1656:

1556:

1551:

1496:

1481:

1471:

1466:

1461:

1406:

1396:

1391:

1375:

1245:

1191:

994:

502:

17:

10699:

10677:

7350:

3.8% (hotel sector) and 2.6% (essential foodstuff, books, newspapers, medical supplies)

6708:

15% (food), 12% (public transport, hotel, cinema) and 0% for electric cars (until 2018)

4942:

Imposto sobre produtos industrializados (Tax over industrialized products) – Federal Tax

12406:

12339:

Consumption Tax Trends 2008: VAT/GST and Excise Rates, Trends and Administration Issues

11963:"Transitioning into sales tax and service tax – clarifying the confusion | ACCA Global"

11418:

10203:

Thacker, Sunil (2008–2009). "Taxation in the Gulf: Introduction of a Value Added Tax".

9634:

9324:

9115:

8837:

8732:

8246:

4296:% (food and non-alcoholic drinks) or 5% (buyers of new homes under special conditions)

3489:

of GDP per capita with purchasing power parity (PPP) is explained in 3% by tax revenue.

3414:

3327:

3064:

2834:

2794:

2742:

1954:$ 0.12) = $ 0.03, leaving the same gross margin of ($ 1.65 – $ 1.32 – $ 0.03) = $ 0.30.

1947:$ 0.10) = $ 0.02, leaving the same gross margin of ($ 1.32 – $ 1.10 – $ 0.02) = $ 0.20.

1896:

1815:

is the amount paid to the government (or refunded, in the case of a negative amount).

1631:

1621:

1606:

1596:

1571:

1521:

1486:

1476:

1446:

1431:

1426:

1281:

1196:

984:

948:

869:

748:

466:

104:

10747:"Russian Federation - Other taxes impacting corporate entities, Value-added tax (VAT)"

9485:

9438:

9421:

5185:

9% for foods, printed matter, and households fuels; 6% for service; or 3% for non-VAT

12327:

10452:

10212:

10048:"¿Cómo es el Sistema Tributario de Chile? - Programa de Educación Fiscal - SII Educa"

9638:

9626:

9245:

9159:

8967:

8841:

8827:

7722:

7710:

4756:

4% for supplier, 4.5% for ITES, 5% for electricity, 5.5% for construction firm, etc.

2620:

2382:

2112:

2059:

1987:

1704:

1546:

1531:

1526:

1501:

1451:

1251:

962:

914:

854:

770:

711:

423:

390:

196:

11656:"Dr. Freda Lewis-Hall Joins Pfizer As Chief Medical Officer - London Stock Exchange"

11470:

10302:

12348:

11102:

10761:"Налоговый кодекс Российской Федерации. Часть вторая от 5 августа 2000 г. N 117-ФЗ"

10500:

10442:

9618:

9347:

9235:

9149:

9119:

8901:

8819:

7706:

2846:

2820:

2329:

2143:

A 2021 study reported that value-added taxes were unlikely to distort trade flows.

2030:

1586:

1511:

1117:

1082:

1062:

874:

842:

716:

570:

321:

9672:

9296:"Rätt lagat? Effekter av sänkt moms på restaurang- och cateringtjänster i Sverige"

9283:

GST in Singapore: Policy Rationale, Implementation Strategy & Technical Design

2337:

2140:

the wage component of the cost of domestically produced goods would not be taxed.

1792:

11900:

11388:

11113:

10357:

9572:

8763:

7265:

5374:

o "Impuesto a la Transferencia de Bienes Muebles y a la Prestación de Servicios"

4490:

6% (accommodation services) or 0% (postal, medical, dental and welfare services)

3474:

3274:

3094:

3016:

2868:

2780:

2738:

2661:

2516:

1931:

1865:

1680:

1296:

1154:

1149:

884:

847:

723:

625:

549:

385:

345:

311:

221:

211:

206:

201:

119:

11945:"Malaysia Budget 2014: 6% New Tax Effective April 2015, Sugar Subsidy Abolished"

10763:[Russian Federation Tax Code, Part 2 August 5, 2000 N 117 Federal Law].

