2976:

2336:

the portfolio sufficiently diversified such that risk exposure is limited to systematic risk only. This number may vary depending on the way securities are weighted in a portfolio which alters the overall risk contribution of each security. For example, market cap weighting means that securities of companies with larger market capitalization will take up a larger portion of the portfolio, making it effectively less diversified. In developing markets a larger number of securities is required for diversification, due to the higher asset volatilities.

2608:...) In practice, such a market portfolio is unobservable and people usually substitute a stock index as a proxy for the true market portfolio. Unfortunately, it has been shown that this substitution is not innocuous and can lead to false inferences as to the validity of the CAPM, and it has been said that, due to the impossibility of observing the true market portfolio, the CAPM might not be empirically testable. This was presented in greater depth in a paper by

5474:

5464:

5454:

2362:

2255:

2158:

1438:

1363:

272:

36:

5484:

5161:

2429:

133:

198:) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost of equity capital is determined only by beta. Despite its failing numerous empirical tests, and the existence of more modern approaches to asset pricing and portfolio selection (such as

2655:

irrationality refers to the CAPM proclaimed ‘revision of prices’ resulting in identical discount rates for the (lower) amount of covariance risk only as for the (higher) amount of Total risk (i.e. identical discount rates for different amounts of risk. Roger’s findings have later been supported by Lai & Stohs.

194:. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the

2654:

Roger Dayala goes a step further and claims the CAPM is fundamentally flawed even within its own narrow assumption set, illustrating the CAPM is either circular or irrational. The circularity refers to the price of total risk being a function of the price of covariance risk only (and vice versa). The

1706:

is calculated using CAPM, we can compare this required rate of return to the asset's estimated rate of return over a specific investment horizon to determine whether it would be an appropriate investment. To make this comparison, you need an independent estimate of the return outlook for the security

2600:

The market portfolio consists of all assets in all markets, where each asset is weighted by its market capitalization. This assumes no preference between markets and assets for individual active and potential shareholders, and that active and potential shareholders choose assets solely as a function

2547:

The model assumes that the probability beliefs of active and potential shareholders match the true distribution of returns. A different possibility is that active and potential shareholders' expectations are biased, causing market prices to be informationally inefficient. This possibility is studied

2335:

away to smaller levels by including a greater number of assets in the portfolio (specific risks "average out"). The same is not possible for systematic risk within one market. Depending on the market, a portfolio of approximately 30–40 securities in developed markets such as the UK or US will render

2634:

CAPM assumes that all active and potential shareholders will consider all of their assets and optimize one portfolio. This is in sharp contradiction with portfolios that are held by individual shareholders: humans tend to have fragmented portfolios or, rather, multiple portfolios: for each goal one

2225:

Betas exceeding one signify more than average "riskiness"; betas below one indicate lower than average. Thus, a more risky stock will have a higher beta and will be discounted at a higher rate; less sensitive stocks will have lower betas and be discounted at a lower rate. Given the accepted concave

2444:

The CAPM assumes that the risk-return profile of a portfolio can be optimized—an optimal portfolio displays the lowest possible level of risk for its level of return. Additionally, since each additional asset introduced into a portfolio further diversifies the portfolio, the optimal portfolio must

1661:

It is a useful tool for determining if an asset being considered for a portfolio offers a reasonable expected return for its risk. Individual securities are plotted on the SML graph. If the security's expected return versus risk is plotted above the SML, it is undervalued since the investor can

1714:

Assuming that the CAPM is correct, an asset is correctly priced when its estimated price is the same as the present value of future cash flows of the asset, discounted at the rate suggested by CAPM. If the estimated price is higher than the CAPM valuation, then the asset is overvalued (and

2521:

Most practitioners and academics agree that risk is of a varying nature (non-constant). A critique of the traditional CAPM is that the risk measure used remains constant (non-varying beta). Recent research has empirically tested time-varying betas to improve the forecast accuracy of the

2525:

The model assumes that the variance of returns is an adequate measurement of risk. This would be implied by the assumption that returns are normally distributed, or indeed are distributed in any two-parameter way, but for general return distributions other risk measures (like

874:

352:

for any security in relation to that of the overall market. Therefore, when the expected rate of return for any security is deflated by its beta coefficient, the reward-to-risk ratio for any individual security in the market is equal to the market reward-to-risk ratio, thus:

2343:

on an asset, that is, the return that compensates for risk taken, must be linked to its riskiness in a portfolio context—i.e. its contribution to overall portfolio riskiness—as opposed to its "stand alone risk". In the CAPM context, portfolio risk is represented by higher

2530:) will reflect the active and potential shareholders' preferences more adequately. Indeed, risk in financial investments is not variance in itself, rather it is the probability of losing: it is asymmetric in nature as in the alternative safety-first asset pricing model.

2619:

The model assumes economic agents optimize over a short-term horizon, and in fact investors with longer-term outlooks would optimally choose long-term inflation-linked bonds instead of short-term rates as this would be more risk-free asset to such an

1423:

There has also been research into a mean-reverting beta often referred to as the adjusted beta, as well as the consumption beta. However, in empirical tests the traditional CAPM has been found to do as well as or outperform the modified beta models.

258:(1972) developed another version of CAPM, called Black CAPM or zero-beta CAPM, that does not assume the existence of a riskless asset. This version was more robust against empirical testing and was influential in the widespread adoption of the CAPM.

2517:

The traditional CAPM using historical data as the inputs to solve for a future return of asset i. However, the history may not be sufficient to use for predicting the future and modern CAPM approaches have used betas that rely on future risk

2237:, the market as a whole, by definition, has a beta of one. Stock market indices are frequently used as local proxies for the market—and in that case (by definition) have a beta of one. An investor in a large, diversified portfolio (such as a

2616:. However, others find that the choice of market portfolio may not be that important for empirical tests. Other authors have attempted to document what the world wealth or world market portfolio consists of and what its returns have been.

1656:

4152:. Unpublished manuscript. A final version was published in 1999, in Asset Pricing and Portfolio Performance: Models, Strategy and Performance Metrics. Robert A. Korajczyk (editor) London: Risk Books, pp. 15–22.

454:

731:

1319:

601:

1826:

1535:. The security market line can be regarded as representing a single-factor model of the asset price, where β is the exposure to changes in the value of the Market. The equation of the SML is thus:

1342:

Note 2: the risk free rate of return used for determining the risk premium is usually the arithmetic average of historical risk free rates of return and not the current risk free rate of return.

2544:

The model assumes that all active and potential shareholders have access to the same information and agree about the risk and expected return of all assets (homogeneous expectations assumption).

2623:

The model assumes just two dates, so that there is no opportunity to consume and rebalance portfolios repeatedly over time. The basic insights of the model are extended and generalized in the

1715:

undervalued when the estimated price is below the CAPM valuation). When the asset does not lie on the SML, this could also suggest mis-pricing. Since the expected return of the asset at time

2112:

1662:

expect a greater return for the inherent risk. And a security plotted below the SML is overvalued since the investor would be accepting less return for the amount of risk assumed.

2563:

The model does not appear to adequately explain the variation in stock returns. Empirical studies show that low beta stocks offer higher returns than the model would predict.

1025:

968:

2534:

have published some research on asset allocation with non-normal returns which shows that investors with very low risk tolerances should hold more cash than CAPM suggests.

716:

1187:

1135:

1063:

649:

1339:

Note 1: the expected market rate of return is usually estimated by measuring the arithmetic average of the historical returns on a market portfolio (e.g. S&P 500).

914:

1704:

497:

1517:(SML), which shows expected return as a function of β. The intercept is the nominal risk-free rate available for the market, while the slope is the market premium, E(

681:

2339:

A rational investor should not take on any diversifiable risk, as only non-diversifiable risks are rewarded within the scope of this model. Therefore, the required

2142:

1909:

1853:

2537:

Some investors prefer positive skewness, all things equal, which means that these investors accept lower returns when returns are positively skewed. For example,

1879:

1733:

1211:

1159:

1107:

1087:

4189:

4080:

Stone, Bernell K. (1970) Risk, Return, and

Equilibrium: A General Single-Period Theory of Asset Selection and Capital-Market Equilibrium. Cambridge: MIT Press.

3469:

5457:

2348:

i.e. less predictability. In other words, the beta of the portfolio is the defining factor in rewarding the systematic exposure taken by an investor.

2597:

The model assumes that there are no taxes or transaction costs, although this assumption may be relaxed with more complicated versions of the model.

2987:

Jansen, D. W., K.G. Koedijk and C. G. de Vries (2000), "Portfolio selection with limited downside risk," Journal of

Empirical Finance, 7, 247-269.

2604:

The market portfolio should in theory include all types of assets that are held by anyone as an investment (including works of art, real estate,

4088:

2552:, which uses psychological assumptions to provide alternatives to the CAPM such as the overconfidence-based asset pricing model of Kent Daniel,

1541:

2684:

2628:

348:(beta) to show how the market must price individual securities in relation to their security risk class. The SML enables us to calculate the

2222:

or discount rate—i.e. the rate at which future cash flows produced by the asset should be discounted given that asset's relative riskiness.

3513:

Campbell, J & Vicera, M "Strategic Asset

Allocation: Portfolio Choice for Long Term Investors". Clarendon Lectures in Economics, 2002.

2383:

2276:

2179:

1459:

1384:

293:

53:

100:

5434:

359:

17:

2601:

of their risk-return profile. It also assumes that all assets are infinitely divisible as to the amount which may be held or transacted.

72:

5338:

4182:

3500:

869:{\displaystyle \beta _{i}={\frac {\mathrm {Cov} (R_{i},R_{m})}{\mathrm {Var} (R_{m})}}=\rho _{i,m}{\frac {\sigma _{i}}{\sigma _{m}}}}

247:

3565:

Breeden, Douglas (September 1979). "An intertemporal asset pricing model with stochastic consumption and investment opportunities".

2590:

a strategy for reliably beating the market). The puzzling empirical relationship between risk and return is also referred to as the

79:

2445:

comprise every asset, (assuming no trading costs) with each asset value-weighted to achieve the above (assuming that any asset is

2327:

which is also known as idiosyncratic risk or diversifiable risk. Systematic risk refers to the risk common to all securities—i.e.

3103:

Daniel, Kent D.; Hirshleifer, David; Subrahmanyam, Avanidhar (2001). "Overconfidence, Arbitrage, and

Equilibrium Asset Pricing".

1223:

505:

1738:

2679:

2646:

Empirical tests show market anomalies like the size and value effect that cannot be explained by the CAPM. For details see the

5038:

4980:

4175:

3518:

2957:

2866:

2841:

86:

4420:

68:

3923:(1965). "The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets".

2690:

2647:

2586:

but makes CAPM wrong), or it is irrational (which saves CAPM, but makes the EMH wrong – indeed, this possibility makes

3353:

Stambaugh, Robert (1982). "On the exclusion of assets from tests of the two-parameter model: A sensitivity analysis".

2490:

Deal with securities that are all highly divisible into small parcels (All assets are perfectly divisible and liquid).

2409:

2302:

2205:

1917:

1485:

1410:

319:

119:

2391:

2284:

2187:

1467:

1392:

301:

5508:

4445:

2230:, the CAPM is consistent with intuition—investors (should) require a higher return for holding a more risky asset.

340:

The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the

3171:

Baltussen, Guido; van Vliet, Bart; van Vliet, Pim (2024-06-11). "The Cross-Section of Stock

Returns before CRSP".

2711:

2513:

argue that "the failure of the CAPM in empirical tests implies that most applications of the model are invalid".

3476:

5523:

3415:

Doeswijk, Ronald; Lam, Trevin; Swinkels, Laurens (2014). "The global multi-asset market portfolio, 1960-2012".

2387:

2280:

2183:

1463:

1388:

297:

57:

4439:

203:

5477:

5312:

4922:

4862:

4658:

4564:

3824:, pp. 79–121 in M. Jensen ed., Studies in the Theory of Capital Markets. New York: Praeger Publishers.

2541:

pay to take on more risk. The CAPM can be extended to include co-skewness as a priced factor, besides beta.

137:

3000:

4648:

4616:

4474:

4457:

4410:

2636:

2583:

1911:

using CAPM, sometimes called the certainty equivalent pricing formula, is a linear relationship given by

725:

93:

2742:

5528:

5513:

5011:

4433:

4427:

3450:

Doeswijk, Ronald; Lam, Trevin; Swinkels, Laurens (2019). "Historical returns of the market portfolio".

2669:

2640:

1510:-axis represents the expected return. The market risk premium is determined from the slope of the SML.

3686:

Fama, Eugene F.; French, Kenneth R. (1993). "Common Risk

Factors in the Returns on Stocks and Bonds".

3065:

5518:

5439:

5383:

5102:

5029:

4973:

4119:

2674:

2453:

2449:). All such optimal portfolios, i.e., one for each level of return, comprise the efficient frontier.

2332:

978:

921:

235:

165:

3700:

3614:

3380:

Ibbotson, Roger; Siegel, Lawrence; Love, Kathryn (1985). "World wealth: Market values and returns".

5276:

5146:

4822:

4497:

3737:

2664:

2372:

2265:

2168:

1448:

1373:

349:

282:

199:

688:

5378:

5286:

5281:

5245:

5142:

5106:

4776:

4637:

4532:

4415:

2706:

2437:

2376:

2269:

2219:

2172:

1452:

1377:

1346:

1165:

1113:

1066:

1035:

286:

239:

46:

2988:

2729:

612:

206:), the CAPM still remains popular due to its simplicity and utility in a variety of situations.

5388:

5185:

5058:

5034:

5019:

4664:

3732:

3695:

3609:

2701:

2591:

2557:

880:

4064:

3180:

1673:

466:

174:

The model takes into account the asset's sensitivity to non-diversifiable risk (also known as

5413:

5071:

5043:

5024:

4802:

4611:

2815:

2527:

2446:

3655:"Maslowian Portfolio Theory: An alternative formulation of the Behavioural Portfolio Theory"

2331:. Unsystematic risk is the risk associated with individual assets. Unsystematic risk can be

656:

5467:

5318:

5230:

5066:

5048:

4966:

4937:

4857:

4622:

4606:

4569:

4451:

4394:

4362:

4156:

3723:

Fama, Eugene F.; French, Kenneth R. (1992). "The Cross-Section of

Expected Stock Returns".

3194:

de Silva, Harindra (2012-01-20). "Exploiting the

Volatility Anomaly in Financial Markets".

2587:

2340:

2120:

1887:

1831:

1499:

341:

3276:

Blitz, David; Van Vliet, Pim; Baltussen, Guido (2019). "The volatility effect revisited".

2942:

Estimating Time-Varying Beta

Coefficients: An Empirical Study of US & ASEAN Portfolios

8:

5487:

5393:

5373:

5200:

5175:

4867:

4812:

4736:

4596:

4526:

4355:

4328:

4042:(1964). "Capital asset prices: A theory of market equilibrium under conditions of risk".

2316:

1858:

251:

195:

168:

5398:

5343:

5255:

4907:

4882:

4842:

4827:

4746:

4716:

4685:

4643:

4387:

4297:

4287:

4111:

4069:

4055:

4008:

3940:

3891:

3874:

3865:

3750:

3635:

3627:

3582:

3547:

3432:

3397:

3293:

3258:

3148:

3131:

3046:

2743:"The Entrepreneur's Cost of Capital: Incorporating Downside Risk in the Buildup Method"

2695:

2624:

2613:

2549:

2433:

2423:

1718:

1196:

1190:

1144:

1138:

1092:

1072:

3768:

Dayala, Roger R.S. (2012). "The

Capital Asset Pricing Model: A Fundamental Critique".

5121:

5097:

5081:

4771:

4756:

4508:

4039:

3796:

3709:

3586:

3578:

3514:

3494:

3401:

3366:

3339:

3297:

3250:

3211:

3176:

3153:

3085:

3038:

2953:

2949:

2899:"Back to the Future Betas: Empirical Asset Pricing of US and Southeast Asian Markets"

2862:

2837:

2811:

2575:

2567:

2553:

219:

4073:

3639:

3262:

2975:(1952), "Safety-first and the holding of assets," Econometrica, 20, No. 3, 425-442.

728:

of the expected excess asset returns to the expected excess market returns, or also

5290:

5225:

4872:

4792:

4588:

4469:

4345:

4264:

4220:

4198:

4103:

4059:

4051:

4000:

3964:

3932:

3886:

3861:

3837:

3777:

3742:

3705:

3666:

3619:

3574:

3539:

3424:

3389:

3362:

3335:

3285:

3242:

3203:

3143:

3112:

3081:

3077:

3030:

2945:

2920:

2910:

2782:

2538:

2227:

4021:

The Capital Asset Pricing Model (CAPM), Short-sale Restrictions and Related Issues

3436:

5429:

5333:

5323:

5304:

5271:

5195:

5190:

5126:

5111:

4947:

4942:

4877:

4852:

4787:

4761:

4741:

4700:

4695:

4690:

4675:

4670:

4558:

4492:

4484:

4372:

4259:

4137:

4027:

3952:

2531:

2320:

2233:

Since beta reflects asset-specific sensitivity to non-diversifiable, i.e. market

345:

231:

215:

187:

175:

3903:, Journal of Investment Management, Vol. 1, No. 2, pp. 60–72. Available at

683:

is the risk-free rate of interest such as interest arising from government bonds

5328:

5308:

5076:

4902:

4897:

4797:

4782:

4543:

4538:

4503:

4302:

4269:

4215:

4207:

3976:

3849:

2510:

2457:

720:

191:

183:

157:

5502:

5403:

5368:

5294:

4766:

4751:

4726:

4680:

4632:

4335:

4292:

4279:

4230:

3781:

3254:

3231:"Benchmarks as Limits to Arbitrage: Understanding the Low-Volatility Anomaly"

3215:

3157:

3089:

3042:

2787:

2770:

2605:

2579:

2571:

2324:

255:

243:

3968:

3393:

3116:

1502:

graphs the results from the capital asset pricing model (CAPM) formula. The

5408:

5363:

5250:

5235:

5116:

4927:

4847:

4817:

4807:

4627:

4601:

4350:

4340:

4323:

4254:

4249:

4225:

3920:

3289:

3230:

2609:

2484:

Can lend and borrow unlimited amounts under the risk free rate of interest.

460:

223:

2472:

Aim to maximize economic utilities (Asset quantities are given and fixed).

1651:{\displaystyle \mathrm {SML} :E(R_{i})=R_{f}+\beta _{i}(E(R_{M})-R_{f}).~}

5240:

5180:

4932:

4912:

4892:

4887:

4832:

4721:

4653:

4084:

3828:

Black, F (1972). "Capital market equilibrium with restricted borrowing".

3428:

3246:

2506:

2328:

2238:

179:

3671:

3654:

3207:

2925:

2915:

2898:

2566:

Some data to this effect was presented as early as a 1969 conference in

136:

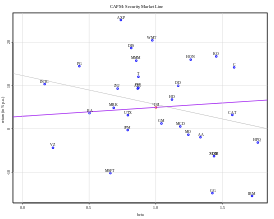

An estimation of the CAPM and the security market line (purple) for the

4989:

4917:

4837:

4514:

4377:

4159:(January–February 1982). "Does the capital asset pricing model work?".

4115:

4012:

3988:

3944:

3754:

3631:

3551:

3050:

3018:

1855:

is too low (the asset is currently undervalued), assuming that at time

227:

2496:

Assume all information is available at the same time to all investors.

5006:

4553:

4548:

4463:

4382:

3530:

Merton, R.C. (1973). "An Intertemporal Capital Asset Pricing Model".

2972:

2428:

5160:

4167:

4107:

4004:

3936:

3746:

3623:

3543:

3311:

Elton, E. J.; Gruber, M. J.; Brown, S. J.; Goetzmann, W. N. (2009).

3034:

2802:

French, Craig W. (2003). "The Treynor Capital Asset Pricing Model".

2740:

2361:

2254:

2157:

1437:

1362:

271:

156:) is a model used to determine a theoretically appropriate required

35:

4731:

4367:

3841:

3326:

Roll, R. (1977). "A Critique of the Asset Pricing Theory's Tests".

2886:(3. ed.). Harlow : Financial Times/Prentice Hall. p. 354.

2345:

449:{\displaystyle {\frac {E(R_{i})-R_{f}}{\beta _{i}}}=E(R_{m})-R_{f}}

3914:

3852:(1968). "Risk, Return and Equilibrium: Some Clarifying Comments".

1828:, a higher expected return than what CAPM suggests indicates that

4575:

3229:

Baker, Malcolm; Bradley, Brendan; Wurgler, Jeffrey (2010-12-22).

1513:

The relationship between β and required return is plotted on the

145:

3911:

Jack Treynor's 'Toward a Theory of Market Value of Risky Assets'

3600:

Shefrin, H.; Statman, M. (2000). "Behavioral Portfolio Theory".

2861:(7th International ed.). Boston: McGraw-Hill. p. 303.

4318:

4958:

3820:

Black, Fischer., Michael C. Jensen, and Myron Scholes (1972).

4241:

3102:

2730:

https://www.nobelprize.org/uploads/2018/06/sharpe-lecture.pdf

161:

3955:(1999). "The early history of portfolio theory: 1600–1960".

3170:

3001:"News and insight | Wealth Management | Barclays"

2741:

James Chong; Yanbo Jin; Michael Phillips (April 29, 2013).

2241:), therefore, expects performance in line with the market.

2234:

1314:{\displaystyle E(R_{i})-R_{f}=\beta _{i}(E(R_{m})-R_{f})\,}

596:{\displaystyle E(R_{i})=R_{f}+\beta _{i}(E(R_{m})-R_{f})\,}

132:

1821:{\displaystyle E(R_{t})={\frac {E(P_{t+1})-P_{t}}{P_{t}}}}

459:

The market reward-to-risk ratio is effectively the market

3310:

3064:

Post, Thierry; van Vliet, Pim; Levy, Haim (2008-07-01).

3904:

3275:

2582:. Either that fact is itself rational (which saves the

190:

of the market and the expected return of a theoretical

3722:

3685:

3019:"Skewness Preference and the Valuation of Risk Assets"

2771:"The Capital Asset Pricing Model: Theory and Evidence"

2478:

Are broadly diversified across a range of investments.

463:

and by rearranging the above equation and solving for

230:(1966) independently, building on the earlier work of

3822:

The Capital Asset Pricing Model: Some Empirical Tests

2944:. Research in Finance. Vol. 32. pp. 19–34.

2481:

Are price takers, i.e., they cannot influence prices.

2123:

1920:

1890:

1861:

1834:

1741:

1721:

1676:

1544:

1226:

1199:

1168:

1147:

1116:

1095:

1075:

1038:

981:

924:

883:

734:

691:

659:

615:

508:

469:

362:

499:, we obtain the capital asset pricing model (CAPM).

3981:

Fischer Black and the Revolutionary Idea of Finance

3449:

3414:

3228:

60:. Unsourced material may be challenged and removed.

3379:

2136:

2106:

1903:

1873:

1847:

1820:

1727:

1698:

1650:

1313:

1217:Restated, in terms of risk premium, we find that:

1205:

1181:

1153:

1129:

1101:

1081:

1057:

1019:

962:

908:

868:

710:

675:

643:

595:

491:

448:

3991:(1966). "Equilibrium in a Capital Asset Market".

3794:

3063:

3016:

2769:Fama, Eugene F; French, Kenneth R (Summer 2004).

2456:, the total risk of a portfolio can be viewed as

2147:

5500:

2764:

2762:

4150:Toward a Theory of Market Value of Risky Assets

4089:"Liquidity Preference as Behavior towards Risk"

3313:Modern portfolio theory and investment analysis

2856:

2631:(CCAPM) of Douglas Breeden and Mark Rubinstein.

2144:is the future price of the asset or portfolio.

2107:{\displaystyle P_{0}={\frac {1}{1+R_{f}}}\left}

1881:the asset returns to the CAPM suggested price.

3679:

3602:Journal of Financial and Quantitative Analysis

3599:

3196:CFA Institute Conference Proceedings Quarterly

344:(SML) and its relation to expected return and

186:(β) in the financial industry, as well as the

4974:

4183:

3875:"The Cross-Section of Expected Stock Returns"

3132:"The Cross-Section of Expected Stock Returns"

3017:Kraus, Alan; Litzenberger, Robert H. (1976).

2759:

164:, to make decisions about adding assets to a

3130:Fama, Eugene F.; French, Kenneth R. (1992).

2827:

2825:

2487:Trade without transaction or taxation costs.

1709:fundamental or technical analysis techniques

5458:Alternative investment management companies

5435:Standards Board for Alternative Investments

4155:

4144:. Vol. 95–209. Unpublished manuscript.

2857:Bodie, Z.; Kane, A.; Marcus, A. J. (2008).

2390:. Unsourced material may be challenged and

2283:. Unsourced material may be challenged and

2244:

2186:. Unsourced material may be challenged and

1466:. Unsourced material may be challenged and

1391:. Unsourced material may be challenged and

651:is the expected return on the capital asset

300:. Unsourced material may be challenged and

5483:

5339:Taxation of private equity and hedge funds

4981:

4967:

4190:

4176:

4034:. Hoboken, NJ: John Wiley & Sons, Inc.

4026:

3983:. Hoboken, NJ: John Wiley & Sons, Inc.

3872:

3652:

3129:

2903:International Journal of Financial Studies

2831:

2768:

2323:, also known as undiversifiable risk, and

1670:Once the expected/required rate of return

1506:-axis represents the risk (beta), and the

4063:

3951:

3890:

3873:Fama, Eugene F.; French, Kenneth (1992).

3736:

3699:

3670:

3613:

3352:

3147:

2924:

2914:

2822:

2786:

2612:in 1977, and is generally referred to as

2410:Learn how and when to remove this message

2303:Learn how and when to remove this message

2206:Learn how and when to remove this message

1486:Learn how and when to remove this message

1411:Learn how and when to remove this message

1310:

592:

320:Learn how and when to remove this message

120:Learn how and when to remove this message

3975:

3193:

2427:

131:

4136:

3919:

3901:The Treynor Capital Asset Pricing Model

3795:Lai, Tsong-Yue; Stohs, Mark H. (2015).

3564:

3558:

3066:"Risk aversion and skewness preference"

2218:The CAPM returns the asset-appropriate

1427:

14:

5501:

4038:

4032:A History of the Theory of Investments

3987:

3767:

3529:

3499:: CS1 maint: archived copy as title (

2939:

2896:

2881:

2801:

2680:Chance-constrained portfolio selection

250:for this contribution to the field of

5039:fixed-income relative-value investing

4962:

4197:

4171:

4083:

3827:

3315:. John Wiley & Sons. p. 347.

2351:

182:), often represented by the quantity

3848:

3325:

2734:

2388:adding citations to reliable sources

2355:

2281:adding citations to reliable sources

2248:

2184:adding citations to reliable sources

2151:

1464:adding citations to reliable sources

1431:

1389:adding citations to reliable sources

1356:

916:is the expected return of the market

298:adding citations to reliable sources

265:

58:adding citations to reliable sources

29:

24:

4065:10.1111/j.1540-6261.1964.tb02865.x

4056:10.1111/j.1540-6261.1964.tb02865.x

3925:Review of Economics and Statistics

3892:10.1111/j.1540-6261.1992.tb04398.x

3866:10.1111/j.1540-6261.1968.tb02996.x

3149:10.1111/j.1540-6261.1992.tb04398.x

2627:(ICAPM) of Robert Merton, and the

2076:

2073:

2070:

1996:

1993:

1990:

1552:

1549:

1546:

800:

797:

794:

758:

755:

752:

25:

5540:

3801:International Journal of Business

2505:In their 2004 review, economists

2452:Because the unsystematic risk is

1352:

248:Nobel Memorial Prize in Economics

5482:

5473:

5472:

5463:

5462:

5453:

5452:

5159:

4446:Electronic communication network

3070:Journal of Banking & Finance

2950:10.1108/S0196-382120160000032002

2804:Journal of Investment Management

2775:Journal of Economic Perspectives

2360:

2253:

2156:

1665:

1436:

1361:

270:

34:

4988:

3915:http://ssrn.com/abstract=628187

3814:

3788:

3761:

3716:

3646:

3593:

3523:

3507:

3462:

3452:Review of Asset Pricing Studies

3443:

3408:

3382:Journal of Portfolio Management

3373:

3346:

3319:

3304:

3278:Journal of Portfolio Management

3269:

3222:

3187:

3164:

3123:

3096:

3057:

3010:

2993:

2981:

2966:

1020:{\displaystyle E(R_{i})-R_{f}~}

963:{\displaystyle E(R_{m})-R_{f}~}

45:needs additional citations for

4096:The Review of Economic Studies

4023:, Journal of Finance, 32 (177)

3688:Journal of Financial Economics

3567:Journal of Financial Economics

3355:Journal of Financial Economics

3328:Journal of Financial Economics

3082:10.1016/j.jbankfin.2006.02.008

2933:

2890:

2884:Corporate financial management

2875:

2850:

2795:

2723:

2691:Fama–French three-factor model

2648:Fama–French three-factor model

2493:Have homogeneous expectations.

2463:

2148:Asset-specific required return

2093:

2080:

2064:

2048:

2035:

2029:

2026:

2000:

1980:

1967:

1789:

1770:

1758:

1745:

1693:

1680:

1639:

1623:

1610:

1604:

1575:

1562:

1307:

1291:

1278:

1272:

1243:

1230:

998:

985:

941:

928:

900:

887:

817:

804:

788:

762:

632:

619:

589:

573:

560:

554:

525:

512:

486:

473:

430:

417:

382:

369:

331:

140:over 3 years for monthly data.

13:

1:

4440:Multilateral trading facility

2717:

2475:Are rational and risk-averse.

69:"Capital asset pricing model"

5313:security characteristic line

4863:Returns-based style analysis

4659:Post-modern portfolio theory

4565:Security characteristic line

4142:Market Value, Time, and Risk

3710:10.1016/0304-405X(93)90023-5

3579:10.1016/0304-405X(79)90016-3

3367:10.1016/0304-405X(82)90002-2

3340:10.1016/0304-405X(77)90009-5

2712:Roy's safety-first criterion

1345:For the full derivation see

711:{\displaystyle \beta _{i}~~}

209:

138:Dow Jones Industrial Average

7:

5301:Capital asset pricing model

5020:Capital structure arbitrage

4617:Efficient-market hypothesis

4521:Capital asset pricing model

4458:Straight-through processing

3659:Journal of Asset Management

2836:. Oxford University Press.

2658:

2637:behavioral portfolio theory

2584:efficient-market hypothesis

2500:

1182:{\displaystyle \sigma _{m}}

1130:{\displaystyle \sigma _{i}}

1058:{\displaystyle \rho _{i,m}}

214:The CAPM was introduced by

150:capital asset pricing model

18:Capital Asset Pricing Model

10:

5545:

5103:Commodity trading advisors

4434:Alternative Trading System

3957:Financial Analysts Journal

3417:Financial Analysts Journal

3235:Financial Analysts Journal

2990:. Retrieved June 20, 2021.

2978:. Retrieved June 20, 2021.

2832:Luenberger, David (1997).

2641:Maslowian portfolio theory

2421:

1711:, including P/E, M/B etc.

970:is sometimes known as the

644:{\displaystyle E(R_{i})~~}

261:

246:jointly received the 1990

204:Merton's portfolio problem

5448:

5440:Managed Funds Association

5422:

5384:High-net-worth individual

5356:

5264:

5218:

5209:

5168:

5157:

5135:

5090:

5057:

5005:

4996:

4709:

4584:

4483:

4403:

4311:

4278:

4239:

4205:

4148:Treynor, Jack L. (1962).

4019:Ross, Stephen A. (1977).

3913:(December). Available at

3909:French, Craig W. (2002).

3899:French, Craig W. (2003).

3770:Business Valuation Review

2675:Carhart four-factor model

909:{\displaystyle E(R_{m})~}

5277:Arbitrage pricing theory

4498:Arbitrage pricing theory

3782:10.5791/BVR-D-12-00001.1

3653:De Brouwer, Ph. (2009).

2788:10.1257/0895330042162430

2665:Arbitrage pricing theory

2245:Risk and diversification

1699:{\displaystyle E(R_{i})}

492:{\displaystyle E(R_{i})}

242:. Sharpe, Markowitz and

200:arbitrage pricing theory

5509:Financial risk modeling

5389:Institutional investors

5282:Assets under management

5107:managed futures account

4777:Initial public offering

4638:Modern portfolio theory

4533:Dividend discount model

4416:List of stock exchanges

4161:Harvard Business Review

3969:10.2469/faj.v55.n4.2281

3394:10.3905/jpm.1985.409036

3117:10.1111/0022-1082.00350

2940:French, Jordan (2016).

2897:French, Jordan (2016).

2707:Modern portfolio theory

2438:capital allocation line

1347:Modern portfolio theory

1326:individual risk premium

1069:between the investment

1067:correlation coefficient

1029:individual risk premium

240:modern portfolio theory

5414:Sovereign wealth funds

5186:High-frequency trading

5035:Fixed income arbitrage

4665:Random walk hypothesis

3290:10.3905/jpm.2019.1.114

3136:The Journal of Finance

3023:The Journal of Finance

2702:Low-volatility anomaly

2592:low-volatility anomaly

2558:Avanidhar Subrahmanyam

2528:coherent risk measures

2441:

2138:

2108:

1905:

1875:

1849:

1822:

1729:

1700:

1652:

1324:which states that the

1315:

1207:

1183:

1155:

1131:

1103:

1083:

1059:

1021:

964:

910:

870:

712:

677:

676:{\displaystyle R_{f}~}

645:

597:

493:

450:

141:

5524:Corporate development

5256:Structured securities

5072:Distressed securities

5044:Statistical arbitrage

5030:Equity market neutral

5025:Convertible arbitrage

4803:Market capitalization

4612:Dollar cost averaging

4157:Mullins Jr., David W.

3284:(1): jpm.2019.1.114.

2882:Arnold, Glen (2005).

2436:. CAL stands for the

2431:

2139:

2137:{\displaystyle P_{T}}

2109:

1906:

1904:{\displaystyle P_{0}}

1876:

1850:

1848:{\displaystyle P_{t}}

1823:

1730:

1701:

1653:

1316:

1208:

1184:

1156:

1132:

1104:

1084:

1060:

1027:is also known as the

1022:

965:

911:

871:

713:

678:

646:

598:

494:

451:

135:

27:Model used in finance

5374:Financial endowments

5319:Fundamental analysis

5067:Shareholder activism

5049:Volatility arbitrage

4623:Fundamental analysis

4607:Contrarian investing

4570:Security market line

4475:Liquidity aggregator

4452:Direct market access

4363:Quantitative analyst

3905:http://www.joim.com/

3429:10.2469/faj.v70.n2.1

3247:10.2469/faj.v67.n1.4

2588:volatility arbitrage

2447:infinitely divisible

2384:improve this section

2277:improve this section

2180:improve this section

2121:

1918:

1888:

1859:

1832:

1739:

1719:

1674:

1542:

1515:security market line

1460:improve this section

1428:Security market line

1385:improve this section

1224:

1197:

1166:

1145:

1114:

1093:

1073:

1036:

979:

922:

881:

732:

689:

657:

613:

506:

467:

360:

350:reward-to-risk ratio

342:security market line

294:improve this section

54:improve this article

5488:List of hedge funds

5478:Hedge fund managers

5394:Insurance companies

5379:Fund of hedge funds

5287:Black–Scholes model

5201:Proprietary trading

5176:Algorithmic trading

5143:Fund of hedge funds

4868:Reverse stock split

4813:Market manipulation

4737:Dual-listed company

4597:Algorithmic trading

4527:Capital market line

4329:Inter-dealer broker

3953:Markowitz, Harry M.

3797:"Yes, CAPM is dead"

3672:10.1057/jam.2008.35

3208:10.2469/cp.v29.n1.2

2916:10.3390/ijfs4030015

1874:{\displaystyle t+1}

1141:for the investment

252:financial economics

196:normal distribution

5344:Technical analysis

4908:Stock market index

4747:Efficient frontier

4686:Technical analysis

4644:Momentum investing

4466:(private exchange)

4356:Proprietary trader

4298:Shares outstanding

4288:Authorised capital

4044:Journal of Finance

4040:Sharpe, William F.

3879:Journal of Finance

3854:Journal of Finance

3725:Journal of Finance

3173:SSRN Working Paper

3105:Journal of Finance

2834:Investment Science

2696:Intertemporal CAPM

2625:intertemporal CAPM

2550:behavioral finance

2442:

2434:efficient frontier

2424:Efficient frontier

2352:Efficient frontier

2134:

2104:

1901:

1871:

1845:

1818:

1725:

1696:

1648:

1311:

1203:

1191:standard deviation

1179:

1151:

1139:standard deviation

1127:

1099:

1079:

1055:

1017:

960:

906:

866:

708:

673:

641:

593:

489:

446:

142:

5529:Management theory

5514:Financial markets

5496:

5495:

5352:

5351:

5155:

5154:

5122:Long/short equity

5098:Convergence trade

5082:Special situation

4956:

4955:

4757:Flight-to-quality

4509:Buffett indicator

4199:Financial markets

4140:(8 August 1961).

3519:978-0-19-829694-2

2959:978-1-78635-156-2

2868:978-0-07-125916-3

2843:978-0-19-510809-5

2568:Buffalo, New York

2554:David Hirshleifer

2420:

2419:

2412:

2325:unsystematic risk

2313:

2312:

2305:

2216:

2215:

2208:

2097:

1957:

1816:

1728:{\displaystyle t}

1647:

1496:

1495:

1488:

1421:

1420:

1413:

1206:{\displaystyle m}

1154:{\displaystyle i}

1102:{\displaystyle m}

1082:{\displaystyle i}

1016:

959:

905:

864:

821:

707:

704:

672:

640:

637:

409:

338:

337:

330:

329:

322:

220:William F. Sharpe

130:

129:

122:

104:

16:(Redirected from

5536:

5519:Financial models

5486:

5485:

5476:

5475:

5466:

5465:

5456:

5455:

5399:Investment banks

5246:Foreign exchange

5216:

5215:

5163:

5003:

5002:

4983:

4976:

4969:

4960:

4959:

4873:Share repurchase

4585:Trading theories

4470:Crossing network

4428:Over-the-counter

4265:Restricted stock

4221:Secondary market

4192:

4185:

4178:

4169:

4168:

4164:

4145:

4138:Treynor, Jack L.

4133:

4131:

4130:

4124:

4118:. Archived from

4093:

4077:

4067:

4035:

4028:Rubinstein, Mark

4016:

3984:

3972:

3948:

3896:

3894:

3869:

3845:

3809:

3808:

3792:

3786:

3785:

3765:

3759:

3758:

3740:

3720:

3714:

3713:

3703:

3683:

3677:

3676:

3674:

3650:

3644:

3643:

3617:

3597:

3591:

3590:

3562:

3556:

3555:

3527:

3521:

3511:

3505:

3504:

3498:

3490:

3488:

3487:

3481:

3475:. Archived from

3474:

3466:

3460:

3459:

3447:

3441:

3440:

3412:

3406:

3405:

3377:

3371:

3370:

3350:

3344:

3343:

3323:

3317:

3316:

3308:

3302:

3301:

3273:

3267:

3266:

3226:

3220:

3219:

3191:

3185:

3184:

3168:

3162:

3161:

3151:

3127:

3121:

3120:

3100:

3094:

3093:

3076:(7): 1178–1187.

3061:

3055:

3054:

3029:(4): 1085–1100.

3014:

3008:

3007:

3005:

2997:

2991:

2985:

2979:

2970:

2964:

2963:

2937:

2931:

2930:

2928:

2918:

2894:

2888:

2887:

2879:

2873:

2872:

2854:

2848:

2847:

2829:

2820:

2819:

2799:

2793:

2792:

2790:

2766:

2757:

2756:

2754:

2752:

2747:

2738:

2732:

2727:

2685:Consumption beta

2635:portfolio — see

2629:consumption CAPM

2548:in the field of

2432:The (Markowitz)

2415:

2408:

2404:

2401:

2395:

2364:

2356:

2308:

2301:

2297:

2294:

2288:

2257:

2249:

2228:utility function

2211:

2204:

2200:

2197:

2191:

2160:

2152:

2143:

2141:

2140:

2135:

2133:

2132:

2113:

2111:

2110:

2105:

2103:

2099:

2098:

2096:

2092:

2091:

2079:

2067:

2063:

2062:

2047:

2046:

2025:

2024:

2012:

2011:

1999:

1987:

1979:

1978:

1958:

1956:

1955:

1954:

1935:

1930:

1929:

1910:

1908:

1907:

1902:

1900:

1899:

1884:The asset price

1880:

1878:

1877:

1872:

1854:

1852:

1851:

1846:

1844:

1843:

1827:

1825:

1824:

1819:

1817:

1815:

1814:

1805:

1804:

1803:

1788:

1787:

1765:

1757:

1756:

1734:

1732:

1731:

1726:

1707:based on either

1705:

1703:

1702:

1697:

1692:

1691:

1657:

1655:

1654:

1649:

1645:

1638:

1637:

1622:

1621:

1603:

1602:

1590:

1589:

1574:

1573:

1555:

1491:

1484:

1480:

1477:

1471:

1440:

1432:

1416:

1409:

1405:

1402:

1396:

1365:

1357:

1320:

1318:

1317:

1312:

1306:

1305:

1290:

1289:

1271:

1270:

1258:

1257:

1242:

1241:

1212:

1210:

1209:

1204:

1188:

1186:

1185:

1180:

1178:

1177:

1160:

1158:

1157:

1152:

1136:

1134:

1133:

1128:

1126:

1125:

1108:

1106:

1105:

1100:

1088:

1086:

1085:

1080:

1064:

1062:

1061:

1056:

1054:

1053:

1026:

1024:

1023:

1018:

1014:

1013:

1012:

997:

996:

969:

967:

966:

961:

957:

956:

955:

940:

939:

915:

913:

912:

907:

903:

899:

898:

875:

873:

872:

867:

865:

863:

862:

853:

852:

843:

841:

840:

822:

820:

816:

815:

803:

791:

787:

786:

774:

773:

761:

749:

744:

743:

717:

715:

714:

709:

705:

702:

701:

700:

682:

680:

679:

674:

670:

669:

668:

650:

648:

647:

642:

638:

635:

631:

630:

602:

600:

599:

594:

588:

587:

572:

571:

553:

552:

540:

539:

524:

523:

498:

496:

495:

490:

485:

484:

455:

453:

452:

447:

445:

444:

429:

428:

410:

408:

407:

398:

397:

396:

381:

380:

364:

332:

325:

318:

314:

311:

305:

274:

266:

166:well-diversified

125:

118:

114:

111:

105:

103:

62:

38:

30:

21:

5544:

5543:

5539:

5538:

5537:

5535:

5534:

5533:

5499:

5498:

5497:

5492:

5444:

5430:Fund governance

5418:

5348:

5272:Absolute return

5260:

5211:

5205:

5196:Program trading

5191:Prime brokerage

5164:

5151:

5131:

5127:Trend following

5112:Dedicated short

5086:

5053:

5010:

4998:

4992:

4987:

4957:

4952:

4943:Voting interest

4853:Public offering

4788:Mandatory offer

4762:Government bond

4742:DuPont analysis

4705:

4701:Value investing

4696:Value averaging

4691:Trend following

4676:Style investing

4671:Sector rotation

4586:

4580:

4559:Net asset value

4485:Stock valuation

4479:

4399:

4307:

4274:

4260:Preferred stock

4235:

4201:

4196:

4128:

4126:

4122:

4108:10.2307/2296205

4091:

4005:10.2307/1910098

3977:Mehrling, Perry

3937:10.2307/1924119

3850:Fama, Eugene F.

3817:

3812:

3793:

3789:

3766:

3762:

3747:10.2307/2329112

3721:

3717:

3701:10.1.1.139.5892

3684:

3680:

3651:

3647:

3624:10.2307/2676187

3615:10.1.1.143.8443

3598:

3594:

3563:

3559:

3544:10.2307/1913811

3528:

3524:

3512:

3508:

3492:

3491:

3485:

3483:

3479:

3472:

3470:"Archived copy"

3468:

3467:

3463:

3448:

3444:

3413:

3409:

3378:

3374:

3351:

3347:

3324:

3320:

3309:

3305:

3274:

3270:

3227:

3223:

3192:

3188:

3169:

3165:

3128:

3124:

3101:

3097:

3062:

3058:

3035:10.2307/2326275

3015:

3011:

3003:

2999:

2998:

2994:

2986:

2982:

2971:

2967:

2960:

2938:

2934:

2895:

2891:

2880:

2876:

2869:

2855:

2851:

2844:

2830:

2823:

2800:

2796:

2767:

2760:

2750:

2748:

2745:

2739:

2735:

2728:

2724:

2720:

2670:Build-up method

2661:

2614:Roll's critique

2539:Casino gamblers

2532:Barclays Wealth

2503:

2468:All investors:

2466:

2426:

2416:

2405:

2399:

2396:

2381:

2365:

2354:

2321:systematic risk

2309:

2298:

2292:

2289:

2274:

2258:

2247:

2220:required return

2212:

2201:

2195:

2192:

2177:

2161:

2150:

2128:

2124:

2122:

2119:

2118:

2087:

2083:

2069:

2068:

2058:

2054:

2042:

2038:

2020:

2016:

2007:

2003:

1989:

1988:

1986:

1974:

1970:

1963:

1959:

1950:

1946:

1939:

1934:

1925:

1921:

1919:

1916:

1915:

1895:

1891:

1889:

1886:

1885:

1860:

1857:

1856:

1839:

1835:

1833:

1830:

1829:

1810:

1806:

1799:

1795:

1777:

1773:

1766:

1764:

1752:

1748:

1740:

1737:

1736:

1720:

1717:

1716:

1687:

1683:

1675:

1672:

1671:

1668:

1633:

1629:

1617:

1613:

1598:

1594:

1585:

1581:

1569:

1565:

1545:

1543:

1540:

1539:

1534:

1525:

1492:

1481:

1475:

1472:

1457:

1441:

1430:

1417:

1406:

1400:

1397:

1382:

1366:

1355:

1301:

1297:

1285:

1281:

1266:

1262:

1253:

1249:

1237:

1233:

1225:

1222:

1221:

1198:

1195:

1194:

1193:for the market

1173:

1169:

1167:

1164:

1163:

1146:

1143:

1142:

1121:

1117:

1115:

1112:

1111:

1094:

1091:

1090:

1089:and the market

1074:

1071:

1070:

1043:

1039:

1037:

1034:

1033:

1008:

1004:

992:

988:

980:

977:

976:

951:

947:

935:

931:

923:

920:

919:

894:

890:

882:

879:

878:

858:

854:

848:

844:

842:

830:

826:

811:

807:

793:

792:

782:

778:

769:

765:

751:

750:

748:

739:

735:

733:

730:

729:

696:

692:

690:

687:

686:

664:

660:

658:

655:

654:

626:

622:

614:

611:

610:

583:

579:

567:

563:

548:

544:

535:

531:

519:

515:

507:

504:

503:

480:

476:

468:

465:

464:

440:

436:

424:

420:

403:

399:

392:

388:

376:

372:

365:

363:

361:

358:

357:

346:systematic risk

326:

315:

309:

306:

291:

275:

264:

236:diversification

232:Harry Markowitz

212:

192:risk-free asset

188:expected return

176:systematic risk

126:

115:

109:

106:

63:

61:

51:

39:

28:

23:

22:

15:

12:

11:

5:

5542:

5532:

5531:

5526:

5521:

5516:

5511:

5494:

5493:

5491:

5490:

5480:

5470:

5460:

5449:

5446:

5445:

5443:

5442:

5437:

5432:

5426:

5424:

5420:

5419:

5417:

5416:

5411:

5406:

5404:Merchant banks

5401:

5396:

5391:

5386:

5381:

5376:

5371:

5369:Family offices

5366:

5360:

5358:

5354:

5353:

5350:

5349:

5347:

5346:

5341:

5336:

5331:

5329:Securitization

5326:

5321:

5316:

5298:

5284:

5279:

5274:

5268:

5266:

5262:

5261:

5259:

5258:

5253:

5248:

5243:

5238:

5233:

5228:

5222:

5220:

5213:

5207:

5206:

5204:

5203:

5198:

5193:

5188:

5183:

5178:

5172:

5170:

5166:

5165:

5158:

5156:

5153:

5152:

5150:

5149:

5139:

5137:

5133:

5132:

5130:

5129:

5124:

5119:

5114:

5109:

5100:

5094:

5092:

5088:

5087:

5085:

5084:

5079:

5077:Risk arbitrage

5074:

5069:

5063:

5061:

5055:

5054:

5052:

5051:

5046:

5041:

5032:

5027:

5022:

5016:

5014:

5012:relative value

5000:

4994:

4993:

4986:

4985:

4978:

4971:

4963:

4954:

4953:

4951:

4950:

4945:

4940:

4935:

4930:

4925:

4920:

4915:

4910:

4905:

4903:Stock exchange

4900:

4898:Stock dilution

4895:

4890:

4885:

4880:

4875:

4870:

4865:

4860:

4855:

4850:

4845:

4840:

4835:

4830:

4825:

4823:Mean reversion

4820:

4815:

4810:

4805:

4800:

4798:Market anomaly

4795:

4790:

4785:

4780:

4774:

4769:

4764:

4759:

4754:

4749:

4744:

4739:

4734:

4729:

4724:

4719:

4717:Bid–ask spread

4713:

4711:

4707:

4706:

4704:

4703:

4698:

4693:

4688:

4683:

4678:

4673:

4668:

4662:

4656:

4651:

4646:

4641:

4635:

4630:

4625:

4620:

4614:

4609:

4604:

4599:

4593:

4591:

4582:

4581:

4579:

4578:

4573:

4567:

4562:

4556:

4551:

4546:

4544:Earnings yield

4541:

4539:Dividend yield

4536:

4530:

4524:

4518:

4512:

4506:

4501:

4495:

4489:

4487:

4481:

4480:

4478:

4477:

4472:

4467:

4461:

4455:

4449:

4443:

4437:

4431:

4430:(off-exchange)

4425:

4424:

4423:

4418:

4407:

4405:

4404:Trading venues

4401:

4400:

4398:

4397:

4392:

4391:

4390:

4380:

4375:

4370:

4365:

4360:

4359:

4358:

4353:

4343:

4338:

4333:

4332:

4331:

4326:

4315:

4313:

4309:

4308:

4306:

4305:

4303:Treasury stock

4300:

4295:

4290:

4284:

4282:

4276:

4275:

4273:

4272:

4270:Tracking stock

4267:

4262:

4257:

4252:

4246:

4244:

4237:

4236:

4234:

4233:

4228:

4223:

4218:

4216:Primary market

4212:

4210:

4203:

4202:

4195:

4194:

4187:

4180:

4172:

4166:

4165:

4153:

4146:

4134:

4081:

4078:

4050:(3): 425–442.

4036:

4024:

4017:

3999:(4): 768–783.

3985:

3973:

3949:

3917:

3907:

3897:

3885:(2): 427–466.

3870:

3846:

3842:10.1086/295472

3836:(3): 444–455.

3825:

3816:

3813:

3811:

3810:

3787:

3760:

3738:10.1.1.556.954

3731:(2): 427–465.

3715:

3678:

3665:(6): 359–365.

3645:

3608:(2): 127–151.

3592:

3573:(3): 265–296.

3557:

3538:(5): 867–887.

3522:

3506:

3461:

3442:

3407:

3372:

3361:(3): 237–268.

3345:

3334:(2): 129–176.

3318:

3303:

3268:

3221:

3186:

3163:

3142:(2): 427–465.

3122:

3111:(3): 921–965.

3095:

3056:

3009:

2992:

2980:

2965:

2958:

2932:

2889:

2874:

2867:

2849:

2842:

2821:

2794:

2758:

2733:

2721:

2719:

2716:

2715:

2714:

2709:

2704:

2699:

2693:

2688:

2682:

2677:

2672:

2667:

2660:

2657:

2652:

2651:

2644:

2632:

2621:

2617:

2602:

2598:

2595:

2576:Michael Jensen

2570:in a paper by

2564:

2561:

2545:

2542:

2535:

2523:

2519:

2511:Kenneth French

2502:

2499:

2498:

2497:

2494:

2491:

2488:

2485:

2482:

2479:

2476:

2473:

2465:

2462:

2422:Main article:

2418:

2417:

2368:

2366:

2359:

2353:

2350:

2315:The risk of a

2311:

2310:

2261:

2259:

2252:

2246:

2243:

2214:

2213:

2164:

2162:

2155:

2149:

2146:

2131:

2127:

2115:

2114:

2102:

2095:

2090:

2086:

2082:

2078:

2075:

2072:

2066:

2061:

2057:

2053:

2050:

2045:

2041:

2037:

2034:

2031:

2028:

2023:

2019:

2015:

2010:

2006:

2002:

1998:

1995:

1992:

1985:

1982:

1977:

1973:

1969:

1966:

1962:

1953:

1949:

1945:

1942:

1938:

1933:

1928:

1924:

1898:

1894:

1870:

1867:

1864:

1842:

1838:

1813:

1809:

1802:

1798:

1794:

1791:

1786:

1783:

1780:

1776:

1772:

1769:

1763:

1760:

1755:

1751:

1747:

1744:

1724:

1695:

1690:

1686:

1682:

1679:

1667:

1664:

1659:

1658:

1644:

1641:

1636:

1632:

1628:

1625:

1620:

1616:

1612:

1609:

1606:

1601:

1597:

1593:

1588:

1584:

1580:

1577:

1572:

1568:

1564:

1561:

1558:

1554:

1551:

1548:

1530:

1521:

1494:

1493:

1444:

1442:

1435:

1429:

1426:

1419:

1418:

1369:

1367:

1360:

1354:

1353:Modified betas

1351:

1330:market premium

1322:

1321:

1309:

1304:

1300:

1296:

1293:

1288:

1284:

1280:

1277:

1274:

1269:

1265:

1261:

1256:

1252:

1248:

1245:

1240:

1236:

1232:

1229:

1215:

1214:

1202:

1176:

1172:

1161:

1150:

1124:

1120:

1109:

1098:

1078:

1052:

1049:

1046:

1042:

1031:

1011:

1007:

1003:

1000:

995:

991:

987:

984:

974:

972:market premium

954:

950:

946:

943:

938:

934:

930:

927:

917:

902:

897:

893:

889:

886:

876:

861:

857:

851:

847:

839:

836:

833:

829:

825:

819:

814:

810:

806:

802:

799:

796:

790:

785:

781:

777:

772:

768:

764:

760:

757:

754:

747:

742:

738:

699:

695:

684:

667:

663:

652:

634:

629:

625:

621:

618:

604:

603:

591:

586:

582:

578:

575:

570:

566:

562:

559:

556:

551:

547:

543:

538:

534:

530:

527:

522:

518:

514:

511:

488:

483:

479:

475:

472:

457:

456:

443:

439:

435:

432:

427:

423:

419:

416:

413:

406:

402:

395:

391:

387:

384:

379:

375:

371:

368:

336:

335:

328:

327:

278:

276:

269:

263:

260:

226:(1965a,b) and

218:(1961, 1962),

211:

208:

158:rate of return

128:

127:

42:

40:

33:

26:

9:

6:

4:

3:

2:

5541:

5530:

5527:

5525:

5522:

5520:

5517:

5515:

5512:

5510:

5507:

5506:

5504:

5489:

5481:

5479:

5471:

5469:

5461:

5459:

5451:

5450:

5447:

5441:

5438:

5436:

5433:

5431:

5428:

5427:

5425:

5421:

5415:

5412:

5410:

5409:Pension funds

5407:

5405:

5402:

5400:

5397:

5395:

5392:

5390:

5387:

5385:

5382:

5380:

5377:

5375:

5372:

5370:

5367:

5365:

5364:Vulture funds

5362:

5361:

5359:

5355:

5345:

5342:

5340:

5337:

5335:

5332:

5330:

5327:

5325:

5322:

5320:

5317:

5314:

5310:

5306:

5302:

5299:

5296:

5295:delta neutral

5292:

5288:

5285:

5283:

5280:

5278:

5275:

5273:

5270:

5269:

5267:

5263:

5257:

5254:

5252:

5251:Money markets

5249:

5247:

5244:

5242:

5239:

5237:

5234:

5232:

5229:

5227:

5224:

5223:

5221:

5217:

5214:

5208:

5202:

5199:

5197:

5194:

5192:

5189:

5187:

5184:

5182:

5179:

5177:

5174:

5173:

5171:

5167:

5162:

5148:

5147:Multi-manager

5144:

5141:

5140:

5138:

5134:

5128:

5125:

5123:

5120:

5118:

5115:

5113:

5110:

5108:

5104:

5101:

5099:

5096:

5095:

5093:

5089:

5083:

5080:

5078:

5075:

5073:

5070:

5068:

5065:

5064:

5062:

5060:

5056:

5050:

5047:

5045:

5042:

5040:

5036:

5033:

5031:

5028:

5026:

5023:

5021:

5018:

5017:

5015:

5013:

5008:

5004:

5001:

4995:

4991:

4984:

4979:

4977:

4972:

4970:

4965:

4964:

4961:

4949:

4946:

4944:

4941:

4939:

4936:

4934:

4931:

4929:

4926:

4924:

4921:

4919:

4916:

4914:

4911:

4909:

4906:

4904:

4901:

4899:

4896:

4894:

4891:

4889:

4886:

4884:

4881:

4879:

4878:Short selling

4876:

4874:

4871:

4869:

4866:

4864:

4861:

4859:

4856:

4854:

4851:

4849:

4846:

4844:

4841:

4839:

4836:

4834:

4831:

4829:

4826:

4824:

4821:

4819:

4816:

4814:

4811:

4809:

4806:

4804:

4801:

4799:

4796:

4794:

4791:

4789:

4786:

4784:

4781:

4778:

4775:

4773:

4770:

4768:

4767:Greenspan put

4765:

4763:

4760:

4758:

4755:

4753:

4752:Financial law

4750:

4748:

4745:

4743:

4740:

4738:

4735:

4733:

4730:

4728:

4727:Cross listing

4725:

4723:

4720:

4718:

4715:

4714:

4712:

4710:Related terms

4708:

4702:

4699:

4697:

4694:

4692:

4689:

4687:

4684:

4682:

4681:Swing trading

4679:

4677:

4674:

4672:

4669:

4666:

4663:

4660:

4657:

4655:

4652:

4650:

4649:Mosaic theory

4647:

4645:

4642:

4639:

4636:

4634:

4633:Market timing

4631:

4629:

4626:

4624:

4621:

4618:

4615:

4613:

4610:

4608:

4605:

4603:

4600:

4598:

4595:

4594:

4592:

4590:

4583:

4577:

4574:

4571:

4568:

4566:

4563:

4560:

4557:

4555:

4552:

4550:

4547:

4545:

4542:

4540:

4537:

4534:

4531:

4528:

4525:

4522:

4519:

4516:

4513:

4510:

4507:

4505:

4502:

4499:

4496:

4494:

4491:

4490:

4488:

4486:

4482:

4476:

4473:

4471:

4468:

4465:

4462:

4459:

4456:

4453:

4450:

4447:

4444:

4441:

4438:

4435:

4432:

4429:

4426:

4422:

4421:Trading hours

4419:

4417:

4414:

4413:

4412:

4409:

4408:

4406:

4402:

4396:

4393:

4389:

4386:

4385:

4384:

4381:

4379:

4376:

4374:

4371:

4369:

4366:

4364:

4361:

4357:

4354:

4352:

4349:

4348:

4347:

4344:

4342:

4339:

4337:

4336:Broker-dealer

4334:

4330:

4327:

4325:

4322:

4321:

4320:

4317:

4316:

4314:

4310:

4304:

4301:

4299:

4296:

4294:

4293:Issued shares

4291:

4289:

4286:

4285:

4283:

4281:

4280:Share capital

4277:

4271:

4268:

4266:

4263:

4261:

4258:

4256:

4253:

4251:

4248:

4247:

4245:

4243:

4238:

4232:

4231:Fourth market

4229:

4227:

4224:

4222:

4219:

4217:

4214:

4213:

4211:

4209:

4204:

4200:

4193:

4188:

4186:

4181:

4179:

4174:

4173:

4170:

4162:

4158:

4154:

4151:

4147:

4143:

4139:

4135:

4125:on 2020-11-27

4121:

4117:

4113:

4109:

4105:

4101:

4097:

4090:

4086:

4082:

4079:

4075:

4071:

4066:

4061:

4057:

4053:

4049:

4045:

4041:

4037:

4033:

4029:

4025:

4022:

4018:

4014:

4010:

4006:

4002:

3998:

3994:

3990:

3986:

3982:

3978:

3974:

3970:

3966:

3962:

3958:

3954:

3950:

3946:

3942:

3938:

3934:

3930:

3926:

3922:

3921:Lintner, John

3918:

3916:

3912:

3908:

3906:

3902:

3898:

3893:

3888:

3884:

3880:

3876:

3871:

3867:

3863:

3859:

3855:

3851:

3847:

3843:

3839:

3835:

3831:

3826:

3823:

3819:

3818:

3807:(2): 144–158.

3806:

3802:

3798:

3791:

3783:

3779:

3775:

3771:

3764:

3756:

3752:

3748:

3744:

3739:

3734:

3730:

3726:

3719:

3711:

3707:

3702:

3697:

3693:

3689:

3682:

3673:

3668:

3664:

3660:

3656:

3649:

3641:

3637:

3633:

3629:

3625:

3621:

3616:

3611:

3607:

3603:

3596:

3588:

3584:

3580:

3576:

3572:

3568:

3561:

3553:

3549:

3545:

3541:

3537:

3533:

3526:

3520:

3516:

3510:

3502:

3496:

3482:on 2014-07-25

3478:

3471:

3465:

3457:

3453:

3446:

3438:

3434:

3430:

3426:

3422:

3418:

3411:

3403:

3399:

3395:

3391:

3387:

3383:

3376:

3368:

3364:

3360:

3356:

3349:

3341:

3337:

3333:

3329:

3322:

3314:

3307:

3299:

3295:

3291:

3287:

3283:

3279:

3272:

3264:

3260:

3256:

3252:

3248:

3244:

3240:

3236:

3232:

3225:

3217:

3213:

3209:

3205:

3201:

3197:

3190:

3182:

3178:

3174:

3167:

3159:

3155:

3150:

3145:

3141:

3137:

3133:

3126:

3118:

3114:

3110:

3106:

3099:

3091:

3087:

3083:

3079:

3075:

3071:

3067:

3060:

3052:

3048:

3044:

3040:

3036:

3032:

3028:

3024:

3020:

3013:

3002:

2996:

2989:

2984:

2977:

2974:

2969:

2961:

2955:

2951:

2947:

2943:

2936:

2927:

2922: