229:

249:

33:

264:, meaning that firms can enter (and exit) the market at will with no logistical, legal, or other inhibiting factors, and if firms have U-shaped long-run average cost curves as in the graphs at the right, then in the long run all firms will end up producing at their point of minimum average cost. For suppose a particular firm with the illustrated long-run average cost curve is faced with the market price

138:

206:

The "diseconomies of scale" do not tend to vary widely by industry, but "economies of scale" do. An auto maker has very high fixed costs, which are lower per unit of output the more output is produced. On the other hand, a florist has very low fixed costs and hence very limited sources of economies

280:

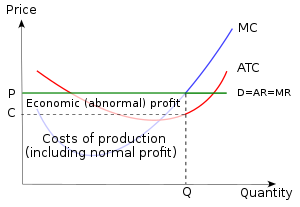

in the graph's notation. With firms making economic profit and with free entry, other firms will enter the market for this product, and their additional supply will bring down the market price of the product; this process will continue until there is no longer any economic profit to entice further

296:

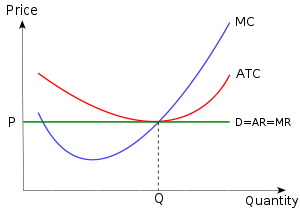

Thus with firms possessing U-shaped long-run average cost curves, perfect competition, with (1) firms small enough relative to the overall market that they cannot individually influence the product's market price, and with (2) free entry, leads in the long run to a situation in which no firm is

215:

An industrial society will tend to have large firms, as industry has substantial economies of scale. A service-based economy will favor smaller firms, as services have limited economies of scale. There will, of course, be exceptions, such as

197:

industry standards (like

Microsoft Windows), etc. If only these "economies of scale" applied, then the ideal firm size would be infinitely large. However, since both apply, the firm must not be too small or too large, to minimize unit costs.

285:, with marginal cost equalling price at the minimum of the long-run average cost curve, and with the gap between average revenue (the height of the average revenue curve at this

272:

in the upper graph), and its per-unit economic profit is the difference between average revenue AR and average total cost ATC at that point, the difference being

297:

making economic profit, and in which firms are of their socially optimal size (producing at the minimum of their long-run average cost curve).

185:

existed, then the long-run average cost-minimizing firm size would be one worker, producing the minimal possible level of output. However,

105:

54:

77:

193:

discounts (components, insurance, real estate, advertising, etc.) and can also limit competition by buying out competitors, setting

84:

268:

indicated in the upper graph. The firm produces at the quantity of output where marginal cost equals marginal revenue (labeled

252:

After entry of enough other firms has occurred, their increase in market supply has driven down the price of the good, so that

91:

281:

entrants. The long-run outcome is shown in the second graph, with production by each firm occurring at the newly labelled

73:

124:

62:

17:

58:

348:

210:

207:

of scale. Thus there are disparate degrees of economies of scales for different types of organizations.

98:

343:

328:

173:

in a given industry at a given time which results in the lowest production costs per unit of output.

43:

316:

47:

306:

182:

142:

8:

189:

also apply, which state that large firms can have lower per-unit costs due to buying at

157:, reflecting diseconomies of scale. Consequently, the societally optimal firm size is OQ

311:

236:. This situation is shown in this diagram, as the price or average revenue, denoted by

228:

186:

329:

Bureaucratic limits of firm size: Empirical analysis using transaction cost economics

211:

Effects of agricultural, industrial, and service-based economies on optimal firm size

253:

233:

248:

337:

145:

diagram shows that as more is produced, so long as output does not exceed OQ

154:

261:

217:

190:

240:, is above the minimum average cost. The firm produces the quantity

32:

232:

In the short run, it is possible for an individual firm to make an

194:

170:

137:

289:) and average cost (the height of the average cost curve at this

201:

244:, at the intersection of marginal cost and marginal revenue.

161:, where long-run average cost is at its lowest level.

223:

335:

149:, economies of scale are obtained. Beyond OQ

61:. Unsourced material may be challenged and

202:Variation in optimal firm size by industry

125:Learn how and when to remove this message

247:

227:

136:

14:

336:

220:, which is a huge services company.

153:, additional production will increase

260:If the market for a product exhibits

59:adding citations to reliable sources

26:

24:

25:

360:

224:Effect of free entry on firm size

31:

13:

1:

322:

176:

74:"Socially optimal firm size"

7:

300:

10:

365:

167:socially optimal firm size

317:Minimum efficient scale

257:

256:of each firm are zero.

245:

162:

307:Diseconomies of scale

251:

231:

183:diseconomies of scale

143:long-run average cost

140:

349:Production economics

55:improve this article

312:Economies of scale

258:

246:

187:economies of scale

169:is the size for a

163:

135:

134:

127:

109:

16:(Redirected from

356:

344:Market structure

254:economic profits

130:

123:

119:

116:

110:

108:

67:

35:

27:

21:

364:

363:

359:

358:

357:

355:

354:

353:

334:

333:

325:

303:

234:economic profit

226:

213:

204:

179:

160:

152:

148:

131:

120:

114:

111:

68:

66:

52:

36:

23:

22:

18:Ideal firm size

15:

12:

11:

5:

362:

352:

351:

346:

332:

331:

324:

321:

320:

319:

314:

309:

302:

299:

293:) being zero.

225:

222:

212:

209:

203:

200:

178:

175:

158:

155:per-unit costs

150:

146:

133:

132:

39:

37:

30:

9:

6:

4:

3:

2:

361:

350:

347:

345:

342:

341:

339:

330:

327:

326:

318:

315:

313:

310:

308:

305:

304:

298:

294:

292:

288:

284:

279:

275:

271:

267:

263:

255:

250:

243:

239:

235:

230:

221:

219:

208:

199:

196:

192:

188:

184:

174:

172:

168:

156:

144:

139:

129:

126:

118:

107:

104:

100:

97:

93:

90:

86:

83:

79:

76: –

75:

71:

70:Find sources:

64:

60:

56:

50:

49:

45:

40:This article

38:

34:

29:

28:

19:

295:

290:

286:

282:

277:

273:

269:

265:

259:

241:

237:

214:

205:

180:

166:

164:

121:

112:

102:

95:

88:

81:

69:

53:Please help

41:

195:proprietary

115:August 2013

338:Categories

323:References

262:free entry

177:Discussion

85:newspapers

218:Microsoft

42:does not

301:See also

181:If only

171:company

99:scholar

63:removed

48:sources

276:minus

101:

94:

87:

80:

72:

141:This

106:JSTOR

92:books

191:bulk

165:The

78:news

46:any

44:cite

57:by

340::

291:Q

287:Q

283:Q

278:C

274:P

270:Q

266:P

242:Q

238:P

159:2

151:2

147:2

128:)

122:(

117:)

113:(

103:·

96:·

89:·

82:·

65:.

51:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.