9842:

9265:"Contrary to Popular Belief, Value-Added Taxes Found to Be Slightly Progressive"

9206:

2005:

10957:

10435:"Tale of a Missed Opportunity: Japan's Delay in Implementing a Value-Added Tax"

10396:

9382:"Now is the Time to Reform the Income Tax with a VAT! | Economy in Crisis"

9000:

8815:

Consumption Tax Trends 2018: VAT/GST and excise rates, trends and policy issues

8752:

7936:

7726:

4386:

4189:% for special categories of products and services like food, medicine and art.

3478:

3132:

2111:

National VAT act as a tariff on imports and their exports are exempt from VAT (

2063:

2019:

1990:

1239:

1211:

1186:

1047:

889:

684:

620:

518:

456:

360:

355:

338:

316:

12173:

10760:

10303:

Israel Lowered the Value-added Tax, but Consumers May Have Little to Celebrate

5736:

12395:

11748:

10456:

10267:

9815:"Microsoft Word - 3472-Act-20-National Parliament-21 November 2015_9075-9077"

9630:

9249:

9163:

7980:

again on 2 June 2013, to 18%. It was reduced from 18% to 17% in October 2015.

3023:

concerts and stage shows are 6%, while some types of cultural events are 0%.

2713:

2309:

2132:

1311:

979:

904:

795:

728:

662:

630:

497:

439:

400:

380:

350:

265:

186:

181:

156:

146:

88:

12081:

11296:

9408:"The dead loss of VAT | Taxation | Current affairs | Comment"

8024:

As of January 2022, the countries and territories listed remained VAT-free.

5732:

3311:

VAT, but the tax is usually passed on to the customer as part of the price.

2535:

VAT base on equivalent to the sale price/service fee or import/export value.

2062:, creating opportunity for fraud. In Europe, the main source of problems is

8773:

8747:

8737:

7714:

3430:

3161:

2872:

2522:

A VAT rate of 0 (zero) percent is applied to the following taxable events:

2465:

2357:

2313:

2211:

of the month after the tax period. The law took effect on January 1, 2022.

1994:

1875:

1756:

1692:

1206:

989:

958:

929:

909:

800:

785:

765:

679:

674:

476:

270:

12061:

10587:

9921:

3509:

239:

9814:

9773:

9622:

9154:

9137:

8905:

3426:

3397:

3279:

Mehrwertsteuer / Taxe sur la valeur ajoutée / Imposta sul valore aggiunto

2996:

2746:

2709:

2317:

2151:

2107:

1788:

1201:

939:

899:

817:

753:

699:

635:

461:

451:

395:

275:

176:

171:

129:

114:

12376:

12218:"VAT rates on different goods and services - Detailed guidance - GOV.UK"

11744:"Andorra crea un IVA con un tipo general del 4,5% y uno reducido del 1%"

9750:

9722:

9696:

9603:

8823:

2509:

Taxation in Indonesia § Value Added Taxation/Goods and Services Taxation

10580:

10447:

8768:

8742:

5556:

VAT = Value Added Tax plus National Health Insurance Levy (NHIL; 2.5%)

3877:

3458:

A variety of goods and service transactions qualify for VAT exemption.

2483:

1771:

with UN membership employ a VAT, including all OECD members except the

1306:

1276:

1159:

1144:

1067:

999:

967:

919:

894:

879:

780:

775:

743:

669:

375:

370:

191:

151:

97:

12191:

11125:

2763:

Financial services, real estate, precious metals are also exempt (0%).

2308:(HST) that combines the GST and provincial sales tax, is collected in

10505:

9240:

9229:

OECD Taxation Working Papers: Reassessing the regressivity of the VAT

7912:

No reduced rate, but rebates generally available for certain services

7690:

3590:% or 6% (for food or live necessary consumables) or 0% in some cases

3090:

3004:

1916:

exemption certifications that the retailer must verify and maintain.

1752:

1139:

1057:

1052:

738:

733:

544:

471:

161:

43:

12242:

9650:

9648:

6967:

10% (essential food, goods for children and medical products) or 0%

4198:

Belasting over de Toegevoegde Waarde/ Omzetbelasting/ Voorbelasting

2802:

2596:

Multinational companies that provide services to Israel through the

11827:"Bahamas Planning to Introduce 7.5 Percent Value Added Tax in 2015"

9124:

the mechanism provides strong incentives for firms to keep invoices

8727:

8722:

7686:

5299:

Impuesto sobre Transferencia de Bienes Industrializados y Servicios

3486:

3404:

3012:

2651:

2605:

2597:

2353:

1301:

1269:

953:

943:

864:

859:

832:

805:

615:

365:

306:

301:

134:

12094:

11487:

Prezydent podpisał ustawę okołobudżetową – VAT wzrośnie do 23 proc

2989:

30:"VAT" redirects here. For the identifier for value-added tax, see

12313:, VOL. 12, Institute of International Business and law, Germany.

10783:

TAX CODE OF THE RUSSIAN FEDERATION PART II, Article 164 Tax Rates

9645:

4251:

4013:

3314:

2812:

2571:

The filing deadline for VAT returns is 30 April of the next year.

2361:

2321:

2067:

1112:

934:

837:

827:

166:

124:

12323:, VOL. 12, Institute of International Business and law, Germany.

11587:"Romania Passes Scaled-Down Tax Cuts After Warnings Over Budget"

9509:"Yes, Trump can make Mexico pay for the border wall. Here's how"

7717:

and 0% for life necessities – basic food, water,

11126:"General Excise Tax (GET) Information | Department of Taxation"

10999:"Puerto Rico May Finally Get Attention of Republican Lawmakers"

8717:

4255:

3410:

2601:

2344:

2333:

2091:

Refund delays by the tax administration can damage businesses.

1675:

1321:

1132:

1127:

1122:

924:

812:

11025:"Puerto Rico adopts VAT system and broadens sales and use tax"

10901:

10391:"Israel to Levy New Taxes on Google, Facebook in Policy Shift"

10173:"VAT rates applied in the Member States of the European Union"

3038:) in 1967, which was a tax applied exclusively for retailers.

3000:

2364:

and all three territories do not collect either a HST or PST.

11333:

11331:

10571:"GST Background Paper for Session 2 of the Tax Working Group"

10268:"Saudi Arabia triples VAT to support coronavirus-hit economy"

8778:

7932:

7275:

6914:

6% on petroleum products, and electricity and water services

5857:

2705:

1336:

1331:

1326:

1316:

1291:

1286:

1233:

1105:

47:

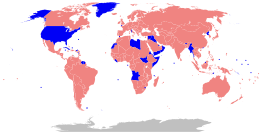

A map of countries and territories by their VAT status, 2019

11372:. Prague Monitor (27 December 2012). Retrieved 14 June 2013.

9135:

8673:

on some goods, but does not collect a nationwide sales tax.

2496:

One Hundred and First Amendment of the Constitution of India

11051:"Puerto Rico Brings First-Ever Value-Added Tax to the U.S."

10528:"Bill to repeal GST tabled in Parliament for first reading"

9897:"Caribbean National Budgets | 2011 Barbados Budget Address"

5053:

5% GST + 0–9.975% PST or 13-15% HST depending on province.

3466:

3390:

In the United States no federal VAT is in effect. Instead,

2877:

2034:

11489:. Wyborcza.biz (14 December 2010). Retrieved 14 June 2013.

11328:

11279:"BMF - Umsatzsteuer Info zum Steuerreformgesetz 2015/2016"

10648:"Main features of the Government's tax programme for 2011"

10075:. Bjreview.com.cn (3 August 2009). Retrieved 14 June 2013.

9797:"NBR seeks extension of time, cost for VAT online project"

9112:

Value Added Taxation: Mechanism, Design, and Policy Issues

3726:% (medicines, pharmaceuticals, books and baby foodstuffs)

3135:

have VAT. All exempt goods and services are listed below.

12115:

Blic Online | Opšta stopa PDV od 1. oktobra biće 20 odsto

11988:"Monaco capital gains tax rates, and property income tax"

11852:

10850:

10848:

8928:

Minister of the Economy, Industry and Employment (France)

3482:

2487:

71:

10112:"Sazby daně z přidané hodnoty a změny DPH | Aktuálně.cz"

9577:"Trump Is Right: 'Border Adjustment' Tax Is Complicated"

2070:

countries. VAT fraud then became a major problem in the

11433:. Index.hu (16 September 2011). Retrieved 14 June 2013.

11042:

6820:

Impuesto de Transferencia de Bienes Muebles y Servicios

2071:

11881:"2019 Worldwide VAT, GST and Sales Tax Guide Honduras"

11505:"CAPÍTULO IV | Taxas | Artigo 18.º | Taxas do imposto"

10845:

9531:

9529:

9376:

9374:

9068:

9066:

9064:

8808:

8806:

7702:

7680:

4656:

4439:

4433:

4398:

4380:

4355:

4349:

4324:

4318:

4293:

4287:

4260:

4245:

4220:

4214:

4186:

4180:

4151:

4145:

4112:

4106:

4081:

4075:

4050:

4044:

4019:

4009:

3980:

3974:

3949:

3943:

3919:% (6.5% for hotels, books and pharmaceutical products)

3916:

3908:

3883:

3873:

3848:

3842:

3813:

3807:

3782:

3776:

3748:

3723:

3719:

3713:

3688:

3682:

3660:% (since 1 January 2014) or 5% (since 1 January 2013)

3657:

3651:

3626:

3620:

3587:

3581:

3554:

3548:

1798:

1765:

Organisation for Economic Co-operation and Development

12062:"Palau Goods & Services Tax (PGST) – PalauGov.pw"

11421:. Madata.GR (9 October 2008). Retrieved 14 June 2013.

11164:

11139:

11067:

9972:"Ley No. 825 Sobre Impuesto a las Ventas y Servicios"

8955:

8019:

3429:

advocated for a national VAT in order to pay for his

2352:(PST), which are collected in British Columbia (7%),

1874:

A widget manufacturer, for example, spends $ 1.00 on

1036:

European Union Common Consolidated Corporate Tax Base

12036:"Norway confirms electric car incentives until 2018"

11718:"Albania - Other taxes impacting corporate entities"

10627:"The Value Added Tax Act with subsequent amendments"

10340:

VAT hits 18% high for third time in Israel's history

10023:"Chile Tax Law Update: VAT to be levied on services"

9601:

2515:

Per 1 April 2022, maximum a Goods and Services Tax (

12095:"Value-added tax to rise from 18% to 20% in Russia"

11634:"Spain raises VAT from 18% to 21% 1 September 2012"

10202:

9526:

9371:

9179:"What is the difference between sales tax and VAT?"

9061:

8803:

2557:

Supermarket receipt showing three categories of IVA

11920:. Government Spokesperson's Office. Archived from

11382:Tax in Denmark: An introduction – for new citizens

10929:

10389:

10248:

9537:"A Better Way— Our Vision for a Confident America"

9486:"Border Adjusted Taxation / Value Added Tax (VAT)"

9183:Tax & Accounting Blog Posts by Thomson Reuters

9176:

4934:20% (IPI) + 19% (ICMS) average + 3% (ISS) average

3420:

11465:

11463:

10232:"UAE outlines VAT threshold for firms in Phase 1"

10086:"Informace GFŘ ke změnám sazeb DPH od 1. 1. 2024"

7961:VAT is not implemented in 2 of India's 28 states.

3313:In 2014 total revenue from VAT was nearly CHF 11

1965:by their respective business practices (e.g. the

12393:

11696:"Momsen - hur fungerar den? | Skatteverket"

11471:"Portail de la fiscalité indirecte - Luxembourg"

11431:Index – Gazdaság – Uniós csúcsra emeljük az áfát

9500:

9207:"Options for Reducing the Deficit: 2019 to 2028"

3253:

3180:Taxation in South Africa § Value-Added Tax (VAT)

2871:. Like other countries' sales and VAT, it is an

11173:"A quick guide to the 'border adjustments' tax"

11170:

10496:"Malaysia to remove GST for consumers on Jun 1"

10138:"Změny DPH přehledně. Tady je kompletní seznam"

9602:Benzarti, Youssef; Tazhitdinova, Alisa (2021).

9209:. Congressional Budget Office. 13 December 2018

9036:

9034:

9032:

5933:

4454:

11535:"Código do Imposto sobre o Valor Acrescentado"

11460:

9323:Crawford, Ian; Keen, Michael; Smith, Stephen.

5940:

3425:Former 2020 Democratic presidential candidate

3260:Taxation in Switzerland § Value added tax

12174:"Value-added tax, VAT rates and registration"

11801:"The Government of The Bahamas - VAT Bahamas"

11626:

11339:"2016 AGN VAT Brochure - European Comparison"

11304:"2016 AGN VAT Brochure - European Comparison"

10418:VAT/GST electronic filing and data extraction

9322:

9001:"Value-Added Tax: A New U.S. Revenue Source?"

8551:South Georgia and the South Sandwich Islands

8471:Saint Helena, Ascension and Tristan da Cunha

7705:% residential energy/insulation/renovations,

3033:

2858:

2828:

2806:

1712:

11251:

11249:

11247:

11245:

11243:

11241:

11239:

11237:

11235:

11233:

11231:

9075:An Introduction to the Value Added Tax (VAT)

9029:

7279:

7269:

4265:12% or 5% in Madeira and 9% or 4% in Azores

3027:

2788:

2486:introduced VAT on 1 January 2007. Under the

2066:. This fraud originated in the 1970s in the

1834:

11918:Portal of the Principality of Liechtenstein

11229:

11227:

11225:

11223:

11221:

11219:

11217:

11215:

11213:

11211:

10976:Trinova Corp. v. Michigan Dept. of Treasury

10205:Michigan State Journal of International Law

3504:

3392:sales and use taxes are used in most states

3166:Impuestos Sobre Transmisiones Patrimoniales

2772:"MOMS" redirects here. For other uses, see

2449:

12038:. Thegreencarwebsite.co.uk. Archived from

11145:

10789:. Russian Ministry of Finance. p. 41.

9611:American Economic Journal: Economic Policy

9439:"The impact of VAT compliance on business"

9422:"The impact of VAT compliance on business"

9043:"Ted Cruz's "Business Flat Tax:" A Primer"

8994:

8992:

8990:

7931:These taxes do not apply in Hong Kong and

2018:VAT has been criticized by opponents as a

1719:

1705:

12168:

12166:

11105:, Citizens Research Council of Michigan,

10909:"Mehrwertsteuer nach Wirtschaftssektoren"

10446:

10432:

9427:. PriceWaterhouseCoopers. September 2010.

9239:

9153:

8864:"How many countries have VAT or GST? 175"

3267:Taxation in Switzerland § Value added tax

3190:Breakdown of tax revenues on VAT 2017/18

2650:(GST) is an abolished value-added tax in

1228:Institute on Taxation and Economic Policy

12326:MOMS, Politikens Nudansk Leksikon 2002,

11208:

10824:

10634:Ministry of Finance and Economic Affairs

10251:"UAE to implement VAT on 1 January 2018"

9506:

9362:Carousel fraud 'has cost UK up to £16bn'

8891:

5535:დღგ = დამატებული ღირებულების გადასახადი

3508:

3499:

3473:

3465:

2552:

2150:

2106:

2009:4 May 2010 "Campaña no más IVA" in Spain

2004:

1797:

42:

12235:

12192:"Budget: How the rise in VAT will work"

10825:Solíková, Veronika (21 December 2023).

9465:

9201:

9199:

9177:kristenbickerstaff (21 December 2020).

9109:

8998:

8987:

8861:

8818:. Secretary-General of the OECD. 2018.

8330:Special administrative region of China

3691:% (8% for taxi and bus transportation)

3285:Foodstuffs (except alcoholic beverages)

14:

12394:

12163:

11776:"Angola Indirect Tax Changes for 2021"

11529:

11527:

11525:

11499:

11497:

11495:

11048:

11030:. PricewaterhouseCoopers. 26 June 2015

10996:

10678:"Merverdiavgiftsloven §§ 6–21 to 6–33"

10387:

10371:"Imported Goods Taxes and Levies 2020"

10328:Taxation and Investment in Israel 2012

9997:"SII | Servicio de Impuestos Internos"

9571:

9262:

9091:from the original on 24 September 2016

8265:Special administrative region of China

7970:Except Eilat, where VAT is not raised.

3335:

3015:has no VAT because of a clause in the

2827:(until the early 1970s labeled as OMS

2610:Electronic filing of VAT is mandatory.

12084:. Bir.gov.ph. Retrieved 14 June 2013.

11724:from the original on 16 December 2019

11584:

11457:. Revenue.ie. Retrieved 14 June 2013.

11419:Οι νέοι συντελεστές ΦΠΑ από 1 Ιουλίου

10700:"Merverdiavgiftsloven §§ 6-1 to 6–20"

10428:

10426:

10020:

9717:

9715:

9507:Thiessen, Marc A. (17 January 2017).

8002:

3600:Belasting over de Toegevoegde Waarde

3372:Value-added tax in the United Kingdom

3351:Taxation in Ukraine § Value added tax

2712:2049/50 but the act was developed in

12272:(in Icelandic). 1988. Archived from

12270:"Lög nr. 50/1988 um virðisaukaskatt"

12261:

11942:

10229:

10116:Aktuálně.cz - Víte, co se právě děje

9221:

9196:

9040:

8999:Bickley, James M. (3 January 2008).

8887:

8885:

7992:

7983:

7973:

7964:

7955:

7946:

7925:

7915:

7906:

6926:Karagdagang Buwis / Dungag nga Buhis

5341:14% (15% on communication services)

2728:Goods and Services Tax (New Zealand)

2583:Taxation in Israel § Value-added tax

2561:Value added tax or VAT, (in Italian

2388:for services except for PPE leases.

2086:

1767:(OECD). As of June 2023, 175 of the

11614:. Ministry of Finance. 24 June 2013

11522:

11492:

11171:William G. Gale (7 February 2017).

10997:Gulino, Denny (18 September 2015).

10958:"What is VAT and how does it work?"

10360:Section - "Value added tax", page 3

10073:China's VAT System – Beijing Review

9656:"Armenia - Corporate - Other taxes"

9414:

9263:Enache, Cristina (13 August 2020).

6230:CJP = Cukai Jualan dan Perkhidmatan

5705:15% (4% additional on tourism tax)

5533:Damatebuli Ghirebulebis gadasakhadi

4417:Impuesto General Indirecto Canario

4271:Imposto sobre o Valor Acrescentado

3117:Taxation in Spain § Value added tax

2767:

2547:Taxation in Italy § Value added tax

2529:export for intangible taxable goods

2428:member states of the European Union

2262:Economy of Barbados § Taxation

2146:

2094:

24:

12117:. Blic.rs. Retrieved 14 June 2013.

12082:Bureau of Internal Revenue Website

11674:"Swedish VAT compliance and rates"

11103:Outline of the Michigan Tax System

10423:

10315:"Israel – VAT rate reduced to 17%"

9875:International Trade Administration

9712:

9281:Chia-Tern Huey Min (October 2004)

8924:Le budget et les comptes de l'État

8791:List of tax rates around the world

8020:VAT-free countries and territories

3081:Goods and Services Tax (Singapore)

2221:Goods and services tax (Australia)

2102:

2041:

1930:

1923:

1895:

1864:

25:

12418:

12369:

11698:. Skatteverket.se. 1 January 2014

11049:Harpaz, Joe (17 September 2015).

10471:"Japan - Corporate - Other taxes"

9082:United States Chamber of Commerce

9072:

9017:from the original on 28 June 2016

8930:. 30 October 2009. Archived from

8882:

7039:Saint Vincent and the Grenadines

6348:0% on books, food and medicines.

6235:Goods and Services Tax (Malaysia)

5246:Democratic Republic of the Congo

3365:

3291:Seeds, living plants, cut flowers

2677:The existing sales tax (Spanish:

2640:Goods and Services Tax (Malaysia)

2490:government, it was replaced by a

2442:an excess, by claiming a rebate.

2411:

2391:

1806:

1043:Global minimum corporate tax rate

12375:

12210:

12184:

12138:

12128:"Od danas veća niža stopa PDV-a"

12120:

12108:

12087:

12075:

12054:

12028:

12002:

11980:

11955:

11943:Song, Sophie (25 October 2013).

11936:

11906:

11887:

11873:

11853:"Gambia Revenue Authority - VAT"

11845:

11819:

11793:

11768:

11736:

11710:

11688:

11666:

11648:

11604:

11585:Andra, Timu (3 September 2015).

11578:

11553:

11480:

11448:

11436:

11424:

11412:

11394:

11375:

11363:

11271:

11190:

10913:Swiss Federal Statistical Office

10654:. 5 October 2010. Archived from

9468:"VAT Software: compliance costs"

9285:, Singapore Ministry of Finance.

9142:Journal of Economic Perspectives

8862:Asquith, Richard (6 June 2023).

8704:

8695:

8688:

8679:

8656:

8649:

8640:

8624:

8617:

8608:

8601:

8592:

8585:

8576:

8569:

8560:

8544:

8537:

8528:

8521:

8512:

8505:

8496:

8489:

8480:

8464:

8448:

8441:

8432:

8425:

8416:

8409:

8400:

8384:

8377:

8368:

8361:

8352:

8345:

8336:

8320:

8313:

8304:

8288:

8281:

8272:

8254:

8235:

8217:

8201:

8185:

8178:

8169:

8153:

8146:

8137:

8121:

8105:

8089:

8073:

8057:

8039:

7883:

7862:

7837:

7812:

7791:

7785:QQS = Qoʻshilgan qiymat soligʻi

7770:

7745:

7670:

7649:

7619:

7598:

7577:

7552:

7527:

7505:

7484:

7463:

7437:

7416:

7395:

7374:

7337:

7316:

7290:

7244:

7214:

7187:

7166:

7145:

7116:

7095:

7074:

7053:

7032:

7008:

6983:

6954:

6933:

6901:

6873:

6848:

6827:

6802:

6778:

6754:

6729:

6695:

6666:

6645:

6624:

6603:

6582:

6555:

6530:

6505:

6484:

6460:

6435:

6410:

6385:

6360:

6335:

6311:

6290:

6269:

6243:

6207:

6186:

6165:

6153:3.8% (lodging services) or 2.5%

6140:

6119:

6095:

6074:

6053:

6032:

6002:

5978:

5953:

5917:

5896:

5875:

5846:

5825:

5800:

5775:

5750:

5716:

5695:

5674:

5649:

5628:

5607:

5583:

5562:

5541:

5515:

5494:

5473:

5448:

5424:

5401:

5380:

5355:

5331:

5306:

5281:

5260:

5239:

5218:

5194:

5172:

5148:

5127:

5106:

5085:

5043:

5022:

5001:

4980:

4959:

4924:

4903:

4879:

4855:

4834:

4813:

4788:

4767:

4743:

4721:

4698:

4673:

4643:

4617:

4592:

4571:

4549:

4524:

4502:

4477: